Central banks’ shifting currency reserves may be to blame for what JPMorgan Chase & Co. is calling one of the most frustrating quarters ever for currency traders.

Reserve managers pared their allocated holdings of dollars to the lowest level since 2013 at the end of last year, while boosting their euro allotment to the highest since 2014, the International Monetary Fund said in a report last month. That rotation helps explain the tight range in the euro-dollar exchange rate -- the world’s most actively traded pair -- and the “soul-destroying” inertia in major currencies, according to JPMorgan.

“There is still a nagging sense that other factors may be conspiring to define and tighten the ranges” in major currencies and suppress volatility, strategists Paul Meggyesi and Patrick Locke wrote in an April 5 note. “Chief amongst these is the widespread suspicion that central banks are diversifying FX reserves.”

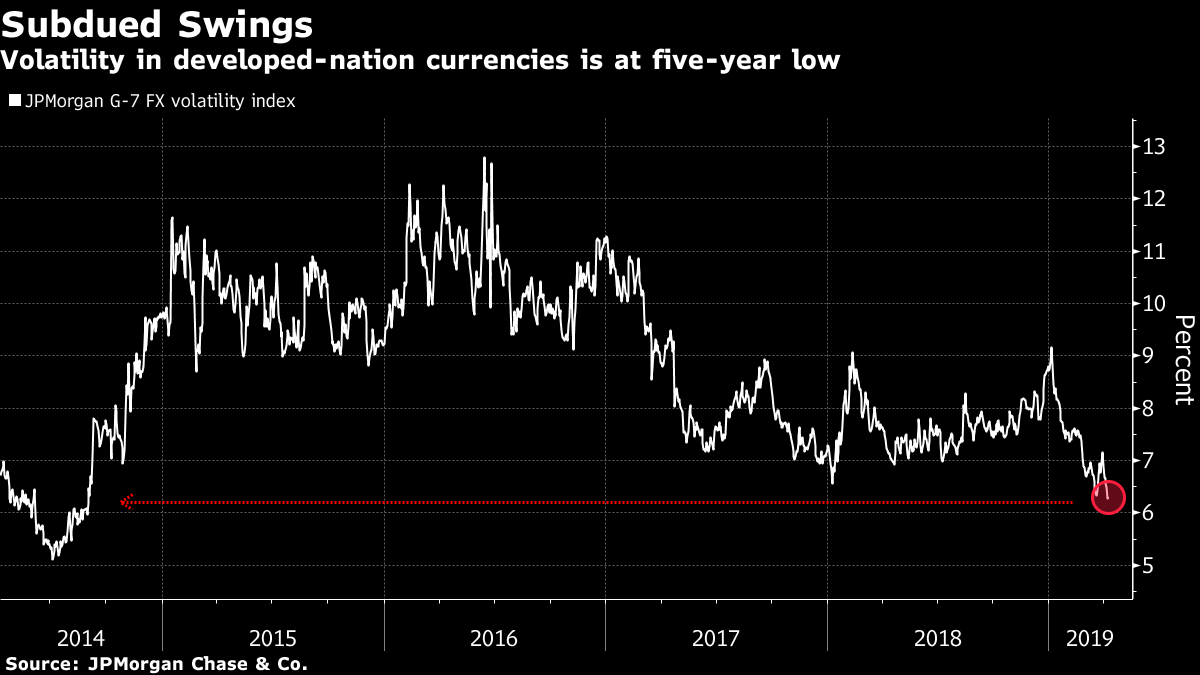

Turbulence in developed-nation currencies is near a five-year low, according to a JPMorgan gauge based on three-month at-the-money options. FX volatility continued to crumble even as price swings in Treasuries spiked last month. Through most of the first quarter, the euro was stuck in the narrowest band since its inception two decades ago. It’s about $1.1260 Monday, within the range that it only briefly broke out of about month ago.

JPMorgan estimates that central banks may have sold $120 billion worth of dollar reserves from their $11.4 trillion hoard in 2018, while adding $160 billion of euro purchases. It’s “extremely rare” for reserve managers to add more euros than dollars in a given year, according to the analysts.

While central-bank flows alone won’t be enough to boost the euro without a meaningful improvement in European growth, a persistent bid will cushion any weakness in the common currency, the analysts concluded.

“The hurdle for a disruptive, high volatility break down in EUR/USD is pretty high,” they wrote. “EUR bears will need to temper their ambitions should central banks continue to reallocate to EUR.”

To contact the reporter on this story: Katherine Greifeld in New York at kgreifeld@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Mark Tannenbaum, Nick Baker

©2019 Bloomberg L.P.