BJ's Wholesale Club is Wednesday's IBD Stock Of The Day, as the discount giant shows exceptional strength in the bear market. BJ stock tried to make a bullish move Wednesday but fell back, as it looks to forge a new base soon.

Thursday's consumer price index will show inflation remained hot in September. But BJ's, with its membership-only business model, has held up better than most other retailers in the current economic environment.

The Westborough, Mass.-based retail chain operates more than 200 stores in the U.S., selling everything from electronics and furniture to gasoline and high-end jewelry. Rival Costco Wholesale has roughly 6.5 million members.

BJ's Wholesale has beaten quarterly earnings expectations since Q2 2018, averaging 20.8% above consensus targets over the past two years. The company now has six straight quarters of sales growth under its belt.

On Aug. 18, the membership club topped earnings views with its second-quarter results. BJ's earnings grew 29% to $1.06 per share in the second quarter, the third straight quarter of accelerating EPS growth. Revenue rose 24% to $5.1 billion, the second quarter in a row of faster sales gains. Same-store sales, not including fuel, advanced 7.6% year over year.

BJ Stock Outperforms Peers Amid Retail Red Flags

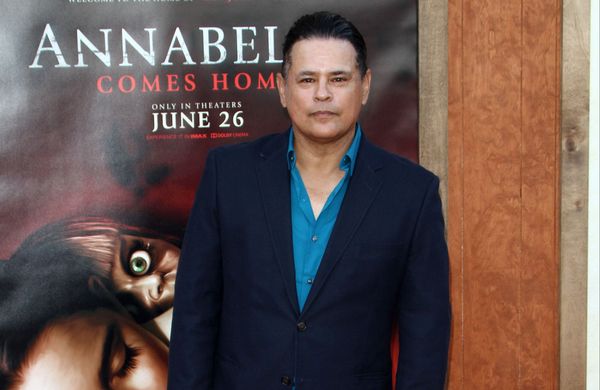

During the earnings call, BJ's Wholesale CEO Bob Eddy touted "gains in traffic and market share" despite inflation tightening consumer spending.

BJ's Wholesale reported that its member base is growing and that it is expanding the digital business.

"Our business model is designed to work well in the current consumer environment where value is king," Eddy said in August.

Analysts expect BJ's earnings to grow 9% to 83 cents per share in the third quarter. They forecast revenue to also increase 9%, to $4.6 billion, according to FactSet. Same-store sales growth is projected at 2%.

BJ's Wholesale Stock

BJ stock fell 1% 71.60 during market trading Wednesday. Intraday, shares rose as high as 74.58, clearing the 50-day moving average and approaching a short, downward-sloping trendline. BJ's stock popped 3.7% on Tuesday.

BJ stock appears to be working on a new flat base, which should be present on a weekly MarketSmith chart after Friday's close. The recent Sept. 12 high of 79.69, plus 1o cents, can be used to give BJ stock a 79.79 buy point, according to MarketSmith analysis. However, amid the current bear market, investors should be wary of making any purchases.

In August, BJ's Wholesale shares cleared a double-bottom base buy point of 71.34, in fits and starts, rising into early September. But shares gave up the double-digit gain, hitting a low of 69.66 on Monday.

The relative strength line for BJ stock has trended up for months and is still only just below all-time levels.

BJ's stock has a 96 Composite Rating out of 99. It has a 93 Relative Strength Rating, an exclusive IBD Stock Checkup gauge for share-price movement that tops at 99. The rating shows how a stock's performance over the last 52 weeks holds up against all the other stocks in IBD's database. The stock's EPS rating is 97.

Retail Rivals Are Struggling

BJ's Wholesale ranks first in the Retail-Discount & Variety industry group. The company is ahead of Dollar General, Dollar Tree and Ollie's Bargain Outlet, among others.

Retail discount stocks overall have not been performing well. COST stock is well below both its 50-day and 200-day moving averages. Dollar Tree gapped down below its 200-moving average following earnings on Aug. 25 and has not bounced back.

Dollar General has formed a flat base below its 50-day moving average, with a 259.75 buy point, according to MarketSmith analysis. But DG stock, amid big swings, hasn't made headway since August 2021.

Please follow Kit Norton on Twitter @KitNorton for more coverage.