Shares of Bitmine Immersion Technologies Inc (NYSE:BMNR) are trading lower Thursday, joining a broader downturn among crypto-related stocks. Here’s what investors need to know.

What To Know: The sell-off appeared to be triggered by a report from The Information, which stated that the Nasdaq exchange is increasing its scrutiny of listed companies that have made substantial investments in digital assets.

The news casts a shadow on crypto-heavy firms like BitMine, which, as of August 31, holds approximately 1.87 million Ethereum (CRYPTO: ETH) and $635 million in cash. This scrutiny comes despite a bullish long-term outlook from BitMine Chairman and Fundstrat’s Chief Investment Officer, Tom Lee.

Lee recently articulated a case for Ethereum’s potential to reach $62,000 per token, citing its growing role as infrastructure for global payment and banking systems. The company views its Ethereum strategy as one of the “biggest macro trades over the next 10-15 years,” a stark contrast to the market’s current regulatory concerns.

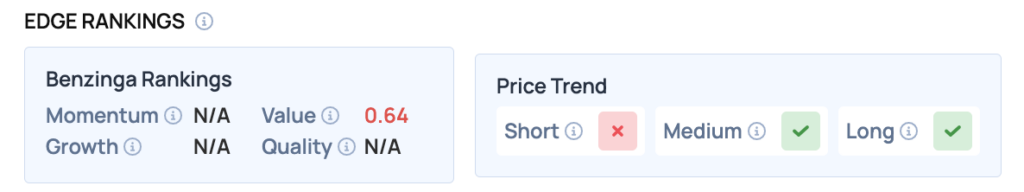

Benzinga Edge Rankings: According to Benzinga Edge rankings, BMNR has a negative short-term price trend, though its medium and long-term trends are viewed positively.

Price Action: According to data from Benzinga Pro, BMNR shares are trading lower by 8.76% to $40.93 Thursday. The stock has a 52-week high of $161.00 and a 52-week low of $1.93.

Read Also: Tom Lee: Ethereum Could Reach $62,000 If It Hits This ETH/BTC Ratio

How To Buy BMNR Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in BitMine Immersion’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock