BHP is continuing to pivot to copper from its old staple iron ore, with no signs headwinds are easing for the key steelmaking ingredient.

The mining giant's copper earnings outweighed those from iron ore for the first time, accounting for more than half of total earnings before interest, tax, depreciation and amortisation in the six months to December 31.

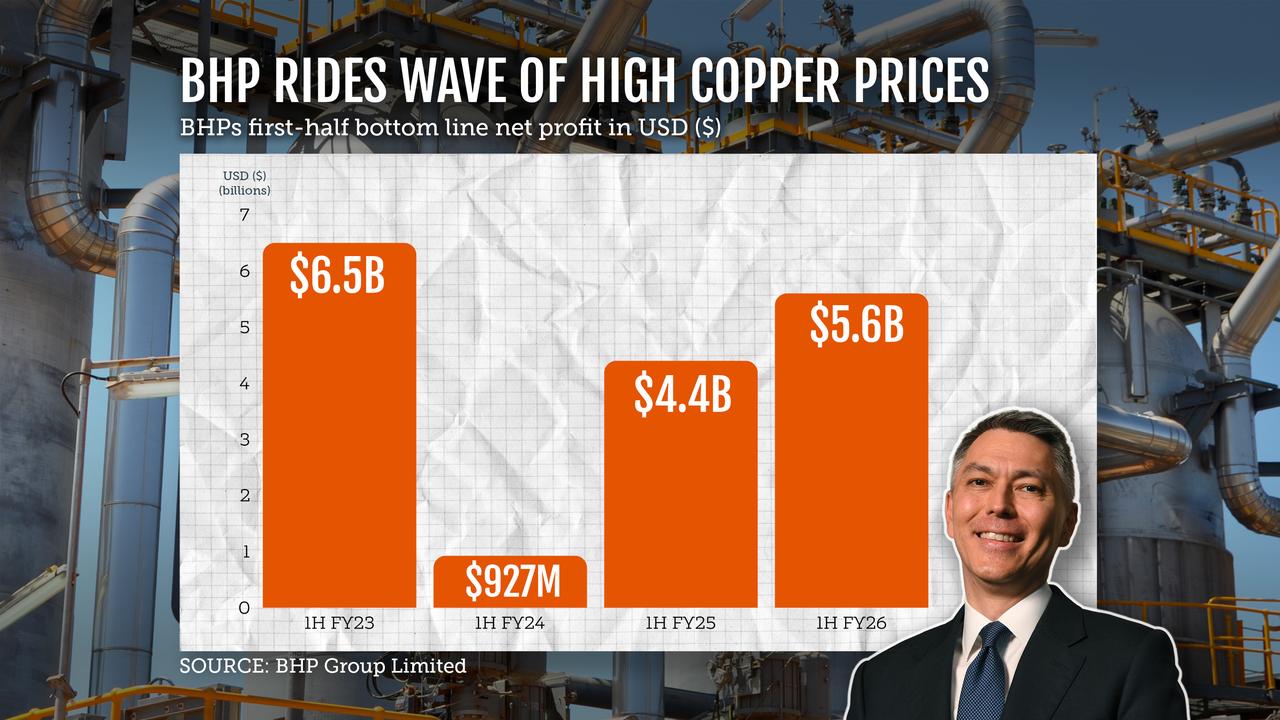

BHP posted a copper-led net profit of $US5.6 billion ($A7.9 billion) in the six months to December 2025 as revenues soared 11 per cent to $US27.9 billion ($A39.4 billion).

Iron ore remained a key cash engine for BHP, but challenges around demand and pricing from China had not gone away, eToro market analyst Zavier Wong said.

"Chinese steel production has held around 1 billion tonnes for seven straight years, but that resilience is being propped up by strong exports and manufacturing rather than the property sector that traditionally drove demand," he said.

"The question is: how long that can last?"

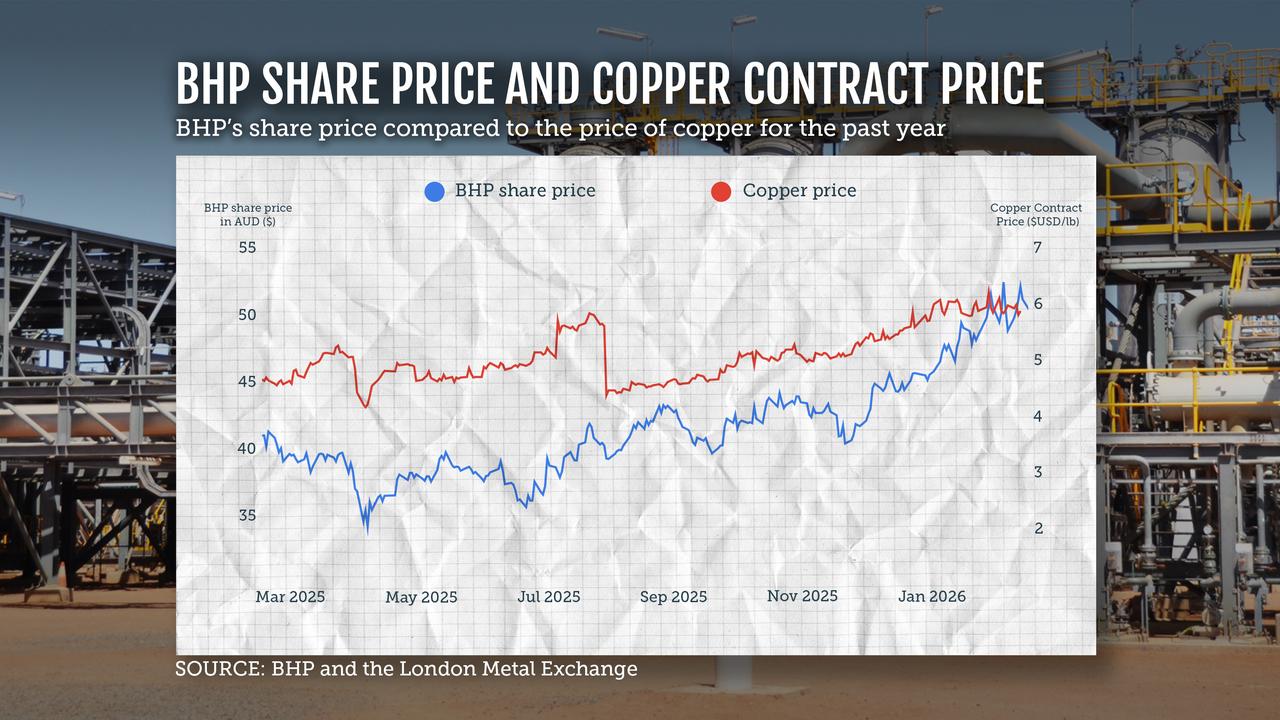

Copper prices have surged to record levels on the back of supply disruptions, along with higher demand from renewable energy projects and the global data centre build-out.

BHP is the world's largest copper producer with operations including the Escondida mine in Chile and Olympic Dam in South Australia, and it has been growing its market position by buying up brownfield and greenfield projects.

"The real test from here isn't delivering results when copper prices are surging, it's whether the growth pipeline can reduce BHP's reliance on iron ore and China over the longer term," Mr Wong said.

BHP, which has an Australian market value of $270 billion, set operational records in its iron ore business, including for first-half production and shipments, while material mined was at an all-time high.

"At Western Australia Iron Ore, we've increased our lead as the world's lowest-cost major producer," CEO Mike Henry said on Tuesday.

"This is a critical advantage, as competition in this market intensifies."

The group has now increased its 2025/26 copper output guidance to 1.9-2.0 million tonnes, and is targeting 2.5 million tonnes per year by the mid-2030s.

"This is allowing us to maximise increased earnings from the recent run-up in copper prices as well as gold," Mr Henry said.

BHP's share price soared more than seven per cent in early trading to a record high of $54.20 after it declared a 73 US cent dividend, up almost 50 per cent.

First-half group underlying earnings - before interest, tax, depreciation and amortisation - jumped 25 per cent to $US15.5 billion ($A21.9 billion), after the record $US8 billion ($A11 billion) contribution from copper.

BHP on Tuesday also revealed Vicuna Corporation - its jointly owned copper, gold and silver mining business in Argentina with Canada's Lundin Mining - will spend $US18 billion ($A25 billion) to develop new projects.

The miner's pivot towards copper indicated its growing leverage to the energy transition alongside resilient iron ore margins, Totality market strategist Aaron Zanchetta said.

"A 60 per cent payout interim dividend underscores balance sheet strength and confidence in cash flow sustainability as the group continues to invest in its copper and potash growth pipeline," he said.