Major coins were seen trading in negative territory Wednesday evening as the global cryptocurrency market cap dropped 4% to $1.8 trillion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -4.2% | 0.4% | $36,987.18 |

| Ethereum (CRYPTO: ETH) | -2.5% | 10% | $2,708.79 |

| Dogecoin (CRYPTO: DOGE) | -3.1% | -4.1% | $0.14 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Internet Computer (ICP) | +7.8% | $21.77 |

| Quant (QNT) | +9.7% | $113.64 |

| Pocket Network (POKT) | +1.7% | $1.25 |

See Also: How To Buy Bitcoin (BTC)

Why It’s Moving? Bitcoin is still hitched to macro-economic factors with possible rate hikes still weighing the market down. That doesn’t, however, signal a lack of money bags waiting to pounce at the right opportunity.

“Bitcoin’s most likely scenario is to continue to consolidate here, but if risk appetite remains firm in February, a lot of money on the sideline is ready to pounce,” wrote OANDA Senior Analyst Edward Moya on Tuesday.

The apex coin has reached its fourth-most oversold point in history, said Marcus Sotiriou, an analyst with United Kingdom-based digital asset broker GlobalBlock.

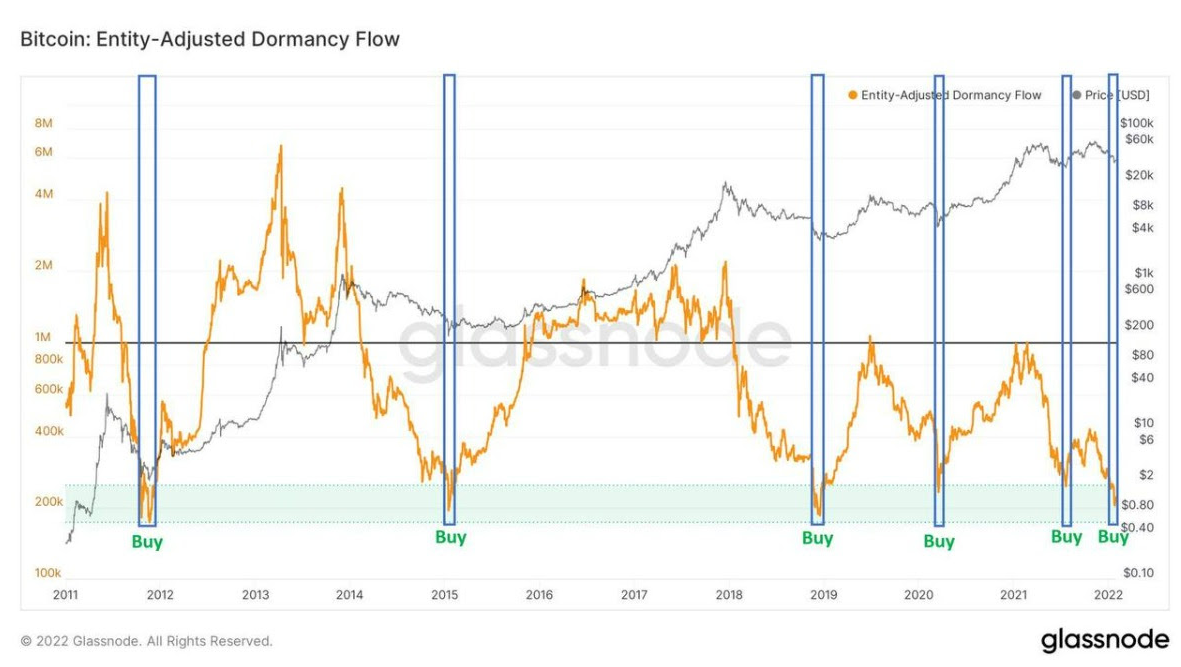

Citing data from Glassnode, Sotiriou, said, “High values for dormancy flow mean that old coins are moving. Extremely low values, like we are seeing currently, show that most of the coins being transacted are young, suggesting that short term holders are capitulating whilst long term holders are holding / accumulating.”

Sotiriou said data indicates that we have reached a point where the gap between long-term holders and short-term holders of BItcoin is at its greatest ever.

Bitcoin "price has decreased by over 50% over the past few months, whales have been accumulating, whilst short term holders capitulating,” wrote Sotiriou.

With the de facto legalization of cryptocurrencies in India, there’s a chance the subcontinental country could become a source for funds flowing into the apex coins and other cryptocurrencies.

Realvision co-founder Raoul Pal pointed to a tweet containing a Deloitte survey that discovered that 82% of Indians plan to invest in Bitcoin and cryptocurrency, which could represent an extra 15% of the world’s population investing in the segment.

Ive been flagging this for a while.... https://t.co/SFOEYVJA8j

— Raoul Pal (@RaoulGMI) February 2, 2022

Things remain hairy for BTC for the short term. On Wednesday, Amsterdam-based cryptocurrency trader Michaël van de Poppe said if the top cryptocurrency by market cap loses the $37,000 level, “it will start to drop fast towards the lower bound of the region around $34-$35K.”

If #Bitcoin loses this level at $37Kish, I think it will start to drop fast towards the lower bound of the region around $34-35K. pic.twitter.com/nMSdQt2J0H

— Michaël van de Poppe (@CryptoMichNL) February 2, 2022

OANDA’s Moya said it was too soon for Bitcoin to make an attempt at $40,000 level,” in a separate note, seen by Benzinga.

“Bitcoin will continue to take a cue from what is happening on Wall Street and right now it looks like next week’s inflation report could be the main event,” the analyst said.