Implied volatility (IV) isn’t just noise — it’s the heartbeat of the options market. In his latest YouTube video, Rick Orford breaks down how to align your strategy with volatility conditions by using metrics like IV Rank and IV Percentile.

Here’s a quick guide from the clip:

Long Options: Look for Low but Rising Volatility

When volatility is below 50% but trending upward, traders may find opportunities in long calls or puts.

- Why it works: You spend less on the option now, and if volatility spikes, your premium rises.

- Example: Buying a call on a stock like Palantir (PLTR) when IV Rank is low but rising.

- Risk: If the stock price moves against you, higher volatility won’t save your trade — the premium can still fall fast.

Short Options: Use High but Falling Volatility

Covered calls, cash-secured puts, or spreads like bear calls and bull puts work best when IV Rank and Percentile are above 60–70%, but trending downward.

- Why it works: You collect richer premiums upfront, and as volatility falls, the option’s value erodes — making it cheaper to buy back or letting it expire worthless.

- Great for: Income strategies in volatile markets that are calming down.

Debit vs. Credit Spreads

- Debit strategies (like long iron condors, bull calls, bear puts): Best when volatility is low, but rising.

- Credit strategies (like short iron condors, bear calls, bull puts): Best when volatility is high, but falling.

How to Find the Trades

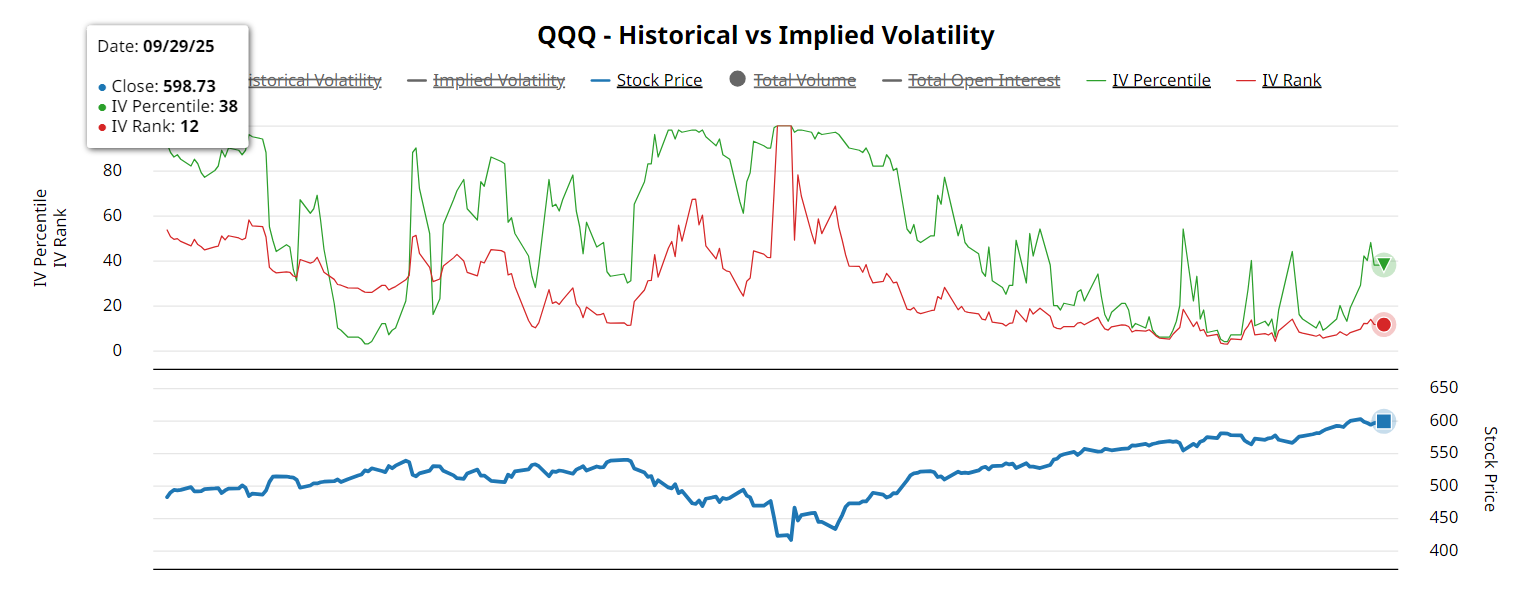

Barchart makes it simple to screen for trades by volatility conditions:

- IV Rank and IV Percentile

- Implied vs. Realized Volatility

- Highest/Lowest Implied Volatility

- Percent Change in Volatility

For example, searching for lowest implied volatility at the time of recording brought up names like Microsoft (MSFT), Apple (AAPL), Altria (MO), and Caterpillar (CAT) — liquid, well-known companies where long strategies may fit.

The Bottom Line

Implied volatility isn’t just a number; it’s a roadmap for picking the right options strategy at the right time.

- Low but rising IV? Think long options or debit spreads.

- High but falling IV? Look at short options or credit spreads.

Watch the clip to see Rick’s lesson →

- Stream Rick Orford’s full YouTube video for the complete breakdown on volatility.

- Explore Barchart’s Volatility Charts page, and check out strategy explainers in the Options Learning Center.