Fintech firm Block Inc. (NYSE:XYZ) announced a significant boost to its full-year guidance despite a worse-than-expected second quarter, with CEO Jack Dorsey attributing the company's accelerated growth and product velocity to its adoption of artificial intelligence (AI).

What Happened: In the second quarter 2025 earnings call, Block raised its full-year gross profit guidance to $10.17 billion, reflecting a renewed confidence in its strategic direction.

Dorsey expressed an optimistic outlook, telling analysts, “I’ve never been more confident of our ability to do that better than I am today… I’m super excited and super bullish on our ability to chip faster, which will make every single thing about Cash App and also Square that much better and more usable.”

This bullish sentiment is a direct result of the company’s focus on faster innovation. Dorsey highlighted the success of new products like Cash App Pools, which went from “ideation to execution and shipping to customers within three months.”

He credited internal AI coding tools, such as “Goose,” for making this possible by accelerating developers and designers and enabling “experiment[s] at near zero cost.”

The company’s raised guidance reflects this momentum. Apart from gross profit guidance, the COO and CFO, Amrita Ahuja, stated that for the full year, they now “expect adjusted operating income of $2.03 billion or 20% margin, expanding margins 2 percentage points year over year.”

Also, “For Q3, we expect gross profit of $2.6 billion, growing 16% year over year. We expect adjusted operating income of $460 million or 18% margin.”

Why It Matters: Block reported earnings of 62 cents per share, which missed the analyst consensus estimate of 68 cents. Its revenue came in at $6.05 billion, which missed the analyst consensus estimate of $6.24 billion and is down from revenue of $6.15 billion from the same period last year.

Price Action: XYZ stock rose 0.95% on Thursday and advanced 5.5% in after-hours. It was down 11.41% year-to-date but 25.55% higher over the past year.

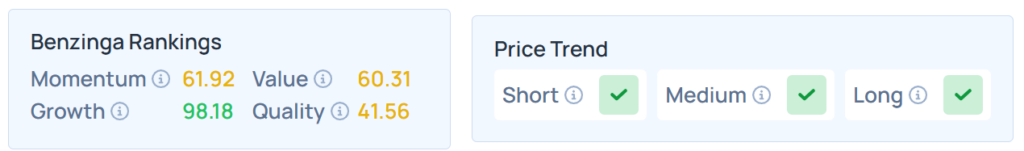

Benzinga's Edge Stock Rankings indicate that XYZ maintains a strong price trend in the long, short, and medium terms. However, the stock scores moderately on growth rankings. Additional performance details are available here.

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended mixed on Thursday. The SPY was down 0.084% at $632.25, while the QQQ advanced 0.34% to $569.24, according to Benzinga Pro data.

On Friday, the futures of the S&P 500, Nasdaq 100, and Dow Jones indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Frederic Legrand – COMEO on Shutterstock