Bitcoin and Ethereum traded firmly in the green on Monday evening as the global cryptocurrency market cap increased 1.2% to $2.1 trillion at press time.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 1.2% | 15.5% | $47,347.65 |

| Ethereum (CRYPTO: ETH) | 2.3% | 15.9% | $3,355.34 |

| Dogecoin (CRYPTO: DOGE) | -0.2% | 20.55% | $0.14 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Waves (WAVES) | 40.2% | $45.01 |

| Gnosis (GNO) | +13.8% | $457.80 |

| EOS (EOS) | +8.7% | $2.89 |

See Also: How To Buy Bitcoin (BTC)

Why It Matters: Cryptocurrencies were buoyant as commodities headed down and stock futures traded flat at press time.

Oil futures were seen trading in the red with May 22 Brent crude futures losing as much as 1.4%. April 22 Gold Comex futures were down 0.82%. S&P 500 and Nasdaq futures traded largely flat.

Bitcoin bulls cannot be stopped, wrote Edward Moya, a senior analyst with OANDA in a note, seen by Benzinga.

“It looks like the commodity trade has hit a key peak and a lot of money is flowing into crypto. A couple of weeks ago, Bitcoin was looking vulnerable after a lot of money moved to the exchanges. Normally, long-term holders that move money to exchanges occur before a big selloff, but that did not happen.”

If the apex cryptocurrency can hold the $47,000 level, a major Bitcoin breakout could take place. “Once Bitcoin crosses the $50,000 level, that should trigger further retail and institutional interest,” said Moya.

There has been a marked improvement in investor sentiment. The “Crypto Fear & Greed Index" by Alternative.me, which flashed "fear" last week, is now indicating “greed.”

Amsterdam-based cryptocurrency trader Michaël van de Poppe pointed to the $44,837.41 level in a chart he tweeted on Monday. He said that if that level is not held, Bitcoin could fall back to $40,000.

Great move of #Bitcoin, taking the liquidity above the highs.

— Michaël van de Poppe (@CryptoMichNL) March 28, 2022

Let's see whether it can flip the level, as that would guarantee continuation towards $50K+. pic.twitter.com/ntA9MnXeMX

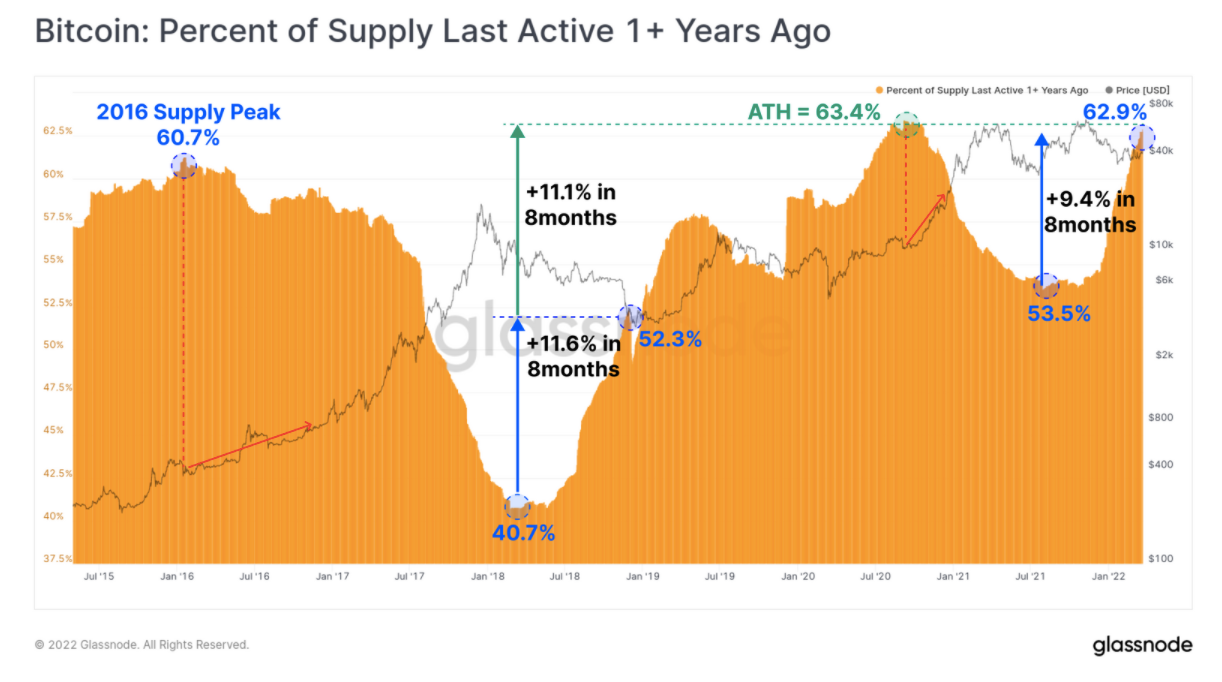

Bitcoin holders held on to their coins in the first quarter of the 2021 bull market. The proportion of coin supply aged one year and above is rapidly approaching all-time highs, according to a note by Glassnode.

The on-chain analytics company said that as we move towards the end of Q1 2022, there is an “extraordinary increase” in the proportion of coins with an age of more than one year — this supply has risen by 9.4% of the circulation in the last 8 months.

“These coins largely reflect BTC volumes accumulated in the Q1-2021 phase of the bull market and the owners have thus held through two 50%+ drawdowns and three all-time highs. This recovery is quite similar in scale and duration to the 2018-19 recovery,” said Glassnode.

On the Ethereum side, the number of addresses with 10,000+ ETH has grown to the largest amount — 1,329 since December 2021, according to Santiment.

Santiment said there is an “evident” correlation between the number of whale addresses and future price movement.

Read Next: This Coin Was Up 2.5x Last Week, Outperforming Bitcoin, Ethereum, Dogecoin By Far