Bitcoin (CRYPTO: BTC) reigns supreme as the leading asset in treasury allocations. However, its younger sibling Ethereum (CRYPTO: ETH) has lately emerged as a stronger contender in the race.

Saylor’s Strategy Leads The Pack

Led by Michael Saylor, Strategy is the pioneering and largest cryptocurrency treasury company in the world, with over $69 billion worth of Bitcoin in its reserves, according to CoinGecko.

Leading Bitcoin mining companies such as MARA Holdings and Riot Platforms have followed suit, accumulating $5.57 billion and $2.11 billion in BTC reserves, respectively.

Trump Media, majority owned by President Donald Trump, has also jumped on the bandwagon, with its current reserves topping the $2-billion mark.

As of this writing, a total of 1,000,936 BTC were in the corporate coffers of public companies, valued at $110.25 billion, cornering 4.77% of the total supply.

| Top BTC Treasury Companies | Total BTC Held | Total Value In USD | Top ETH Treasury Companies | Total ETH Held | Total Value In USD |

| Strategy Inc. (NASDAQ:MSTR) | 632,457 | $69.66 Billion | BitMine Immersion Technologies Inc. (AMEX:BMNR) | 1,713,899 | $7.59 Billion |

| MARA Holdings Inc. (NASDAQ:MARA) | 50,639 | $5.57 Billion | Sharplink Gaming Inc. (NASDAQ:SBET) | 740,760 | $3.2 Billion |

| Bullish (NYSE:BLSH) | 24,000 | $2.64 Billion | Bit Digital Inc. (NASDAQ:BTBT) | 120,306 | $0.53 Billion |

| Riot Platforms Inc. (NASDAQ:RIOT) | 19,239 | $2.11 Billion | Ethzilla Corp. (NASDAQ:ETHZ) | 102,237 | $0.45 Billion |

| Trump Media & Technology Group Corp. (NASDAQ:DJT) | 18,430 | $2.03 Billion | BTCS Inc. (NASDAQ:BTCS) | 70,140 | $0.31 Billion |

See Also: Bitcoin 65% Crash Risk Returns As Fed Liquidity Evaporates: Not Just ‘Paper Hands’

ETH Treasury Play Picks Up Pace

The Ethereum treasury play was slow to catch on, but it has gained massive momentum in the last two months. Several small-cap companies have adopted ETH as their primary reserve asset.

BitMine Immersion Technologies, under the leadership of leading Wall Street strategist Tom Lee, has rapidly become the largest Ethereum treasury company, and the second-largest cryptocurrency treasury after Strategy, with a stash exceeding $7.50 billion.

Seasoned investors like Cathie Wood and Peter Thiel have acquired significant stakes in the firm.

Sharplink Gaming had $3.2 billion in ETH reserves, while the newly-branded ETHZilla — also backed by Thiel — had more than $450 million.

The total ETH held by public companies stood at 2,984,248, worth $13.22 billion, accounting for 2.7% of the total coins in circulation. This is roughly 12% of the total BTCs held in treasury reserves.

Price Action: At the time of writing, BTC was exchanging hands at $110,152, down 2.37% in the last 24 hours, according to data from Benzinga Pro. ETH was down 5.93% to $4,433 at last check.

Strategy shares slid 0.64% in after-hours trading after closing 4.17% lower at $343.20 during Monday’s regular trading session. BMNR stock closed down 7.27% at $49.60.

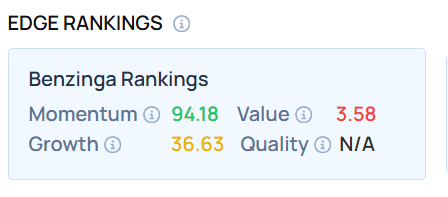

As of this writing, the MSTR stock demonstrated a very high Momentum score. Visit Benzinga Edge Stock Rankings to evaluate the performance of all Bitcoin and Ethereum treasury firms and determine which one best matches your portfolio.

Photo Courtesy: artjazz on Shutterstock.com

Read Next: