Bitmine Immersion Technologies Inc (AMEX:BMNR) shares traded lower Thursday afternoon, giving back the week’s earlier gains. This was happening while there was a drop in the price of Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH). The downturn also came despite a flurry of positive news that sent the stock soaring on Monday.

- BMNR is feeling the pressure from bearish momentum. Check the market position here.

What To Know: This week, BitMine announced a significant expansion of its cryptocurrency holdings, revealing it now controls 2.8% of the total Ethereum token supply.

The company's assets, which include 3.31 million Ethereum and $305 million in cash, are now valued at $14.2 billion. This move puts BitMine past the halfway mark of its “Alchemy of 5%” goal to acquire 5% of all Ethereum.

The aggressive accumulation, including the purchase of 77,055 Ethereum last week, solidified BitMine's position as the world’s largest Ethereum treasury.

Chairman Tom Lee recently expressed confidence that easing U.S.-China trade tensions would boost trading volumes. However, it appears some investors are taking profits following the stock’s recent surge, leading to today’s decline. The company continues to attract institutional interest, backed by prominent investors like Cathie Wood’s ARK Invest.

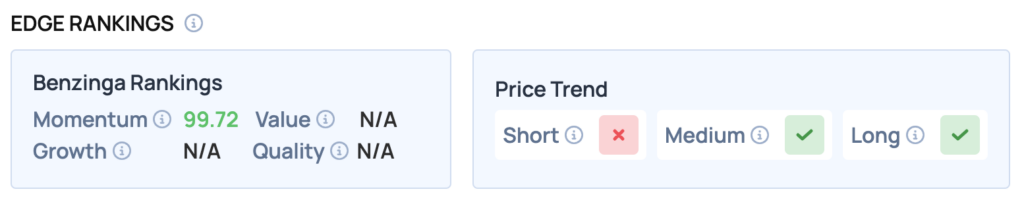

Benzinga Edge Rankings: Highlighting its recent powerful run, Benzinga Edge rankings give the stock a Momentum score of 99.72.

BMNR Price Action: BitMine Immersion shares closed down 10.47% at $44.45 on Thursday, according to Benzinga Pro data.

Read Also: Michael Saylor Targets $150,000 For Bitcoin As Strategy Breaks New Ground With S&P Rating

How To Buy BMNR Stock

By now, you're likely curious about how to participate in the market for BitMine Immersion — be it to purchase shares or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option or sell a call option at a strike price above where shares are currently trading — either way, it allows you to profit from the share price decline.

Image: Shutterstock