/Biogen%20Inc%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

With a market cap of $20.4 billion, Biogen Inc. (BIIB) is a leading biopharmaceutical company specializing in treatments for neurological, rare, and immunological diseases. Headquartered in Cambridge, Massachusetts, Biogen has built its reputation as a pioneer in neuroscience, with decades of leadership in multiple sclerosis therapies, including Tecfidera, Avonex, and Tysabri.

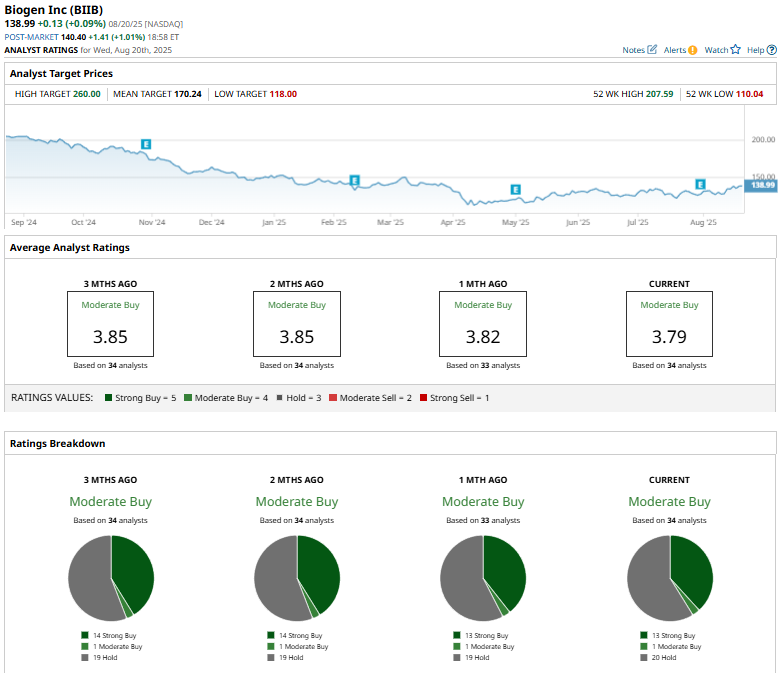

Shares of this leading biotechnology company have significantly underperformed the broader market over the past year. BIIB has declined 32.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. In 2025, BIIB stock is down 9.1%, compared to the SPX’s 8.7% rise on a YTD basis.

Narrowing the focus, BIIB has also trailed the SPDR S&P Biotech ETF’s (XBI) 11.5% fall during the past year and a marginal dip in 2025.

On Jul. 31, Biogen delivered Q2 2025 earnings, posting adjusted EPS of $5.47 and revenue of $2.6 billion, both well above expectations. This feat was driven by rapid uptake of new product launches, solid growth in rare disease therapies like Skyclarys, and rising Leqembi sales, which hit $63 million in the U.S. While older multiple sclerosis drugs continued to decline, the momentum in newer treatments helped lift overall results. The company raised its full-year EPS outlook to $15.50–$16.00 from $14.50–$15.50, signaling confidence in sustained growth, and shares climbed 1.1% after the earnings release.

For the current fiscal year, ending in December, analysts expect BIIB’s EPS to decline 3.6% to $15.87 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

Among the 34 analysts covering BIIB stock, the consensus is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” and 20 “Holds.”

This configuration is less bullish than two months ago, with 14 analysts suggesting a “Strong Buy.”

On August 8, Truist Securities downgraded Lantheus Holdings from “Buy” to “Hold,” reducing its price target to $63 from $111 due to the weak performance of its key product, PYLARIFY, which has missed expectations for two consecutive quarters.

The mean price target of $170.24 represents a 22.5% premium to BIIB’s current price levels. The Street-high price target of $260 suggests an ambitious upside potential of 87.1%.