Bitcoin traded higher intraday on Monday evening as the global cryptocurrency market cap rose 1.9% to $938.8 billion at 8:58 p.m. EDT.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 1.9% | 2.8% | $19,586.54 |

| Ethereum (CRYPTO: ETH) | 2.8% | 4.5% | $1,337.72 |

| Dogecoin (CRYPTO: DOGE) | 2.1% | 2.3% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Huobi Token (HT) | +17.15% | $7.84 |

| Lido DAO (LDO) | +13.4% | $1.52 |

| Curve DAO Token (CRV) | +9.5% | $0.90 |

See Also: Best Cryptocurrencies To Hedge Against Inflation

Why It Matters: The apex coin was trading below the psychologically important $20,000 mark at the time of writing.

The two largest cryptocurrencies — Bitcoin and Ethereum — were in the green along with stock futures after the tech-heavy Nasdaq ended its best session since July. The index closed over 350 points higher on Monday.

OANDA Senior Market Analyst Craig Erlam said that Bitcoin’s relation with risk assets hasn’t been “perfect” lately but saw more alignment last week.

“The gains today mirror those in equity markets, with risk assets more broadly getting the week off to a good start,” said Erlam in a note, seen by Benzinga.

Bitcoin “came within a whisker of $20,000 once more before pulling back and now it's trading on the front foot again with its sight set on that level,” said the analyst.

Michaël van de Poppe said that “economic data is getting worse in the United States.” The cryptocurrency trader pointed to the NY Empire Manufacturing index which fell 7.6 points to -9.1 in October versus market estimates of -4.0 in a tweet.

Slowly, but surely, economic data is getting worse in the United States.

— Michaël van de Poppe (@CryptoMichNL) October 17, 2022

NY Empire Manufacturing was bad today, but also numbers two weeks ago came in worse.

Bigger picture means that we're at the end of this run of the $DXY and Yields.

Time for risk-on.

Time for #Bitcoin.

“Bigger picture means that we're at the end of this run of the [dollar index] and Yields,” said van De Poppe. He said it is time for “risk-on” and “Bitcoin.”

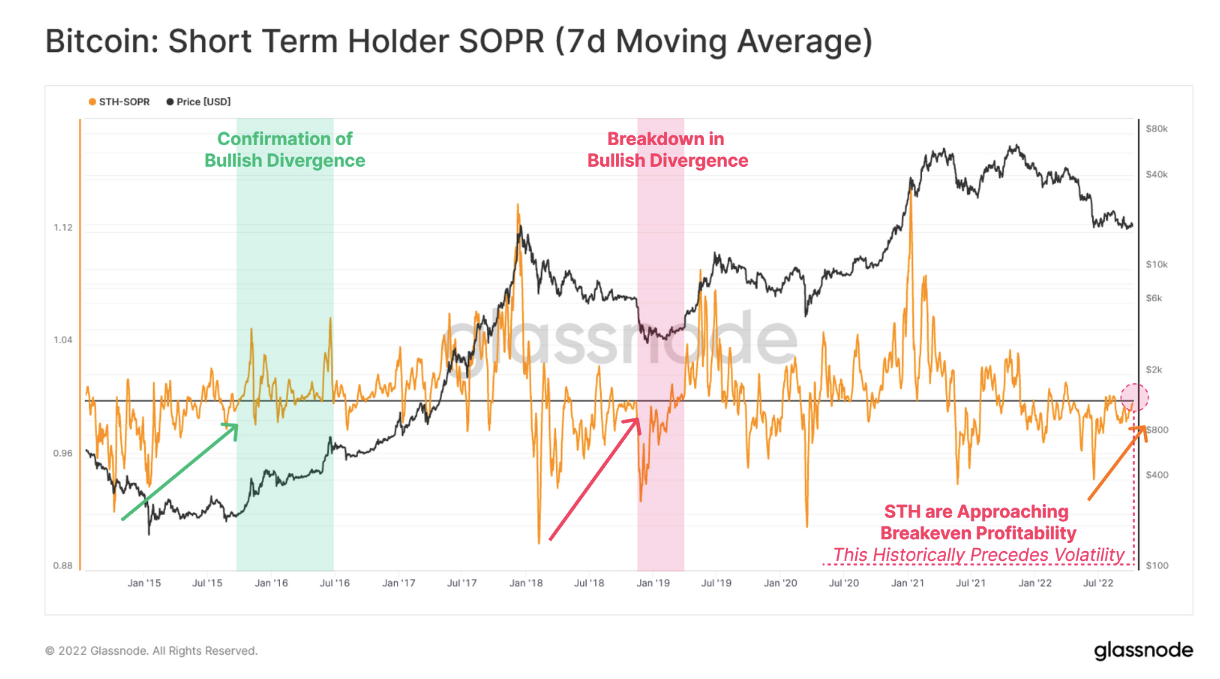

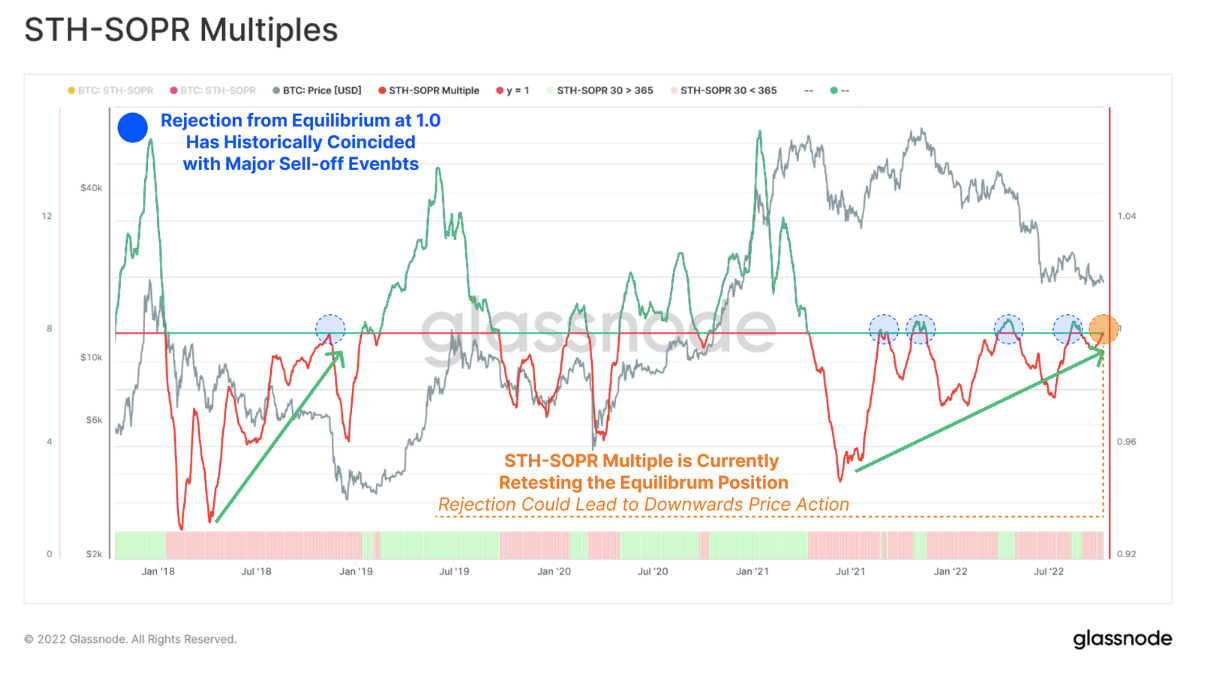

On-chain analysis firm Glassnode said in a blog that Bitcoin is experiencing a “period of historically low volatility” and various metrics — both on and off-chain — indicate a “period of elevated volatility is likely ahead.”

The company said in its post that spending behavior on-chain indicates compression into a decision point where spot prices intersect with Short-Term Holder cost basis.

Pointing to a metric called Spent Output Profit Ratio (SOPR), Glassnode said that STH-SOPR is attempting its fifth breakout of this bear cycle and is “battling for a shift in momentum.” Prior attempts were met with rejection and a decline in Bitcoin prices followed.

“The severity of drawdowns in the STH-SOPR multiple are diminishing with time, reflecting the increasing likelihood that seller exhaustion is occurring.”

Chartist Ali Martinez tweeted data on apex coin whales, which indicates that the number of addresses holding between 1000 BTC and 100,000 BTC has remained steady over the past month at around 2,121 addresses.

#Bitcoin | Data from @santimentfeed shows that the number of addresses holding between 1,000 #BTC and 100,000 $BTC has remained steady over the past month at around 2,121 addresses. pic.twitter.com/luhzAXAMki

— Ali (@ali_charts) October 17, 2022

Read Next: This Crypto Surged A Whopping 54% Last Week Even As Bitcoin, Ethereum Tumbled