Uber Technologies Inc. (NYSE:UBER) is in the spotlight as it prepares to report its third-quarter 2025 earnings before the opening bell on Tuesday, with investors closely watching whether the company can meet the aggressive financial targets set by its leadership.

Check out UBER’s stock price here.

Uber CEO Sees Mid-30s EBITDA Growth In Q3

After a record-breaking second quarter, all eyes are on Uber’s third-quarter guidance for Gross Bookings, projected to land between $48.25 billion and $49.25 billion. The company also guided for Adjusted EBITDA between $2.19 billion and $2.29 billion.

Achieving these numbers would represent “another quarter of high teens gross bookings growth” and “low to mid-30s EBITDA growth,” said Uber CEO Dara Khosrowshahi during its second quarter earnings call.

Bill Ackman Sees Uber As ‘Significantly Undervalued’

The high expectations are bolstered by strong conviction from prominent investors, including Bill Ackman.

His firm, Pershing Square, recently described its position in Uber, calling the stock “significantly undervalued” and “mispriced”. Ackman's firm stated it anticipates Uber will “generate 30% or greater annual earnings per share growth over the medium term”.

See Also: Bill Ackman Has 70% Of His Portfolio Invested In These 5 Stocks: Here’s What Q2 13F Filings Show

Investors Watch For ‘Super App’ Metrics

Analysts are focused on Uber’s “super app” strategy and its long-term positioning in autonomous vehicles (AVs). Eric Clark, the portfolio manager at Alpha Brands, noted in a Schwab Network video that the app is “truly becoming that super app”.

He added that by “bolting on more and more services” like groceries and delivery, Uber “keeps you coming back with good frequency”.

Uber Could Likely Be The Winner Of Robotoxi Wars

This platform strategy is seen as Uber’s key advantage in the emerging AV space.

Louis Navellier of Navellier & Associates said he expects Uber “to be the big winner” of the “robo taxi wars”, arguing it has the “best apps to retrieve the vehicles”.

The ambitious third-quarter forecast follows a powerful second-quarter performance, where Uber achieved all-time highs in both audience and frequency, reaching 180 million monthly active consumers.

That quarter was also marked by a new $20 billion share repurchase authorization, signaling strong management confidence in future free cash flow.

Uber Rallies Over 57% In 2025

While the stock closed 3.30% higher at $99.72 per share on Monday, it rose 0.68% in after-hours, ahead of its earnings before Tuesday morning. The stock was up 57.86% year-to-date and 36.14% over the year.

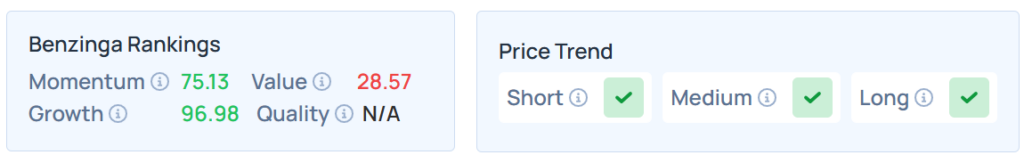

Benzinga’s Edge Stock Rankings indicate that UBER maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking. Additional performance details are available here.

While the S&P 500, Dow Jones and Nasdaq 100 closed in a mixed manner on Monday, the futures were lower on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: JHVEPhoto / Shutterstock