Beyond Meat Inc (NASDAQ:BYND) shares are trading higher Wednesday afternoon, offering a welcome reversal to investors following a 47% decline over the past month. Here’s what investors need to know.

- BYND stock is showing exceptional strength Wednesday. See what the experts say here.

What To Know: With no new company-specific filings or press releases driving the price action, the rally appears to be a sympathy move tied to broader market optimism ahead of the Thanksgiving holiday.

Wall Street is surging as investors position themselves for the holiday season, which is typically the strongest stretch of the year for corporate sales.

The Consumer Staples sector, which Beyond Meat falls under, is leading Wednesday's gains alongside technology and materials. This sector-wide lift is likely lifting BYND, which had become technically oversold.

The stock has faced severe selling pressure recently, having tumbled sharply over the past month following a disappointing third-quarter earnings report. The company reported a 13.3% year-over-year revenue decline to $70.2 million and issued a weak fourth-quarter revenue outlook of $60 million to $65 million, missing analyst expectations.

The combination of consumer staples sector strength and deep oversold conditions suggests a relief rally for the plant-based meat maker ahead of the Thanksgiving holiday.

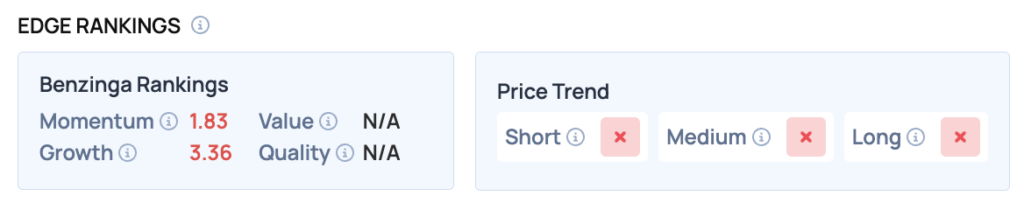

Benzinga Edge Rankings: Benzinga Edge data underscores the company’s recent technical weakness, currently assigning Beyond Meat a low Momentum score of 1.83 and negative price trends across the short, medium and long term.

BYND Price Action: Beyond Meat shares were up 17.84% at $1.01 at the time of publication on Wednesday, according to Benzinga Pro data.

Read Also: Apple Stock Breaks To All-Time Highs — Succession Clarity Unlocks New Chapter

How To BYND Stock

By now you're likely curious about how to participate in the market for Beyond Meat – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock