Sen. Bernie Sanders (I-Vt.) on Monday aligned himself with Pope Leo's criticism of outsized executive pay, saying the pontiff is "exactly right" to call out soaring compensation packages and pointing specifically to Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk's proposed $1 trillion award.

Bernie Sanders Echoes Pope On Soaring Executive Pay

Sanders said such windfalls call attention to widening inequality and argued the package should be rejected, renewing a fight he waged last week when he labeled Musk's prospective payout "grossly immoral."

Sanders posted on X on Monday, stating, "The Pope is exactly right. No society can survive when one man becomes a trillionaire while the vast majority struggle to just survive — trying to put food on the table, pay rent and afford health care. We can and must do better."

Pope Warns Of Trillionaire Era Dangers Ahead

Pope Leo, in a recent interview published in bits over the last weekend, warned about the concentration of wealth and the dramatic expansion of CEO pay ratios, saying chief executives now make "600 times more than what average workers are receiving."

See Also: Elon Musk And Sam Altman May Not Agree On Everything, But On This One Topic Their Ideas Align

Citing reports that Musk could become a trillionaire under Tesla's plan, he asked, "What does that mean and what's that about? If that is the only thing that has value anymore, then we're in big trouble."

Tesla Board And Analysts Defend Compensation Plan

Tesla's board has framed the proposed, performance-based award as a way to keep Musk focused on meeting audacious targets over a decade, including massive growth in robotaxis, robotics and market value. Board chair Robyn Denholm defended the package, saying it motivates "doing things that no one else has done before," and argued comparisons to conventional executive pay miss its purpose.

Morgan Stanley's Adam Jonas has called the proposal "a good deal" for Tesla shareholders, adding that while $1 trillion is a large figure, it is "modest compared to the size of the market opportunity" Tesla is pursuing in AI, autonomy and robotics.

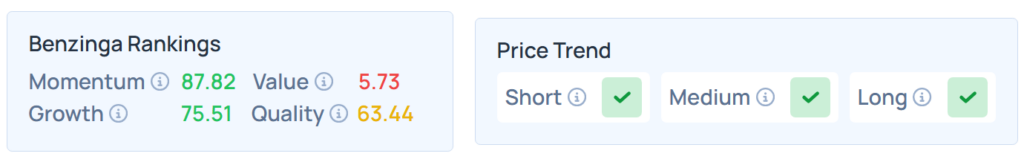

Price Action: So far in 2025, Tesla’s stock is up 8.17%, underperforming the S&P 500’s 12.72% gain and the Nasdaq 100’s 15.82% increase, according to Benzinga Pro. Benzinga’s Edge Stock Rankings indicate that TSLA continues to show strength across short, medium and long-term horizons. Check here for deeper insights on key price metrics.

Photo Courtesy: Jana Shea on Shutterstock.com

Read Next: