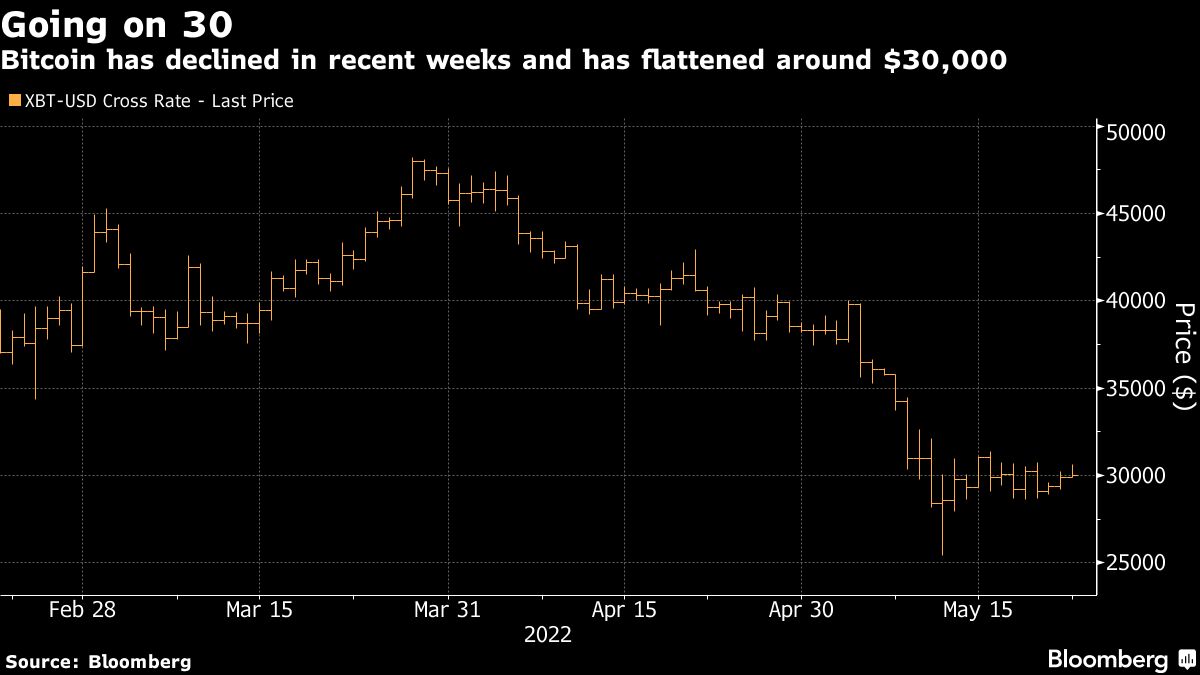

Bitcoin drifted around the $30,000 level it’s been hovering around since the collapse of the TerraUSD algorithmic stablecoin triggered a selloff in cryptocurrencies.

The largest digital token was down 0.6% to trade at $29,720 as of 3:02 p.m. in New York. It had moved higher earlier in the session, offering a reprieve to traders who watched it fall for seven straight weeks, the longest losing streak since August 2011, according to data compiled by Bloomberg. That mirrored the length of the declines in the S&P 500, underscoring how stocks and crypto remain closely linked.

“If the S&P falls some more, that should create one final flush and a great buying opportunity for Bitcoin,” Fundstrat Global technical strategist Mark Newton said. “There’s a lot of bearishness, and we should be approaching a time when you really want to buy into that in the next couple of months.”

Bitcoin has struggled in recent weeks as inflation remains elevated even with central banks in rate-hiking mode, boosting prospects for more monetary tightening. Also weighing on the outlook for crypto markets, regulators across the world have stepped up calls for stricter oversight since the TerraUSD stablecoin tumbled from its intended dollar peg earlier this month.

Lagarde Says Crypto Is ‘Worth Nothing’ and Should Be Regulated

While Bitcoin has been touted in the past as a hedge against inflation, it’s proved in recent months to be highly correlated with risk assets like companies in the Nasdaq 100, which has tumbled amid the changing monetary regime.

“The markets right now are just punishing anything that’s on the speculative side,” said Chris Gaffney, president of world markets at TIAA Bank.

The tendency to trade in line with stocks means crypto traders are now closely watching economic indicators for signs of where monetary policy -- and, by extension, digital-asset prices -- is heading.

“Bitcoin is likely to hover around $29,000 to $31,000 for the next couple of weeks,” said Noelle Acheson and Konrad Laesser of Genesis Global Trading in a note Friday. They added that some economic-data releases, like US gross domestic product or inflation measures, “could change the narrative.”

Rick Bensignor, president of Bensignor Investment Strategies and a former Morgan Stanley strategists, uses DeMark technical indicators -- which compare the most recent maximum and minimum prices to the previous period’s equivalent price to measure demand -- to argue Bitcoin likely won’t break higher anytime soon.

“I’d still expect another four weeks of heaviness,” he said in a note Monday. The May 12 low around $25,425 and the bounce from that keeps support intact at $28,900, he said.

©2022 Bloomberg L.P.