Leading cryptocurrencies diverged from stocks on Monday, as risk appetite eased ahead of the Federal Reserve’s interest rate decision.

| Cryptocurrency | Gains +/- | Price (Recorded at 9:20 p.m. ET) |

|---|---|---|

| Bitcoin (CRYPTO: BTC) | +0.30% | $115,274.46 |

|

Ethereum (CRYPTO: ETH) |

-1.31% | $4,528.91 |

| XRP (CRYPTO: XRP) | -0.92% | $2.99 |

| Solana (CRYPTO: SOL) | -2.09% | $235.14 |

| Dogecoin (CRYPTO: DOGE) | -2.83% | $0.2679 |

Risk Appetite Dims Ahead Of Fed Meet

Bitcoin crawled in the $115,000 region for much of the day, although trading volume shot up 52% in the 24-hour period. Ethereum was also rangebound, bouncing within a narrow range between $4,470 and $4,500.

Bitcoin's dominance fell to 57.5%, while Ethereum's market share rose marginally to 13.7%.

Over $400 million was liquidated from the cryptocurrency market in the last 24 hours, with $330 million in long positions wiped out.

Bitcoin’s open interest experienced a modest gain of 0.02% in the last 24 hours, while funds locked in Ethereum derivatives rose 1.60%. The majority of Binance traders with open BTC positions were long, according to the Long/Short ratio.

The market sentiment remained "Neutral," according to the Crypto Fear & Greed Index.

Top Gainers (24 Hours)

| Cryptocurrency (Market Cap>$100 M) | Gains +/- | Price (Recorded at 9:20 p.m. ET) |

|---|---|---|

| OpenxAI Network (OPENX) | +136.69% | $1.60 |

|

Avantis (AVNT) |

+52.18% | $1.18 |

| Unibase (UB) | +23.51% | $0.04821 |

The global cryptocurrency market capitalization stood at $4 trillion, down 0.82% in the last 24 hours.

Progress In US-China Trade Talks

Stocks rallied on Monday. The Dow Jones Industrial Average rose 49.23 points, or 0.1%, to end at 45,883.45. The S&P 500 climbed 0.5% to 6,615.28, while the tech-heavy Nasdaq Composite closed up 0.9% at 22,348.75.

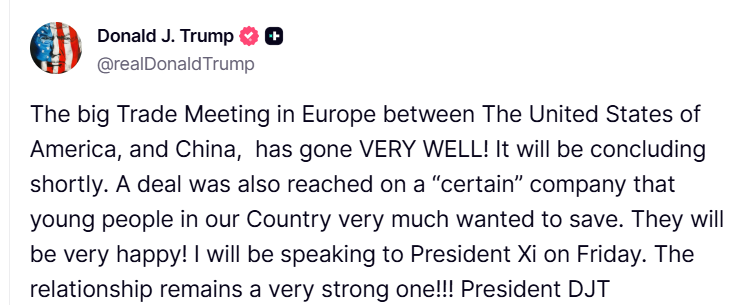

Trump said in a Truth Social post that the trade meeting between the U.S. and China went "very well," adding that a deal was reached on a company "that young people in our Country very much wanted to save," potentially referring to TikTok.

The Federal Reserve is set to decide on the interest rates on Wednesday, with traders pricing in a 95.9% chance that the central bank would cut rates by 0.25%, according to the CME FedWatch tool.

Key Ethereum Level To Watch Out For

On-chain analytics firm CryptoQuant noticed that the Bitcoin Scarcity Index jumped for the first time since June.

"The index jumps when immediate buying power exceeds available supply, as if buyers are racing to acquire Bitcoin on the market," CryptoQuant added.

If the index continues to stay positive for consecutive days, it typically indicates the start of a "strong accumulation phase" and may assist the continuation of the uptrend.

Widely followed cryptocurrency commentator Ted Pillows highlighted Ethereum's strong support around $3,800-$4,000.

"This is the level I’m eyeing to load heavily on Ethereum. If that happens, we will get a lot of quality alts on good discounts too," the analyst predicted.

Photo Courtesy: Yalcin Sonat On Shutterstock.com

Read Next: