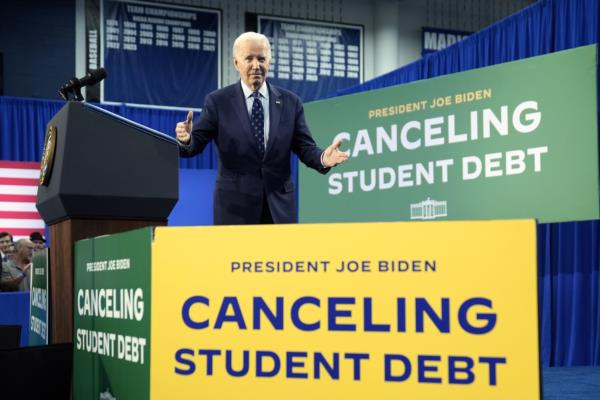

President Joe Biden has announced a new proposal aimed at providing relief to over 30 million Americans burdened by student loan debt. This initiative comes after the Supreme Court rejected Biden's initial attempt at mass student loan cancellation.

Differences from Previous Plan

The new plan differs from Biden's first proposal, which sought to erase $10,000 in debt for borrowers with incomes up to $125,000. The current plan focuses on specific categories of borrowers in need of assistance and utilizes the Higher Education Act as its legal basis.

Eligibility Criteria

The new proposal targets five groups of borrowers, including those with growing debt due to unpaid interest, individuals eligible for federal forgiveness programs, long-term loan repayers, attendees of low-value college programs, and those facing financial hardship.

Application Process and Timeline

Most debt cancellation will be automatic, except for cases where borrowers need to demonstrate hardship. Relief could begin as early as this fall, with the Education Department expected to release a formal proposal in the coming months.

Legal Challenges and Uncertainties

While the Biden administration is confident in the plan's legality under the Higher Education Act, conservative opponents are likely to challenge it in court. Republicans argue that widespread loan cancellation should be legislated by Congress, not executed through executive action.

Potential Reversal of Cancellation

If the plan faces legal setbacks and is overturned, the question of whether forgiven student loans can be reinstated arises. While technically possible, reversing debt forgiveness on a large scale would be complex and politically sensitive.

Overall, the fate of Biden's student loan cancellation plan remains uncertain, with legal battles and political dynamics shaping its future.