The seventh interest rate hike in a row will put more pressure on mortgage holders, with NAB the first of the big banks to pass on the 0.25 percentage point lift to its home loan customers.

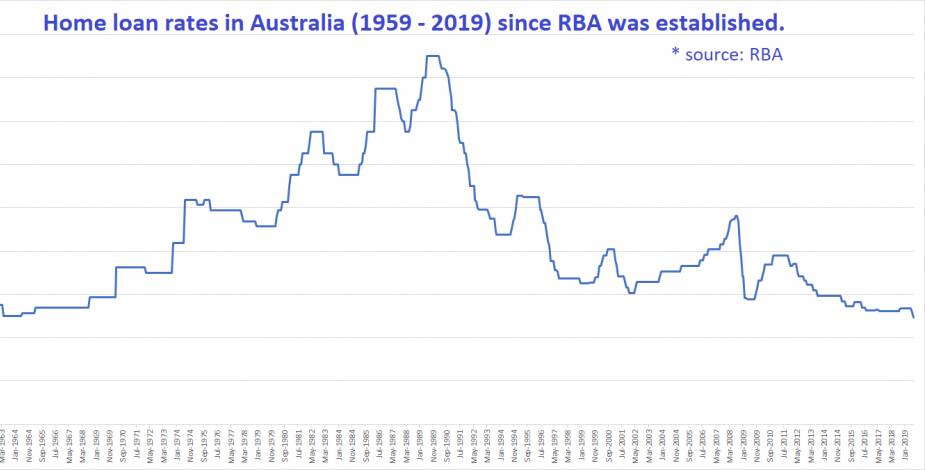

On Tuesday afternoon, the Reserve Bank of Australia lifted interest rates by another 25 basis points, taking the official cash rate to 2.85 per cent.

Provided lenders pass on the hike to borrowers, the latest interest rate hike will add more than $114 to monthly repayments for a typical $750,000 mortgage.

The Herald's view: Blunt instrument of interest rates targets inflation but hits borrowers and jobs

Numbers crunched by Compare the Market found the cumulative 275 basis points in rate hikes since May will add about $1205 to the average 30-year $750,000 loan.

"Unfortunately, there aren't many winners this Melbourne Cup Day with another whack to the household budget when we're already feeling the pinch," Compare the Market's Stephen Zeller said.

A survey by the comparison outfit found 50 per cent of Australians were worried they wouldn't be able to afford rising mortgage and rental payments in the next year.

Borrowers may suffer when interest rates rise but savers enjoy a boost to the interest rate on their savings accounts if banks pass on the hikes.

NAB has not yet announced higher rates for savers.

RateCity research director Sally Tindall said NAB was likely waiting to see what the other big banks would do.

"By keeping quiet on savings rates, NAB is strategically holding its cards close to its chest, waiting for the other three big banks to reveal their hands," she said.

"Let's hope the other three big banks come to the party for savers and pass on the full RBA hike."

Elsewhere, manufacturing conditions have stayed flat for the third month in a row as worker and supply chain shortages continue to drag business activity down.

The Australian Industry Group performance of manufacturing index showed consumer-related manufacturers performed well in October, with food and beverage sectors buoyed by a lift in orders in the lead-up to the festive season.

But industry-related manufacturing, such as metal products, had a slow month, with uncertainty in the construction sector leading to a slowdown in orders.

"Australian manufacturing is in a holding pattern, with three straight months of flat results," AI Group chief executive Innes Willox said.

"Manufacturers are concerned that if economic conditions deteriorate - as this month's federal budget forecasts - they will be unable to maintain employment and production in the face of these pressures."

In the October budget, Treasury downgraded its economic growth forecasts from the budget before, with gross domestic product tipped to fall to 1.5 per cent in 2023/24 before starting to recover.

The index showed average wages falling slightly across the manufacturing sector for the month despite ongoing labour shortages.

However, wages have been trending above long-run averages for most of the year.

Input prices also remained above historical averages despite decelerating in October.

"Manufacturers' selling prices increased but at a slower pace as fewer businesses passed through higher input costs," the report said.