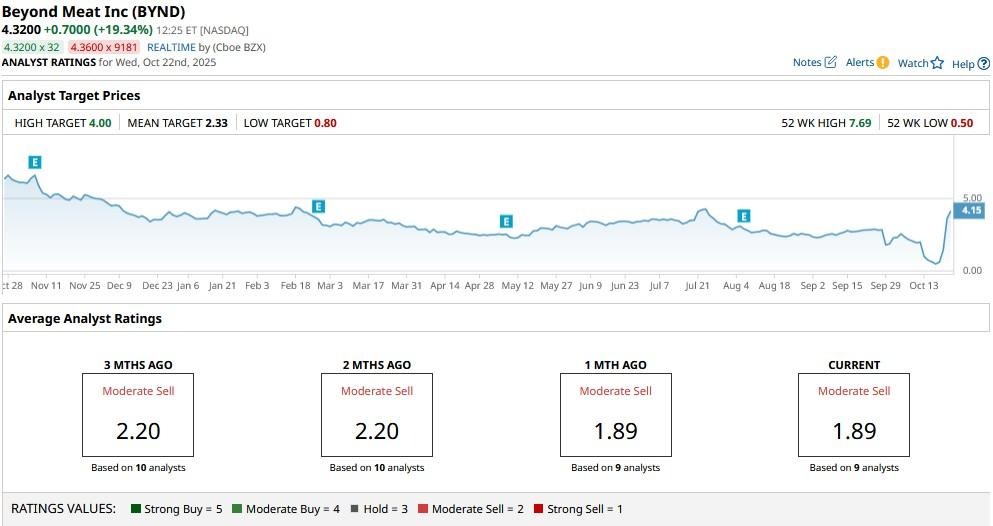

Beyond Meat (BYND) shares were seen trading as high as $7.69 in the last five sessions, up 1,438% from its year-to-date low, as the plant-based meat company remains a target of meme stock enthusiasts.

Earlier this week, the Nasdaq-listed firm announced an extended partnership with retail giant Walmart (WMT) hat further intensified individual traders’ interest in the penny stock.

At its intraday peak, BYND stock was valued at $7.69 versus its low of $0.50.

Where Options Data Suggests BYND Stock Is Headed Next

Barchart’s options data paints a picture of continued extreme volatility for Beyond Meat stock over the remainder of this year.

The price range indicated in contracts expiring Jan. 16, 2026 is $0.47 on the downside and $7.35 on the upside. In the near term as well, through the end of next week, options traders are pricing in potential for material downside to $1.39.

Considering the recent surge in BYND shares has been largely driven by retail momentum instead of fundamental or financial strength, the downside is much more likely to play out in this penny stock in both the near and longer term.

In fact, individual traders have already started dumping their shares, with Beyond Meat now going for less than $4 only.

Why Beyond Meat Shares Remain Not Worth Owning

Investors are strongly advised against initiating a position in Beyond Meat shares at current levels since meme stock rallies are notorious for burning latecomers.

These speculative, hype-driven names often pare back gains just as quickly as they’re accumulated.

Moreover, BYND is a penny stock, which means it’s vulnerable to unusual volatility and pump-and-dump behavior that typically punishes those who stay longer than they’re welcome.

In short, continued losses, negative margins, and no clear timeline for profitability together suggest chasing the ongoing momentum in BYND shares is more of a gamble than a sound investment.

Wall Street Continues to Rate Beyond Meat at ‘Sell’

Wall Street firms also recommend caution in playing BYND stock at current levels.

The consensus rating on Beyond Meat shares remains at “Moderate Sell” with even the Street-high price target of $4 no longer indicating any meaningful upside from here.