/Bio-Techne%20Corp%20site%20magnified%20-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

Minneapolis, Minnesota-based Bio-Techne Corporation (TECH) develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets. With a market cap of $9.6 billion, Bio-Techne operates through Protein Sciences & Diagnostics and Genomics segments.

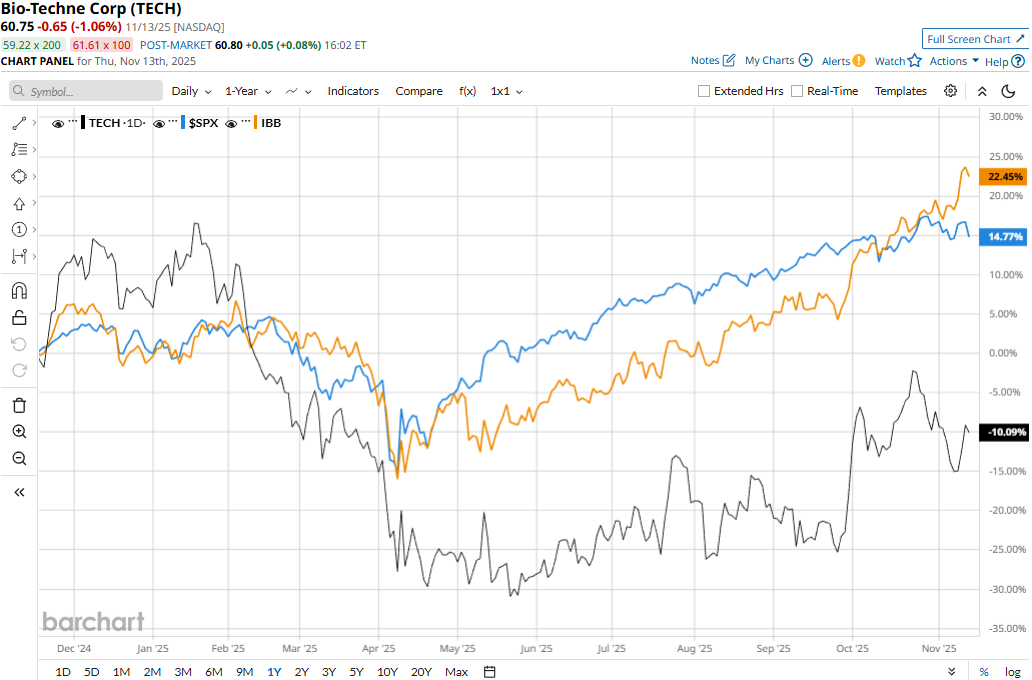

The biotech major has significantly underperformed the broader market over the past year. Bio-Techne stock prices declined 15.7% in 2025 and plunged nearly 20% over the past year, compared to the S&P 500 Index’s ($SPX) 14.6% gains in 2025 and 12.6% returns over the past year.

Narrowing the focus, Bio-Techne has also underperformed the industry-focused iShares Biotechnology ETF’s (IBB) 23.5% surge on a YTD basis and 13.6% gains over the past 52 weeks.

Bio-Techne’s stock prices dropped 1.9% in the trading session following the release of its Q1 results on Nov. 5. The company observed 1% drop in organic sales and 1% unfavourable impact on sales from businesses held-for-sale, which was partially offset by currency translation gains. Overall, its net sales dropped by 1% year-over-year to $286.6 million, missing the consensus estimates by 96 bps. However, its adjusted EPS remained flat year-over-year at $0.42, meeting Street’s expectations.

On the positive note, Bio-Techne has observed encouraging signs of stabilization in its US academic end market and strength from big pharma customers, which may improve performance in the coming quarters.

For the full fiscal 2026, ending in June, analysts expect TECH to deliver an adjusted EPS of $1.66, down 2.9% year-over-year. The company has a solid earnings surprise history. It has met or surpassed the Street’s bottom-line estimates in each of the past four quarters.

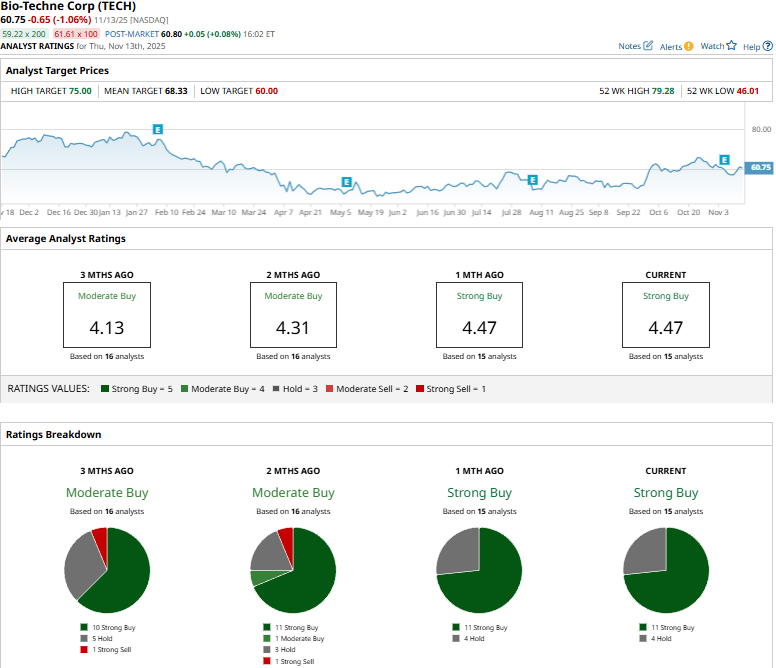

Among the 15 analysts covering the TECH stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buys” and four “Holds.”

This configuration is notably more optimistic than three months ago, when 10 analysts gave “Strong Buy” recommendations and one analyst had a “Strong Sell” rating on the stock.

On Nov. 6, Wells Fargo (WFC) analyst Brandon Couillard reiterated an “Overweight” rating on Bio-Techne and raised the price target from $59 to $70.

Bio-Techne’s mean price target of $68.33 represents a 12.5% premium to current price levels. Meanwhile, the street-high target of $75 suggests a 23.5% upside potential.