/Blackrock%20Inc_%20logo%20and%20money%20background-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

New York-based BlackRock, Inc. (BLK) is one of the world’s largest asset management firms. It provides various investment and technology services to institutional and retail clients. With a market cap of $174.7 billion, BlackRock’s operations span various countries in the Americas, Europe, the Indo-Pacific, Africa, and internationally.

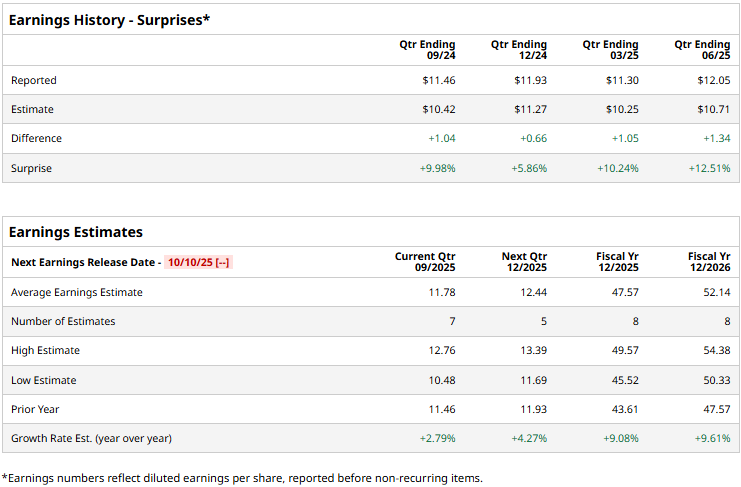

The asset management giant is expected to report its third-quarter results before the markets open on Friday, Oct. 10. Ahead of the event, analysts expect BLK to deliver an adjusted EPS of $11.78, up 2.8% from $11.46 reported in the year-ago quarter. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, BlackRock’s EPS is expected to come in at $47.57, up 9.1% year-over-year from $43.61 reported in 2024. Meanwhile, in fiscal 2026, its earnings are expected to increase by 9.6% year-over-year to $52.14 per share.

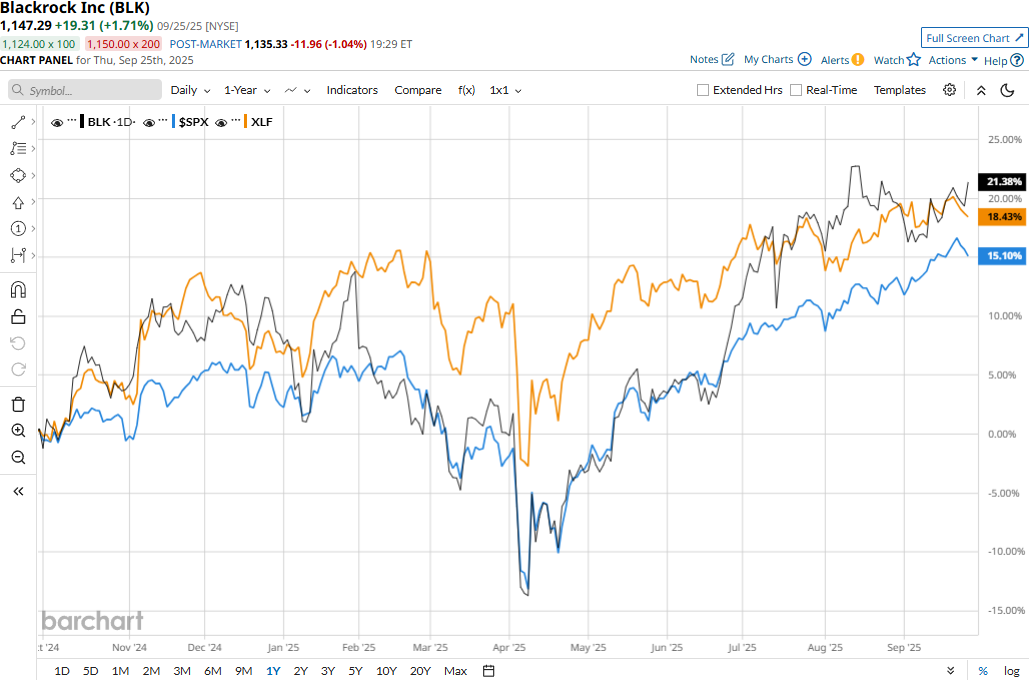

BlackRock’s stock prices have soared 22.5% over the past 52 weeks, notably outpacing the S&P 500 Index’s ($SPX) 15.4% gains and the Financial Select Sector SPDR Fund’s (XLF) 19.4% surge during the same time frame.

BlackRock’s stock prices declined 5.9% in the trading session following the release of its mixed Q2 results on Jul. 15. The company has continued to observe solid growth momentum across its business, which has led to an impressive 12.9% year-over-year surge in overall topline to $5.4 billion. However, this figure missed the Street’s expectations by 35 basis points. Further, its GAAP-based operating margins observed a 5.6% contraction to 31.9%, due to acquisition-related expenses.

On a more positive note, the company’s net inflows year-to-date have reached a staggering $152 billion. Moreover, its non-GAAP EPS surged 16.3% year-over-year to $12.05, exceeding the consensus estimates by 12.5%. Following the initial dip, BLK stock prices gained more than 5% in the two subsequent trading sessions.

Analysts remain optimistic about the stock’s prospects, and BLK maintains a consensus “Strong Buy” rating overall. Of the 18 analysts covering the stock, opinions include 13 “Strong Buys,” three “Moderate Buys,” and two “Holds.” BLK’s mean price target of $1,183.25 suggests a modest 3.1% upside potential from current price levels.