/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

It seems that the shares of Super Micro Computer (SMCI) cannot catch a break Following a nosedive after reporting a third consecutive quarter of earnings misses, billionaire Philippe Laffont’s technology-focused investment management firm Coatue revealed in a recent filing that it has fully divested its entire stake in the beleaguered artificial intelligence infrastructure solutions provider.

About Super Micro

Founded in 1993, California-based Super Micro is a leading provider of high-performance, highly configurable server, storage, networking, and infrastructure solutions. The company focuses on sectors like AI, cloud, high-performance computing (HPC), 5G/Edge, and enterprise computing.

Valued at a market cap of $27.1 billion, SMCI stock is up 48.9% on a YTD basis.

Rattled by corporate governance and audit woes not so long ago, is Laffont’s divestment another affront to the stock? Or is this just a routine example of profit taking that investors should ignore?

Q4 Was Poor But Not Alarming

Granted, SMCI’s latest results for the fourth quarter look bad on the surface with both revenue and earnings missing estimates.

The company reported net sales of $5.8 billion in the quarter, up 7.5% from the previous year, as earnings slipped to $0.41 per share from $0.54 per share in the year-ago period. Earnings missed the consensus estimate of $0.44 per share as operating profits declined to $228.4 million from $288.5 million in the prior year.

However, there have been some green shoots. For instance, SMCI has grown its revenue and earnings at compound annual growth rates (CAGRs) of 27.38% and 27.48%, respectively, over the past 10 years.

Moreover, in fiscal year 2025, SMCI reported net cash from operating activities of $1.7 billion, dramatically better than an outflow of $2.5 billion in the previous fiscal year. Overall, the company closed the year with a cash balance of $5.2 billion, which was much above its short-term debt levels of $75.1 million.

Notably, for the first quarter of 2026, SMCI expects revenue to be in the range of $6 billion to $7 billion and earnings to be between $0.40 to $0.52 per share. Analysts remain optimistic about the growth prospects of the company, with forward revenue and earning growth rates expected to be 38.31% and 17.39%, compared to the sector medians of 7.63% and 11.30%, respectively.

SMCI Is a Tough Blend of Risks and Rewards

Super Micro’s is a curious case.

While on one hand, its unique liquid cooling racks and servers provide it with a competitive advantage in AI infrastructure solutions, on the other hand, dwindling margins, and still-hard-to-forget issues regarding delayed SEC filings are still keeping serious investors away.

However, the company is entering a more decisive growth phase, driven by targeted strategic initiatives. A key development is the introduction of its Data Center Building Block Solutions (DCBBS), an integrated platform designed to streamline and accelerate the deployment of artificial intelligence infrastructure for enterprises and cloud providers. By using a modular design, it enables clients to move from concept to full-scale operation far more quickly, while maintaining compatibility with the latest GPUs. This structure is expected to strengthen margins, as it offers a higher-value proposition compared to traditional deployment models.

CEO Charles Liang emphasized that, unlike subscription-based infrastructure models where vendors retain ownership, this framework allows customers to maintain complete control over their hardware and data, which is an increasingly important factor in AI-driven workloads.

Further, the company’s position in the AI infrastructure market is reinforced through its close partnership with Nvidia (NVDA) for large-scale deployments of Blackwell and Blackwell Ultra rack solutions. These projects, covering complete servers and turnkey AI data center pods, often involve multimillion-dollar contracts, significantly larger than component-level or single-node sales, which typically generate only a fraction of that amount. Notably, rack-scale solutions also offer stronger gross margins, further enhancing the company’s revenue potential.

Yet, as highlighted previously, SMCI is not without its share of problems. Firstly, it has to address the issue of declining profitability and muted revenue growth. Although the company did report huge revenue growth rates in previous years, currently it is reporting single-digit growth rates which is not acceptable in the ultra-high-growth domain of AI. Then, there is the issue of inventory build-up to $4.7 billion in Q4 from $3.9 billion in Q3, which raises questions about demand.

Analyst Opinions on SMCI Stock

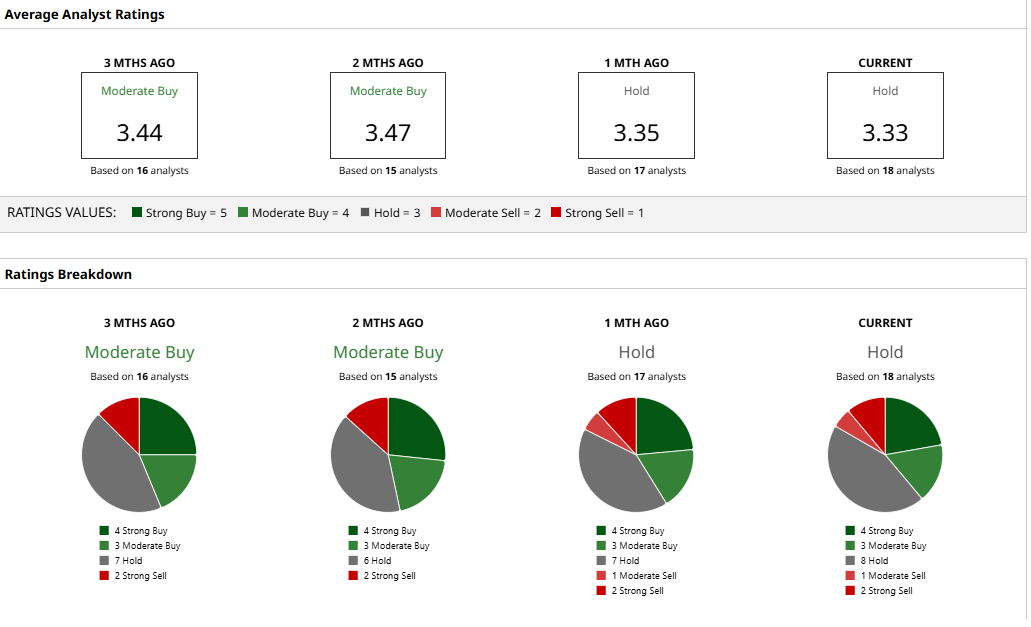

Considering this, analysts have deemed SMCI stock a “Hold” with a mean target price of $47.62. This denotes upside potential of about 5% from current levels. Out of 18 analysts covering the stock, four have a “Strong Buy” rating, three have a “Moderate Buy” rating, eight have a “Hold” rating, one has a “Moderate Sell” rating, and two have a “Strong Sell” rating.