Beyond Meat (BYND) stock has become the latest meme stock sensation, as it surged over 80% in a single trading session yesterday despite Wall Street's negative outlook. The plant-based meat maker's shares jumped from around $0.65 to $1.19 as retail investors piled in, driving trading volumes to 31 times the three-month average. Today, BYND stock jumped another whopping 135% to around $3.50. Short interest sits above 51%, creating the perfect setup for a squeeze that retail traders love to exploit.

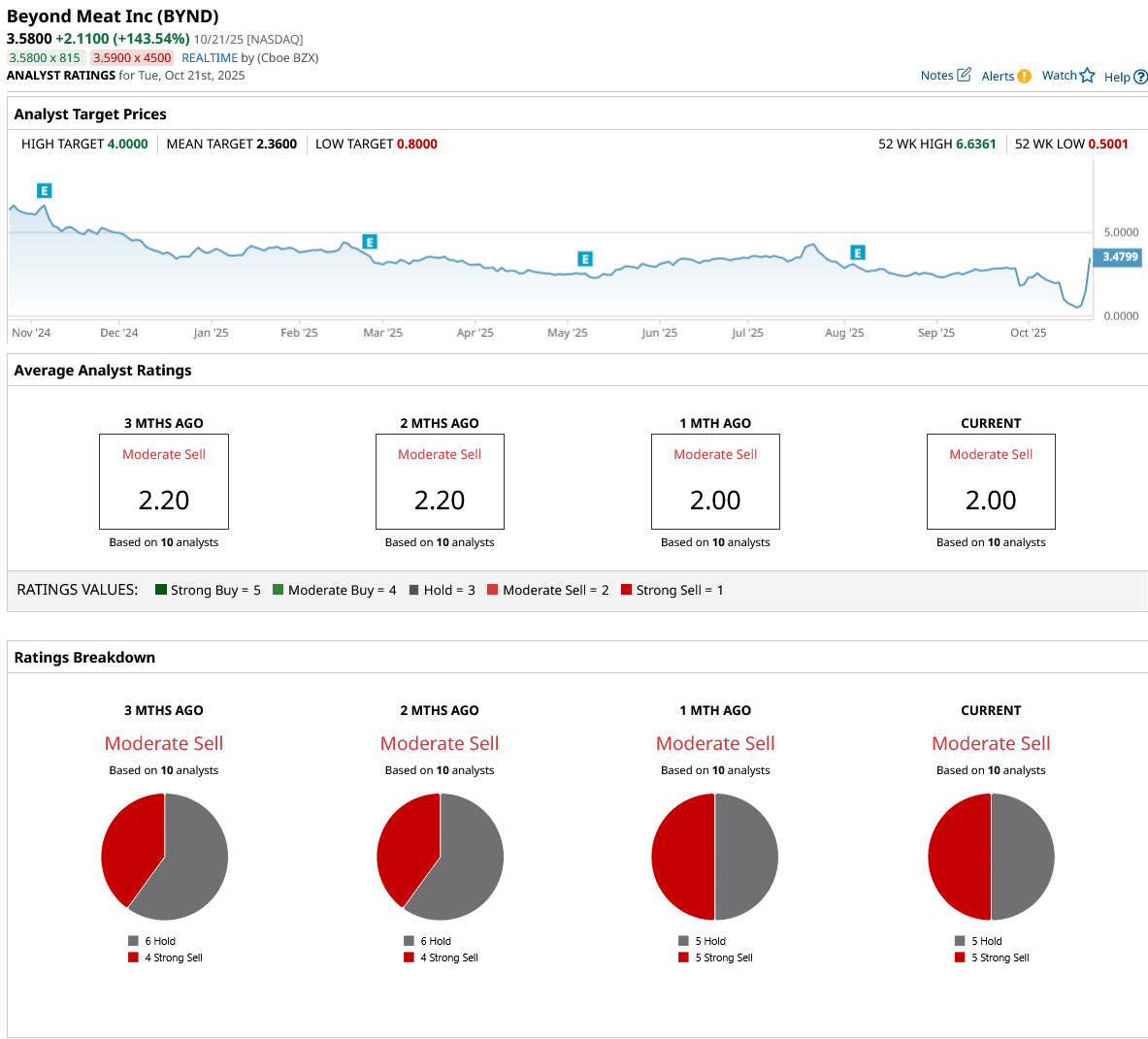

The high price target for BYND stock suggests potential upside of more than 10% from current levels, though that still values shares at just $4. And that's quite the optimistic take, considering BYND's mean target of just $2.36. And several analysts have gone further, with some arguing the stock's intrinsic value is essentially zero given the company's fundamental challenges.

Beyond Meat recently completed a debt swap that will issue roughly 316 million new shares on top of the existing 76 million outstanding. Creditors who convert their notes will own 88% of the company, massively diluting current shareholders. The move provided Beyond Meat breathing room by reducing leverage and extending debt maturities, but the dilution is severe.

Sales dropped 20% last quarter to just $75 million as consumer appetite for plant-based meat continues to weaken. BYND stock went public in 2019 and was valued at $14 billion compared to just $112 million today. The meme stock crowd sees opportunity in the combination of extreme short interest, tiny float, and a consumer-friendly brand name.

But unlike GameStop (GME) or AMC (AMC), Beyond Meat lacks a prominent champion to rally retail investors. The business fundamentals suggest this pop may be short-lived rather than the start of a sustained recovery.

Can Beyond Meat Stock Recover Over the Next 12 Months?

Beyond Meat is fighting for survival after posting disastrous second-quarter results that showed just how far the plant-based meat pioneer has fallen. Revenue declined by 20% year-over-year (YoY) to $75 million, while it reported a loss of $33.2 million, or $0.43 per share, in Q2.

Management expects third-quarter sales between $68 million and $73 million, which indicates that conditions will get worse before they improve. The U.S. retail channel got hammered, with sales dropping 27% as consumers rejected higher prices and retailers moved plant-based products from the refrigerated section to frozen aisles.

International foodservice also struggled as promotional activity from last year didn't repeat, and some quick-service restaurants paused or discontinued Beyond's burger products. Gross margin fell to 11.5% from 14.7% a year ago, squeezed by lower volumes and unfavorable product mix.

Beyond Meat brought in an interim “chief transformation officer” to slash operating expenses and expand gross margins. The company conducted layoffs and is intensifying cost cuts across the board. Management aims to reach EBITDA-positive operations in the second half of 2026, though that goal seems ambitious given current trends.

What Is the BYND Stock Price Target?

Beyond Meat is trying to rebrand itself, emphasizing the "Beyond" name rather than specific meat alternatives. It recently teased Beyond Ground, a four-ingredient product with 27 grams of protein that doesn't replicate any specific meat.

Brown believes this shift toward highlighting protein content and nutritional benefits rather than meat replication could attract new customers. Beyond Meat ended Q2 with $117.3 million in cash and $1.2 billion in debt. It faces convertible note maturities in 2027 and is actively working on refinancing options.

Analysts tracking BYND stock forecast sales to rise from $282.4 million in 2025 to $311 million in 2028. It is forecast to end 2028 with a loss per share of $0.05 compared to a loss per share of $1.88 this year. Moreover, the company’s free cash outflow is projected at over $250 million through 2028.

Out of the 10 analysts covering BYND stock, five recommend “Hold” and five recommend “Strong Sell.” The average stock price target is $2.36, which is below the current price of about $3.50.