The global cryptocurrency market cap fell 2.7% to $1.09 trillion on Tuesday evening as investors awaited key consumer price index data.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -3% | 0.5% | $23,113.15 |

| Ethereum (CRYPTO: ETH) | -4.5% | 4.1% | $1,698.57 |

| Dogecoin (CRYPTO: DOGE) | -1.1% | 3.45% | $0.07 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Celsius (CEL) | +5.7% | $0.95 |

| Nexo (NEXO) | +5.2% | $0.82 |

| UNUS SED LEO (LEO) | +3.7% | $4.96 |

See Also: How To Get Free Crypto

Why It Matters: Bitcoin and Ethereum traded in the red at press time as the cryptocurrency rally cooled. Stock futures were flat at press time.

Cryptocurrencies have recently seen a correlation with tech stocks, and those exhibited weakness on Tuesday after a major chip firm delivered a revenue warning. Stock investors exercised caution ahead of Wednesday’s inflation number release.

“Bitcoin’s rally is stalling as crypto traders need to see what happens with tomorrow’s inflation report,” said Edward Moya, a senior market analyst, in a note seen by Benzinga.

“Inflation is what killed Bitcoin late last year and if pricing pressures are showing significant signs of easing, Bitcoin might be able to burst above its recent trading range.”

Cryptocurrency trader Michaël van de Poppe tweeted that Bitcoin’s trend is upwards but a correction is taking place due to CPI fears. If the coin holds above the $21,300 mark it could continue to trend and if it breaks above $24,500 it could continue on to $28,000.

Well, #Bitcoin is consolidating here and I hear the craziest numbers flying around.

— Michaël van de Poppe (@CryptoMichNL) August 9, 2022

The trend is still upwards, potentially a correction now is taking place due to CPI fears.

Important:

� Hold above $21.3K to continue the trend.

� Break above $24.5K to continue to $28K. pic.twitter.com/PVG3RDOrjg

The apex coin has flipped support as on Monday’s close at $23,450. Last time it did so in 2021, Bitcoin rallied 26%, said Justin Bennett.

$BTC with a potentially significant close on Monday. $23,450 just flipped to support.#Bitcoin rallied 26% the last time it reclaimed this level in 2021.

— Justin Bennett (@JustinBennettFX) August 9, 2022

Inflation data on Wednesday and Thursday, so expect volatility. https://t.co/ITOgUZNyx7 pic.twitter.com/q0bMUypUYR

“Inflation data on Wednesday and Thursday, so expect volatility,” said the trader.

Trader projections aside, the community doesn’t believe that Bitcoin and other coins will continue rising back to “ prosperous levels” according to sell hashtag mentions on Twitter, Reddit and Discord, said Santiment.

The #crypto community don't appear to believe in #Bitcoin and other assets continuing to rise back to prosperous levels, according to the frequency of #sell mentions on #Twitter, #Reddit, and #Discord. The spike in sell interest has hit a 2-month high. https://t.co/t5NR24tJCf pic.twitter.com/ZIY97nqx7o

— Santiment (@santimentfeed) August 9, 2022

The on-chain and social analysis platform said the spike in sell interest has hit a 2-month high.

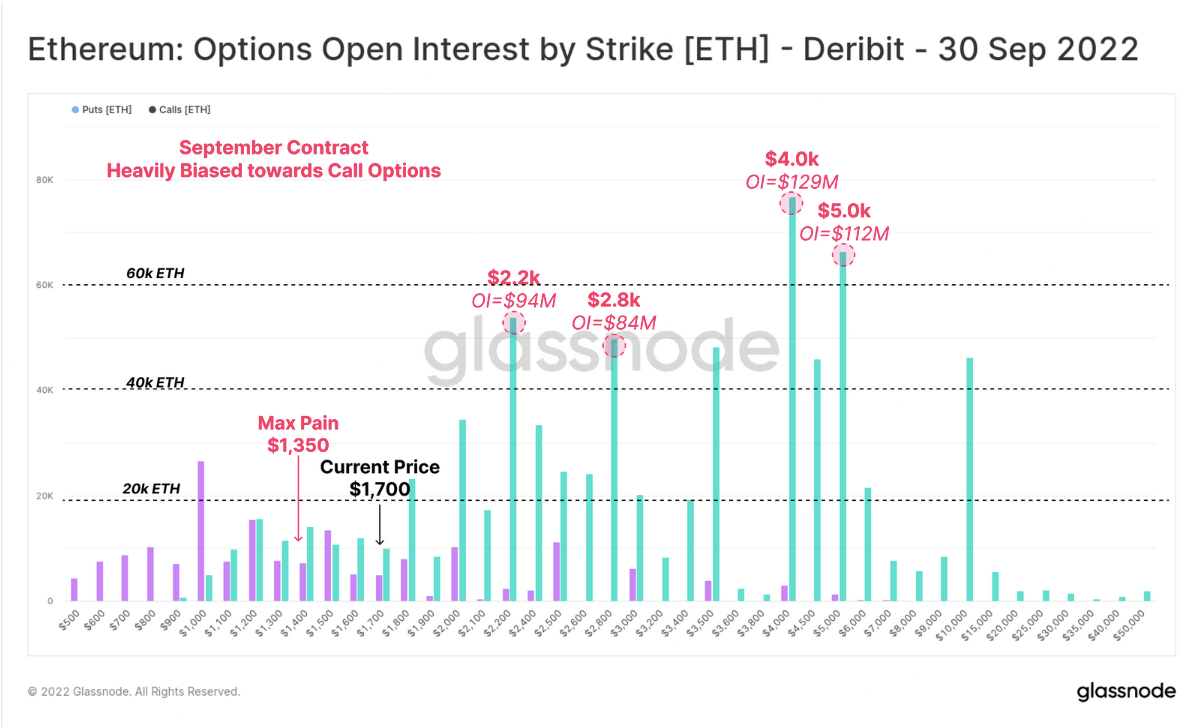

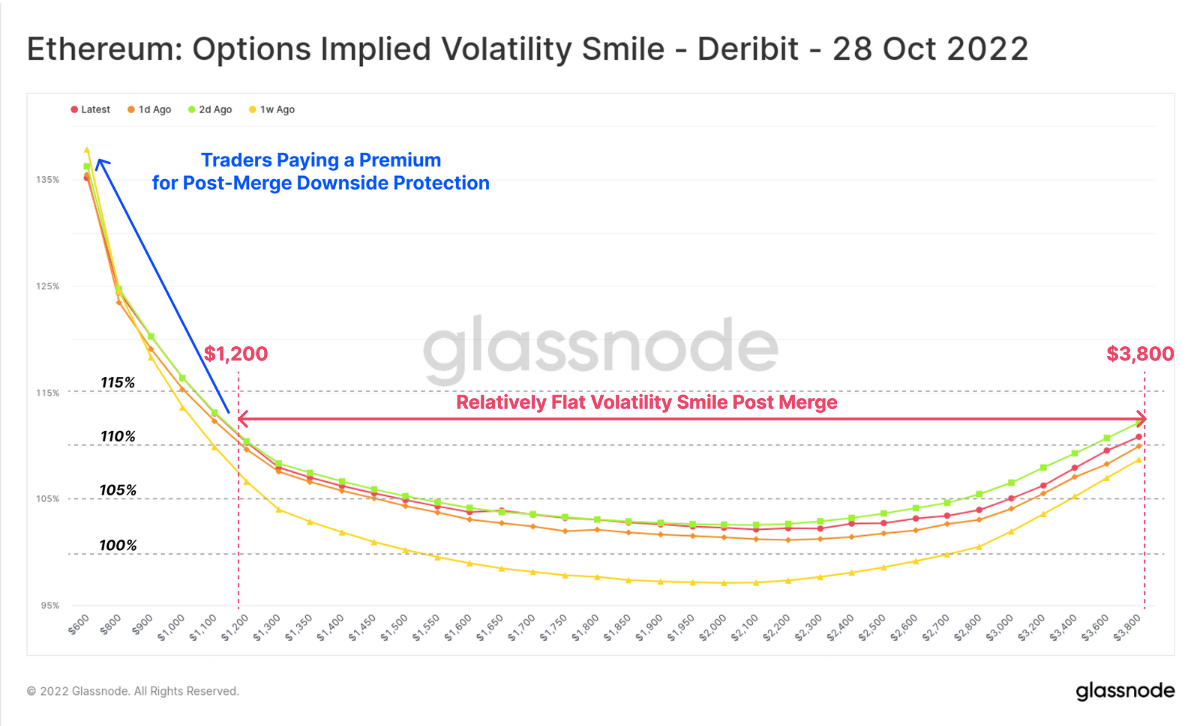

Ahead of the Ethereum merge, scheduled for mid September, traders are long — as reflected through options activity for that month, however the situation changes thereafter, according to Glassnode.

“Both futures and options market are in backwardation after September, suggesting traders are expecting the Merge to be a 'buy the rumor, sell the news' style event, and have positioned accordingly,” said the on-chain analysis firm in a weekly blog post. Backwardation refers to a situation where the spot price of an asset is higher than its forward price.

Glassnode noted that call options dwarf put options for size and traders are better on Ethereum prices above $2,200 with considerable open interest even at the $5,000 level. However, this changes in October and the dramatic decline is visible on the right tail, which suggests there is lower demand for ETH exposure through options after the Merge concludes.

Read Next: JP Mogan Says Crypto Markets 'Have Found A Floor': Why Bitcoin, Ethereum May Have Bottomed