/Best%20Buy%20Co_%20Inc_%20store%20by-%20Michael%20Vi%20via%20iStock.jpg)

With a market cap of $14.3 billion, Best Buy Co., Inc. (BBY) is a leading multinational retailer specializing in consumer electronics, appliances, and related services, operating in the United States and Canada. The company offers a wide range of technology products and support through its physical stores and online platforms under various brand names, including Best Buy, Geek Squad, and Lively.

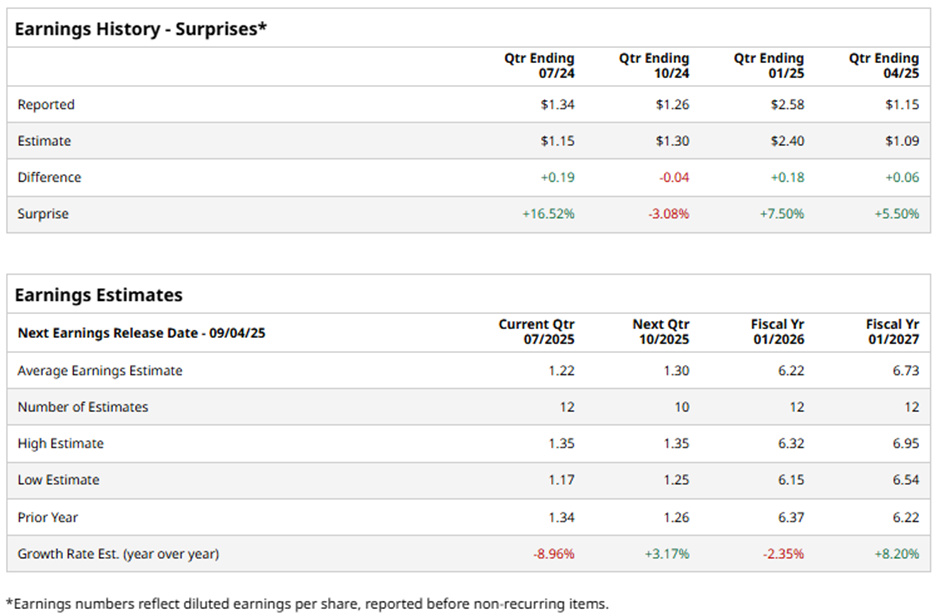

The Richfield, Minnesota-based company is expected to announce its fiscal Q2 2026 earnings results on Thursday, Sept. 4. Ahead of this event, analysts expect Best Buy to report an adjusted EPS of $1.22, down nearly 9% from $1.34 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last quarters while missing on another occasion.

For fiscal 2026, analysts expect the consumer electronics retailer to report an adjusted EPS of $6.22, a 2.4% decline from $6.37 in fiscal 2025. However, adjusted EPS is anticipated to grow 8.2% year-over-year to $6.73 in fiscal 2027.

Shares of Best Buy have declined 21.6% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 17.1% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 24.3% return over the period.

Despite posting a better-than-expected Q1 2026 adjusted EPS of $1.15, Best Buy shares tumbled 7.3% on May 29 due to a significant cut in its full-year comparable sales and adjusted EPS guidance to $6.15 - $6.30. Investor sentiment was further dampened by concerns over rising U.S. tariffs, which could increase costs on imported goods, roughly 30% - 35% of Best Buy's inventory, pressuring margins and consumer demand for high-ticket items.

Analysts' consensus view on BBY stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, eight recommend "Strong Buy," 13 indicate “Hold,” and one advises "Moderate Sell." As of writing, the stock is trading below the average analyst price target of $78.42.