Over the weekend, Sen. Bernie Sanders (I-Vt.) is aiming for President Donald Trump's $300 million White House ballroom project, accusing the billionaire and his corporate allies of turning political payoffs into architectural grandeur.

Sanders Calls Out Big Tech's ‘Checks To Trump'

Sanders took to X, formerly Twitter, saying that Trump's "Big Beautiful Bill" handed billions in tax breaks to major corporations like Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Microsoft Corporation (NASDAQ:MSFT), Amazon.com, Inc. (NASDAQ:AMZN) and Meta Platforms, Inc. (NASDAQ:META) now helping fund the new White House addition.

Sanders wrote, "This year, Trump's Big Beautiful Bill gave: Google an $18 billion tax break. Amazon a $16 billion tax break. Microsoft a $12 billion tax break. Facebook an $11 billion tax break. Now, they're writing checks to Trump for his $300 million ballroom. Gee, I wonder why?"

Google, Amazon, Microsoft, Meta and the White House did not immediately respond to Benzinga's request for comments.

What Is Big Beautiful Bill And How It Impacted Big Tech

On July 4, 2025, President Trump signed the One Big Beautiful Bill Act into law. The sweeping tax measure delivers major perks to businesses, especially Big Tech, potentially unlocking an earnings boost not yet reflected in stock prices.

The law restores immediate expensing for research and development costs, reversing a 2017 rule that required companies to amortize those expenses over five years. It also allows retroactive deductions for previously deferred R&D costs, letting firms claim years of tax savings at once, noted Business Insider.

Under Generally Accepted Accounting Principles, R&D expenses have always been recognized immediately, even when tax law required amortization. That mismatch meant companies paid more tax upfront, creating deferred tax assets for future use.

Trump's $300 Million Ballroom Draws Fire

The 90,000-square-foot ballroom is the most ambitious White House addition in more than seven decades. The project required demolishing the East Wing to make room for a marble-floored, gold-accented event space inspired by Trump's Mar-a-Lago estate.

White House officials said the ballroom will be fully financed through private contributions and Trump's personal funds — not taxpayer money.

Press Secretary Karoline Leavitt defended the effort, calling it a symbol of the "beauty and strength" of the American spirit.

Elizabeth Warren Also Mocked The Timing Of Construction

Earlier this month, Sen. Elizabeth Warren (D-Mass.) ridiculed Trump regarding new demolition work at the White House.

“Oh you're trying to say the cost of living is skyrocketing? Donald Trump can't hear you over the sound of bulldozers demolishing a wing of the White House to build a new grand ballroom,” she stated at the time.

Warren's criticism comes amid ongoing negative consumer sentiment. According to a Harris poll shared by the Guardian, 74% of Americans reported their monthly household expenses had increased by at least $100 compared to the previous year.

While overall inflation has declined from its 2022 peak, it remained at 2.9% annually in August, exceeding the Federal Reserve's 2% target.

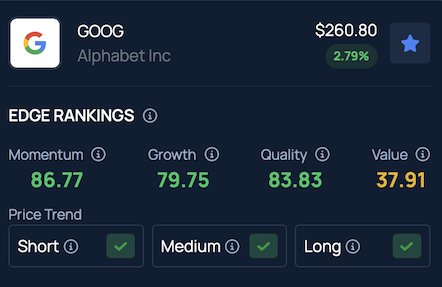

Benzinga’s Edge Stock Rankings place GOOG in the 86th percentile for Momentum, indicating robust price trends across short, medium and long-term periods. Click here to compare its performance with competitors.

Read Next:

Photo Courtesy: LiamMurphyPics on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.