As Bitcoin (CRYPTO: BTC) scaled a fresh new high on Friday, this analyst highlighted the potential in these Bitcoin miners that were undervalued, according to him.

What Happened: Bitcoin hit a fresh high of $118,403.89 per coin on Friday, up over 106% in the last year.

Eric Jackson, the founder and president of EMJ Capital Ltd., highlighted in an X post that there was something that investors were missing.

He said that BTC miners — IREN Ltd. (NASDAQ:IREN) and Cipher Mining Inc. (NASDAQ:CIFR), “are still priced like it's (Bitcoin is) $58K.”

Jackson also pointed out a pattern wherein, after a Bitcoin price rally, the miners usually lag and then they ultimately “explode.”

There is potential in these two firms, as Jackson underscores three points in their favour. IREN and CIFR have been;

- Cutting costs

- Increasing their exahashes per second

- Making a massive move into AI and high-performance computing (HPC) out of their BTC cash flow.

“The market just hasn't caught up yet. I'm long,” he added.

See Also: Warren Buffett Indicator Soars To 208%, Surpassing Dot-Com, 2008 Levels

Why It Matters: Jackson has been bullish on IREN for a while, as he had pointed out in June that he was expecting the stock to soar over $100 apiece in the next 18 months. –

Apart from this, a commentary by the analytics team of TeraHash, shared with Benzinga, pointed out that despite a 3% drop in Bitcoin’s network hashrate in June, daily miner revenues soared to approximately $55,300 per exahash per second (EH/s), one of the highest profitability levels this year.

This shift was driven by strategic adaptation: some miners pursue high-performance computing for AI, while others leverage operational flexibility. A less visible group profits from grid curtailment, hash rate hedging, and leasing idle capacity.

TeraHash models show miners integrating grid programs and derivatives could sustain margins despite rising difficulty.

Price Action: Cipher Mining stock has risen 29.19% on a year-to-date basis and 43.12% over a year. Meanwhile, IREN was up 62.81% YTD and 52.05% over the past year. As of the publication of this article, Bitcoin was trading at $117,620.53 per coin.

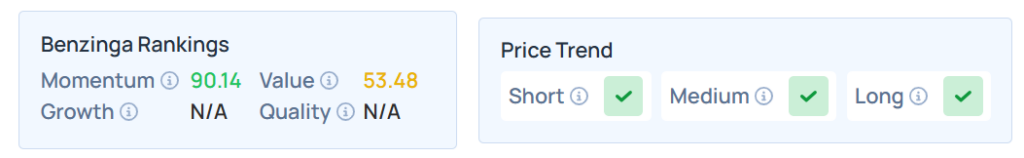

Benzinga Edge Stock Rankings shows that IREN had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, whereas its value ranking was moderate at the 53.48th percentile. Find More details about CIFE and other mining stocks here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended on a mixed note on Friday. The SPY was up 0.28% at $625.82, while the QQQ declined 0.14% to $555.45, according to Benzinga Pro data.

Read Next:

Photo Courtesy: OlegD On Shutterstock.com