Shares of Bitfarms Ltd (NASDAQ:BITF) are trading lower Thursday morning after the digital infrastructure company announced a capital raise. Here’s what investors need to know.

What To Know: Late Wednesday, Bitfarms revealed plans for a $300 million convertible senior notes offering due in 2031, with an option for the initial purchasers to buy up to an additional $60 million of the notes.

The market's negative reaction, driven by concerns of potential shareholder dilution, casts a shadow on an otherwise positive week for the company. Bitfarms announced a strategic pivot from its core Bitcoin mining operations to the artificial intelligence and high-performance computing sectors.

This new direction is already backed by a separate $300 million project financing facility from Macquarie Group, aimed at developing its Panther Creek data center in Pennsylvania.

While the company’s AI ambitions have fueled a stock surge of more than 100% over the past month, the new offering could be a near-term headwind. Bitfarms intends to use the proceeds for general corporate purposes, which may include efforts to accelerate its AI expansion.

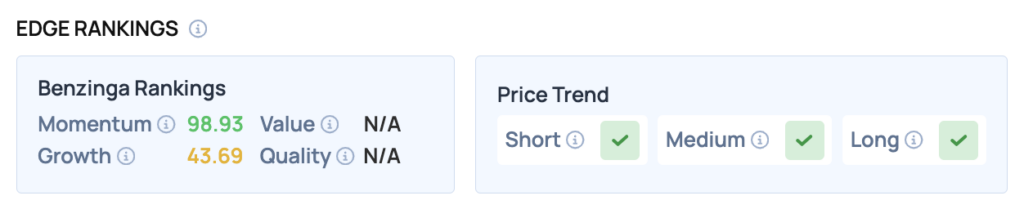

Benzinga Edge Rankings: Highlighting the stock’s powerful recent run, Benzinga Edge rankings show Bitfarms with an exceptional Momentum score of 98.93 out of 100.

BITF Price Action: Bitfarms shares were down 13.83% at $5.58 at the time of publication on Thursday. Despite the declines, the stock is still trading near its 52-week high of $6.60.

Read Also: Trump’s Stealth Move May Be Behind The Biggest Gold Boom Since 1979

How To Buy BITF Stock

By now you're likely curious about how to participate in the market for Bitfarms – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock