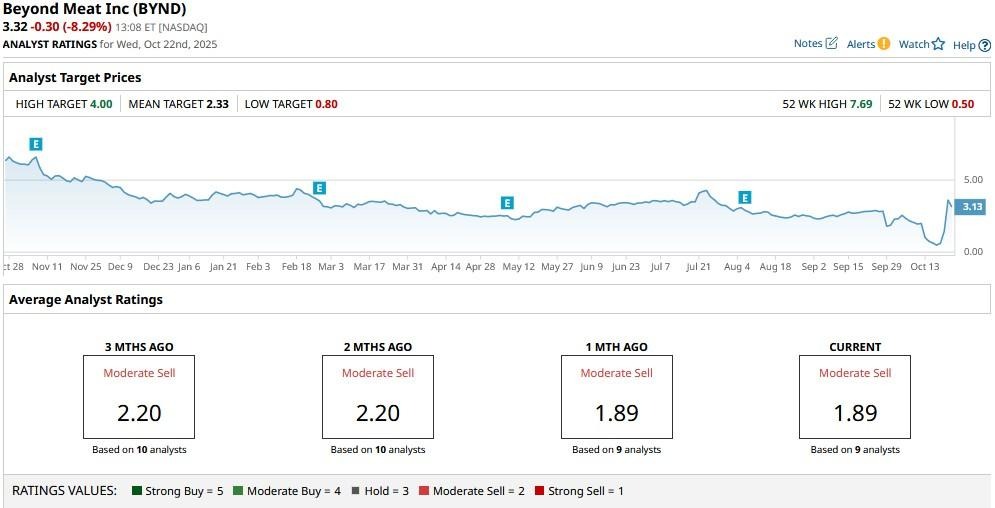

Beyond Meat (BYND) has been rather lucrative for meme stock enthusiasts in recent sessions, but a senior TD Cowen analyst warns it could crash as much as 80% from its current price.

In a research note on Wednesday, Robert Moskow maintained his “Sell” rating on the plant-based meat alternatives company and lowered his price target further from $2 to just $0.80.

Retail traders have already started dumping BYND stock in the Wednesday session. Shares are now down that’s down over 50% versus their intraday high at the time of writing.

Why Does TD Cowen Recommend Dumping BYND Stock?

TD Cowen is bearish on the Nasdaq-listed firm mostly because of the dilution risk from its recent convertible notes offering.

The said offering helped Beyond Meat lower its debt principal by an exciting 83% but more than quintupled its overall share count as well, which, according to Robert Moskow, is a major red flag.

Plus, the company’s financials do not warrant an investment either. BYND continues to post losses, its margins remain negative, and the management has no clear timeline for achieving profitability.

Together, these factors suggest BYND shares’ recent rally is more hype than substance.

Why Else Are Beyond Meat Shares Super Risky to Own?

Investors must tread with caution on Beyond Meat Inc since it falls in “two” notoriously dangerous categories of equities: meme stocks and penny stocks.

These categories are typically prone to extreme volatility, speculative trading, and pump-and-dump cycles.

Without robust fundamentals, meme stock and penny stock rallies can fade rather quickly, leaving latecomers exposed to sharp losses. In short, it’s a flashing red light for cautious investors.

That’s why options traders are pricing in a steep decline in Beyond Meat through the end of 2025.

How Wall Street Recommends Playing Beyond Meat Here

Robert Moskow is not the only Wall Street analyst recommending caution on Beyond Meat stock.

The consensus rating on BYND shares also currently sits at “Moderate Sell” with a mean target of $2.33 warning of a massive crash ahead.