NEW YORK CITY - Tax season is just around the corner, and with it comes a variety of challenges, especially for immigrants. From language barriers, to misinformation and overall complexity of the system, filing taxes for immigrants can come with a great deal of challenges and stress.

One of the satisfactory outcomes of tax season is receiving a tax refund check, a reimbursement made to a taxpayer for any excess amount paid to the federal or state government. This check often signifies an injection of cash, surpassing a typical worker's paycheck, and is often used to pay down debt or bolster savings.

Last year, many Americans were surprised when the expiration of pandemic-era federal benefits resulted in their receiving a smaller tax refund. This upcoming tax year, however, the story might be different, with some taxpayers potentially receiving 10% more than in 2023, CBS News reports. The reason for this? Adjusted IRS Brackets.

What Are The New IRS Brackets?

Given last year's inflation rate, the Internal Revenue Service (IRS) has released its new tax brackets to accommodate these economic changes.

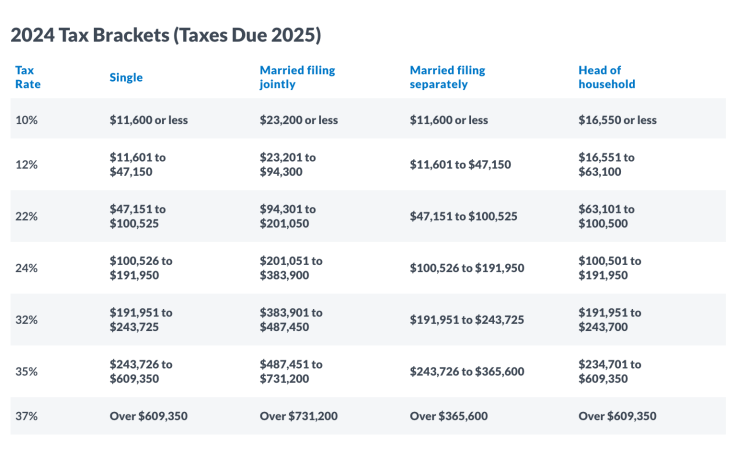

In 2024, the top tax rate of 37% applies to those earning an income over $609,350 for individual filers, up from $578,125 last year. Meanwhile, the lowest threshold of 10% applies to those earning an income of $11,600 or less, up from $11,000 in 2023. This means that what you pay in taxes could change in 2024.

Here is a table of the adjustments of the IRS brackets of this year.

How Can Inflation Affect Your Tax Refund?

Despite the economic hardships inflation might impose on households—particularly low and middle class ones— ironically, this same phenomenon could benefit taxpayers at the time they get their tax refund.

This is because the IRS adjusted many of its provisions in 2023 for inflation, essentially pushing the standard deduction to a more generous level (see table above). These changes raise IRS brackets by 7.1%— a historically large adjustment.

Last year, the average tax refund was $3,167, or almost 3% less than the prior year, according to IRS statistics. By comparison, the typical refund check jumped 15.5% to almost $3,300 in 2022, when taxpayers received generous tax credits like the expanded Child Tax Credit.

This year, given the new provisions, these numbers might change for you, depending on your income and how you file your taxes.

"Say your income didn't keep pace with inflation— made the same as the prior year but didn't increase your income by that inflation rate of 7% or so— you could see a better refund," Steber told CBS MoneyWatch. "We are predicting a higher refund for those people, up to 10%"

When Can You Expect to Get Your Tax Refund?

The IRS will kick off the new tax filing season on Jan. 29, which means that taxpayers will have between that date and April 15 to file their returns. If you need more time, you can request an extension, which gives you until mid-October to file.

Most taxpayers get their tax refunds within 21 days. People who file their taxes as soon as possible on Jan. 29 should get their payments by Feb. 19.

However, this is not always guaranteed, as some cases may need more time to review than others. The best way to check the status of your tax refund is to visit Where's My Refund? On IRS.gov or the IRS2Go app.

Tax Refund Calculator

One way to check your refund is to plug in your income and other data into a 2024 tax refund calculator, which are offered by tax prep companies such as H&R Block as well as financial sites such as Nerdwallet.

The adjustment of the IRS brackets will not automatically mean a larger tax refund for all taxpayers. In fact, more taxpayers could end up owing this year, given that more people took on side gigs last year to compensate for higher costs, Steber said.

Homeowners who tapped expanded home energy tax credits might get a bigger refund, he noted, as well as people whose incomes didn't keep up with inflation.

Another group that could see bigger refunds are low-income families with children, given an expansion of the Earned Income Tax Credit. The maximum tax credit for 2023 is $7,430, up from $6,935 the prior year.

Bottom Line

As tax season approaches, it might be a good time to check what your anticipated tax returns might be. Given the adjusted IRS brackets, your returns might fluctuate, as America continues to recover from a historic inflation fueled by the pandemic.

While tax refund calculators might not give the exact correct amount you will get back from the IRS, the estimation could help prepare you for the months to come.

Learn more about the new IRS Brackets by clicking here.

© 2024 Latin Times. All rights reserved. Do not reproduce without permission.