Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending September 12:

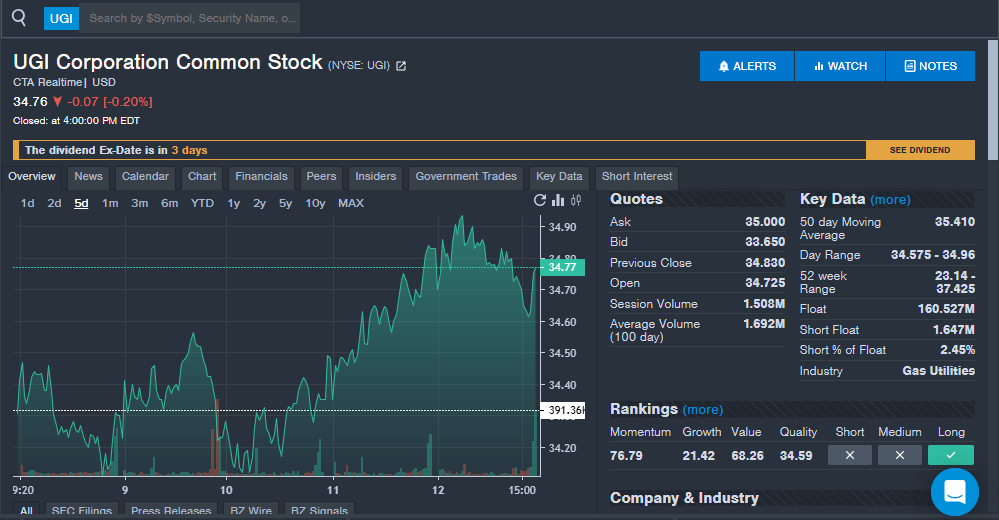

UGI Corporation (NYSE:UGI): The energy company saw strong interest from investors during the week. Shares have started to recover after trading lower from third-quarter financial result reported in August. The company beat analyst estimates for earnings per share in the third quarter, beating for an eighth straight quarter. Revenue missed analyst estimates in the third quarter, missing for an 11th straight quarter. Investors could be reacting to the company's highlights in the quarterly results, which includes ongoing portfolio transformation of the AmeriGas business and asset sales.

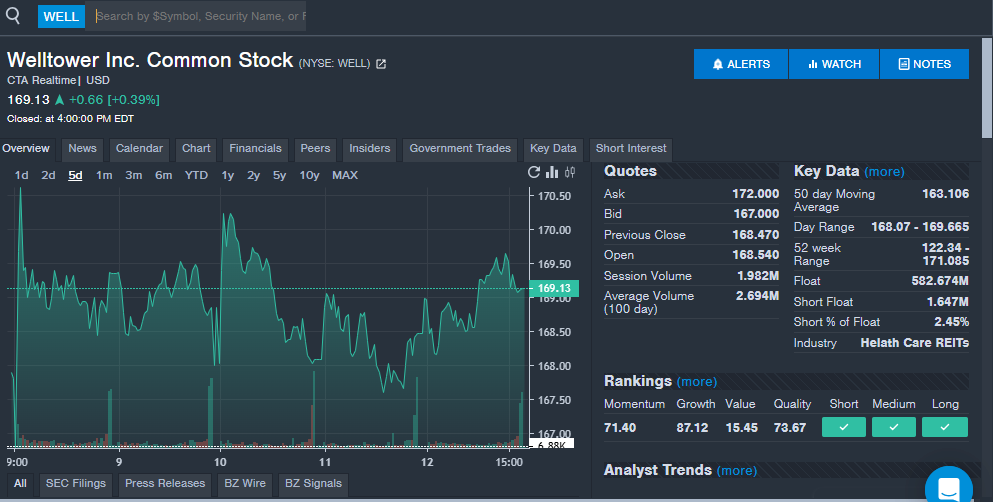

Welltower Inc (NYSE:WELL): The diversified health care real estate investment trust saw increased attention during the week, likely due to recent analyst price target increases. With shares trading near all-time highs of around $171, multiple analysts raised price targets. Scotiabank raised the price target from $172 to $181, Wells Fargo raised the price target from $175 to $185 and Mizuho raised the price target from $170 to $186. The company beat analyst estimates for earnings and revenue in the second quarter and has posted several double beats in consecutive quarters.

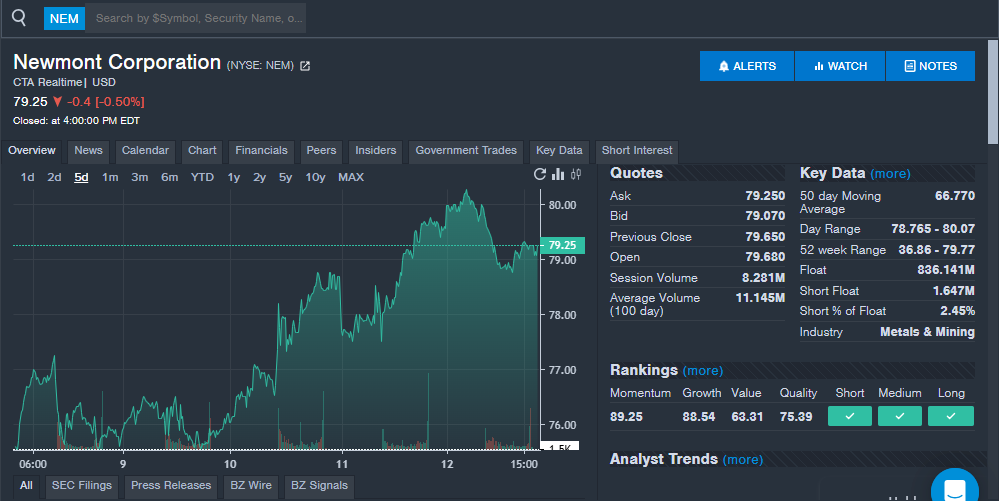

Newmont Corporation (NYSE:NEM): The surge of interest in gold stocks continues and Newmont saw increased attention from investors. The stock is one of the top performers in the S&P 500 year-to-date with a 107% gain and analysts are mixed on what comes next. Macquarie downgraded the stock from Outperform to Neutral, while RBC Capital upgraded the stock from Sector Perform to Outperform. A recent Bloomberg report suggesting the company is weighing job cuts that could be in the thousands to improve costs after a $15 billion acquisition of Newcrest Mining. Gold prices have hit record highs, but Newmont's costs have also increased.

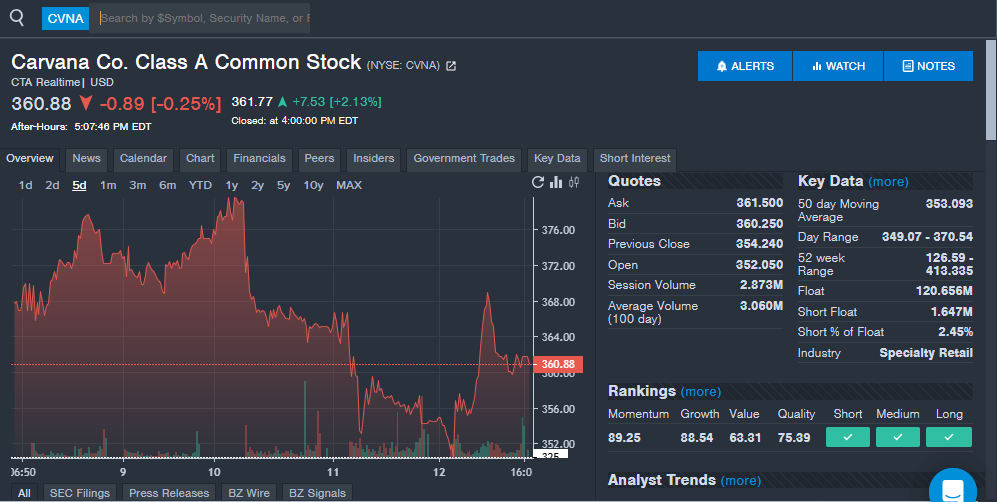

Carvana Co (NYSE:CVNA): The ecommerce used car platform company saw strong interest from readers during the week. The interest comes with shares up 81% year-to-date. Of interest is notable large insider selling in recent months, which could be on the minds of investors. The company also saw shares trade lower in August after car rental company Hertz announced a partnership with Amazon.com. Hertz was previously a partner with Carvana.

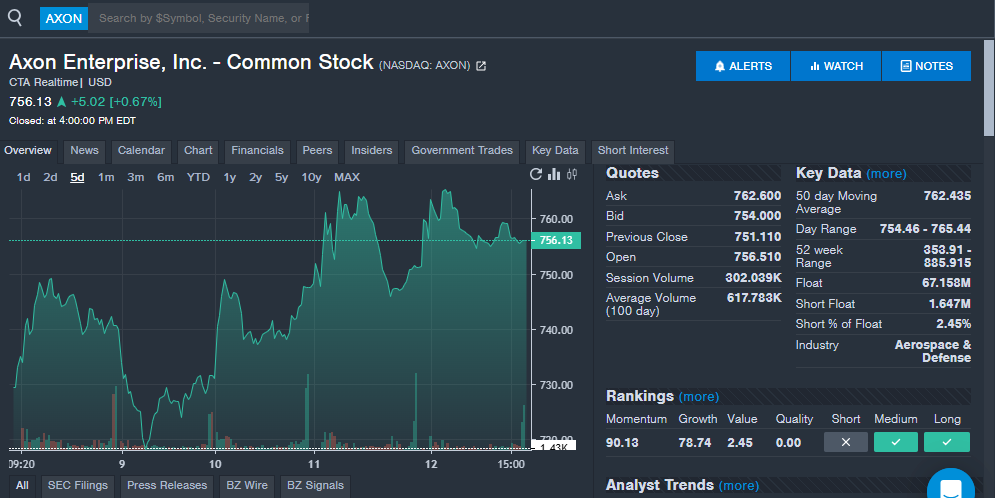

Axon Enterprise Inc (NASDAQ:AXON): The public safety company saw increased interest, which comes after another double beat against analyst estimates for the second quarter, which was reported last month. The company saw revenue up 29% or more year-over-year across its three main business segments. Annual recurring revenue was up 39% to $1.2 billion. The company also raised its full-year revenue outlook after the results. Axon CEO Rick Smith was on CNBC's "Mad Money" in August where he shared that the entire ecosystem is seeing growth. Smith highlighted growth of AI-related products as well.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: