/Block%20Inc_%20(SQ)%20Image%20by%20Sergei%20Elagin%20via%20Shutterstock.jpg)

Valued at a market cap of $46.3 billion, Block, Inc. (XYZ) is a global technology and financial services company that builds tools to help individuals and businesses participate in the digital economy. The Oakland, California-based company’s continued investment in emerging technologies, including blockchain and digital finance, supports its mission to create economic empowerment through modern financial tools. It is scheduled to announce its fiscal Q3 earnings for 2025 after the market closes on Thursday, Nov. 6.

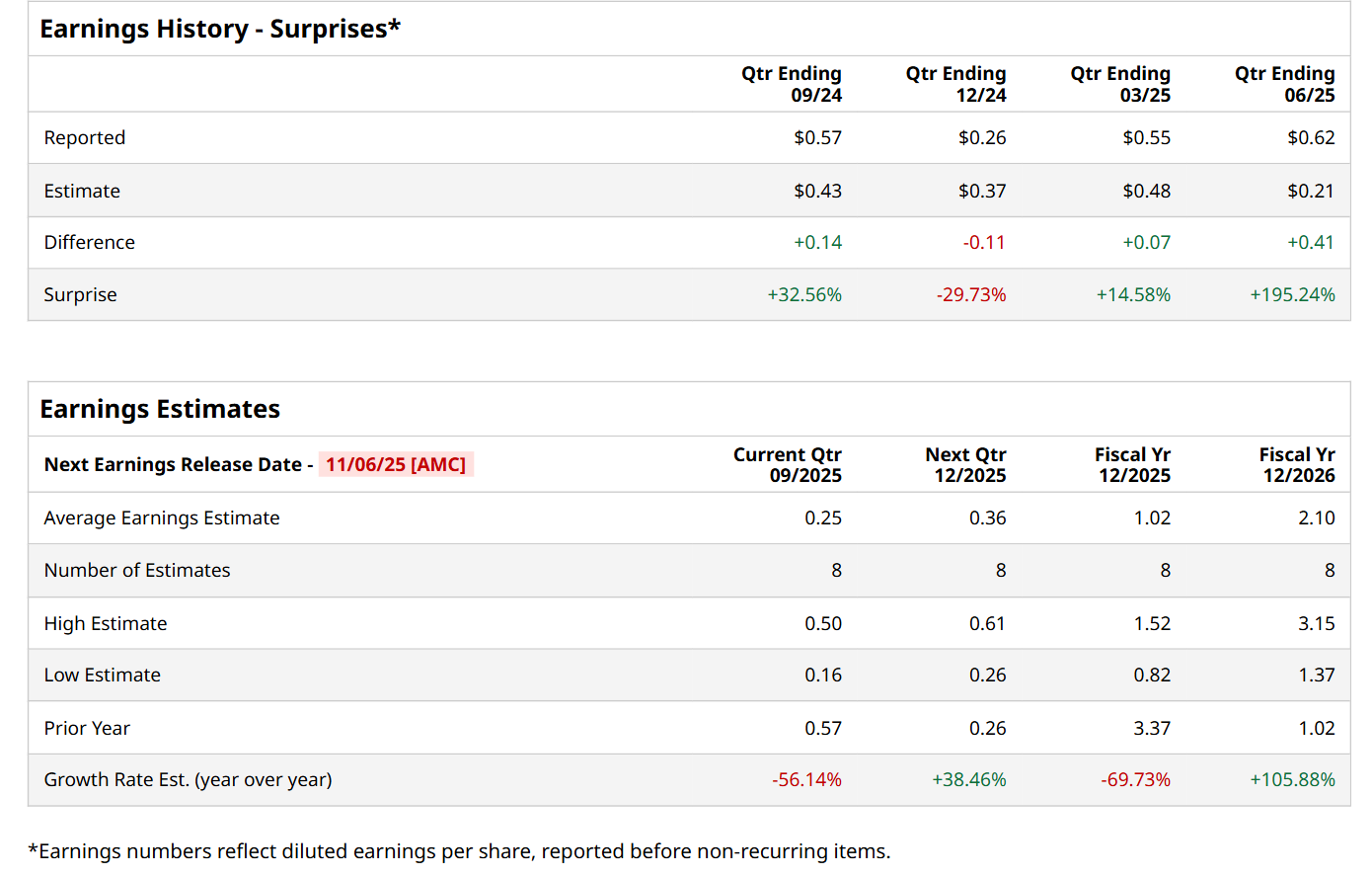

Ahead of this event, analysts expect this fintech company to report a profit of $0.25 per share, down 56.1% from $0.57 per share in the year-ago quarter. The company has exceeded Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion. In Q2, Block’s EPS of $0.62 outpaced the consensus estimates.

For fiscal 2025, analysts expect XYZ to report a profit of $1.02 per share, down by a notable 69.7% from $3.37 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by a robust 105.9% year-over-year to $2.10 in fiscal 2026.

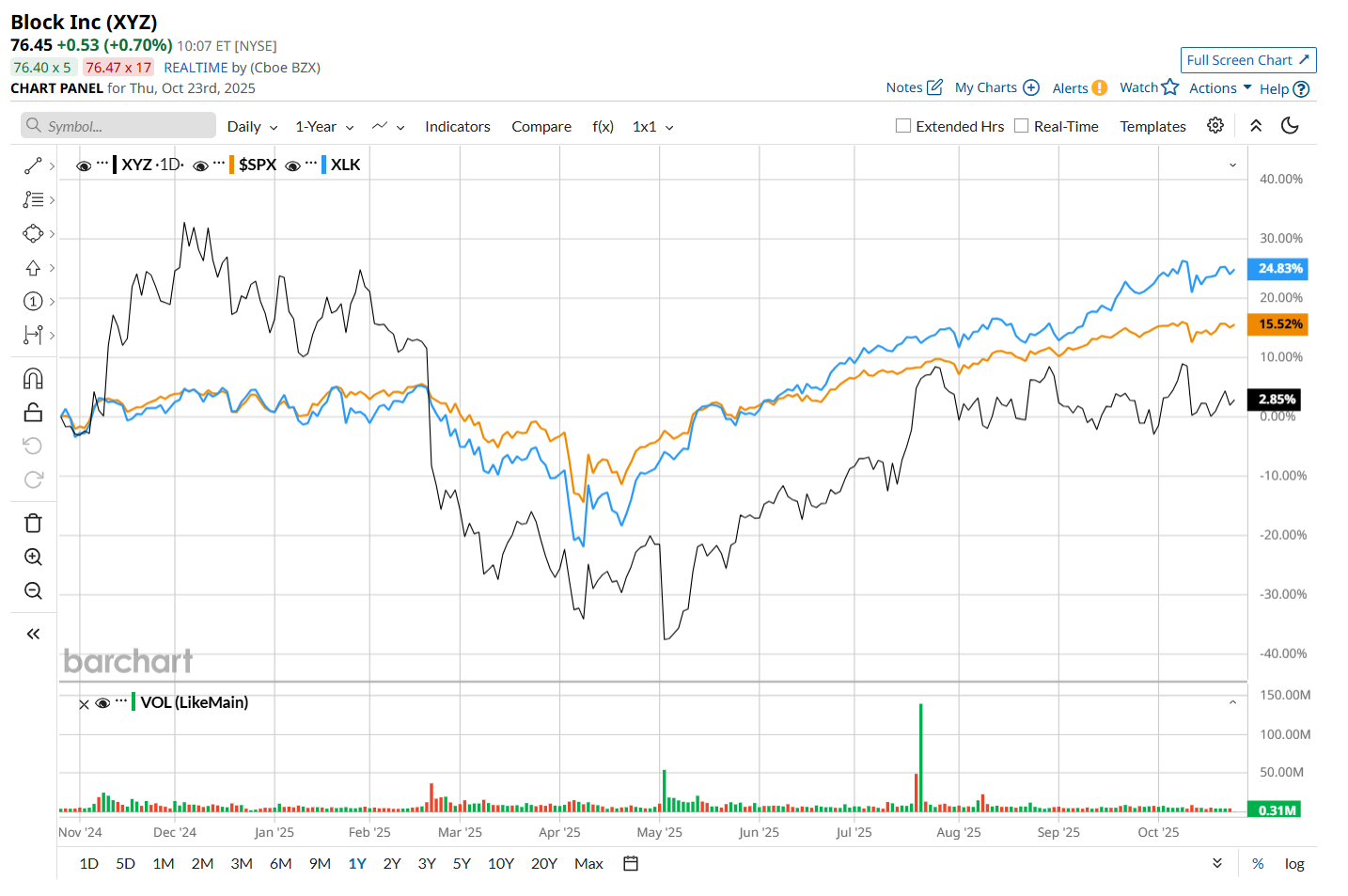

Block has gained 11% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.4% return and the Technology Select Sector SPDR Fund’s (XLK) 26.7% rise over the same time frame.

Block delivered a mixed Q2 performance on Aug. 7, and its shares plummeted 4.5% in the following trading session. The company’s rise in transaction-based and subscription and services-based revenue was more than offset by a fall in bitcoin revenue. This led to a 1.6% year-over-year decline in its total net revenue to $6.1 billion, which missed the consensus estimates by 4.3%. This revenue shortfall might have weighed on investor sentiment. Nonetheless, on the brighter side, its adjusted EPS of $0.62 increased by a notable 31.9% from the year-ago quarter and came in 3.3% ahead of analyst estimates.

Wall Street analysts are moderately optimistic about XYZ’s stock, with an overall "Moderate Buy" rating. Among 41 analysts covering the stock, 25 recommend "Strong Buy," four indicate “Moderate Buy,” seven suggest "Hold,” and five advise “Strong Sell.” The mean price target for Block is $86.14, implying a 9% potential upside from the current levels.