Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending September 26:

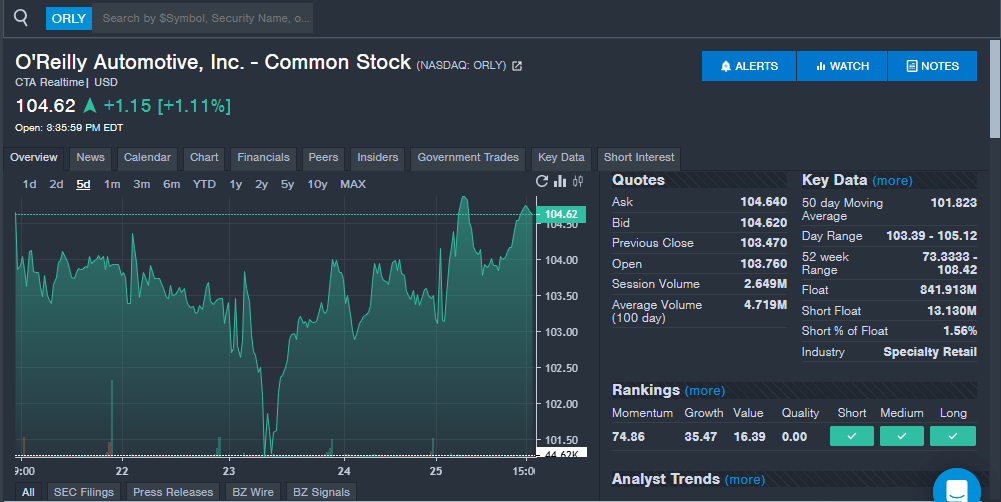

O'Reilly Automotive Inc (NASDAQ: ORLY): The auto parts company saw strong interest from readers with shares near all-time highs. The company recently received favorable ratings from analysts with Wolfe Research initiating coverage with an Outperform rating and $121 price target and TD Cowen maintaining a Buy rating and raising the price target from $112 to $125. O'Reilly is likely to report third-quarter results next month and will look to reverse course from recent trends. The company has missed analyst estimates for earnings per share in six straight quarters and missed revenue estimates in six of the last seven quarters. With strong interest from readers and bullish analyst takes, the stock is likely one to watch heading into earnings.

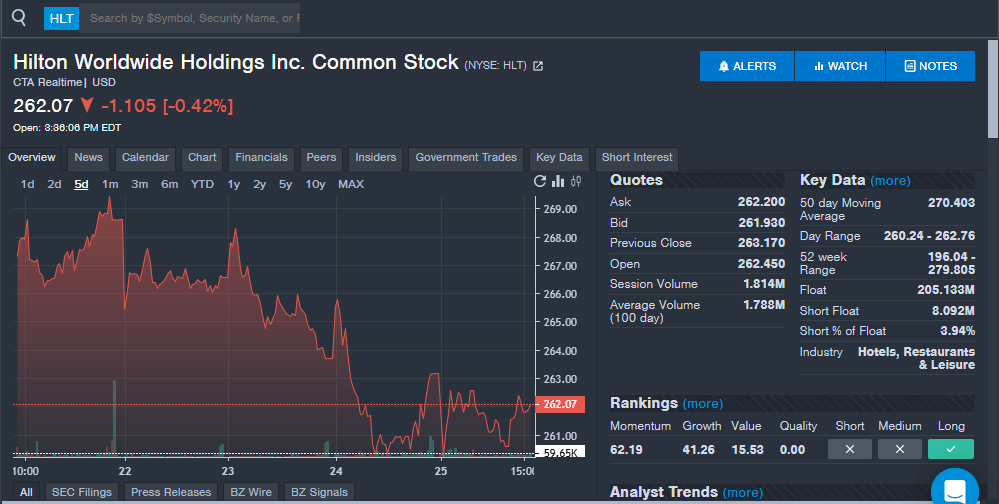

Hilton Hotels Corporation (NYSE: HLT): The hotel company saw strong interest from readers during the week amid analyst rating updates and ahead of quarterly earnings. The company saw Bernstein maintain a Market Perform rating and raise the price target from $261 to $288 and Morgan Stanley maintain a Buy rating with a price target of $286. Hilton recently confirmed it will report third-quarter financial results on Oct. 22. Analysts expect the company to report earnings per share of $2.06, up from $1.92 in last year's third quarter. Analysts also expect quarterly revenue of $3.02 billion, up from $2.87 billion in last year's third quarter. The company has beaten analyst estimates for earnings per share in seven straight quarters and beat revenue estimates in seven of the last 10 quarters.

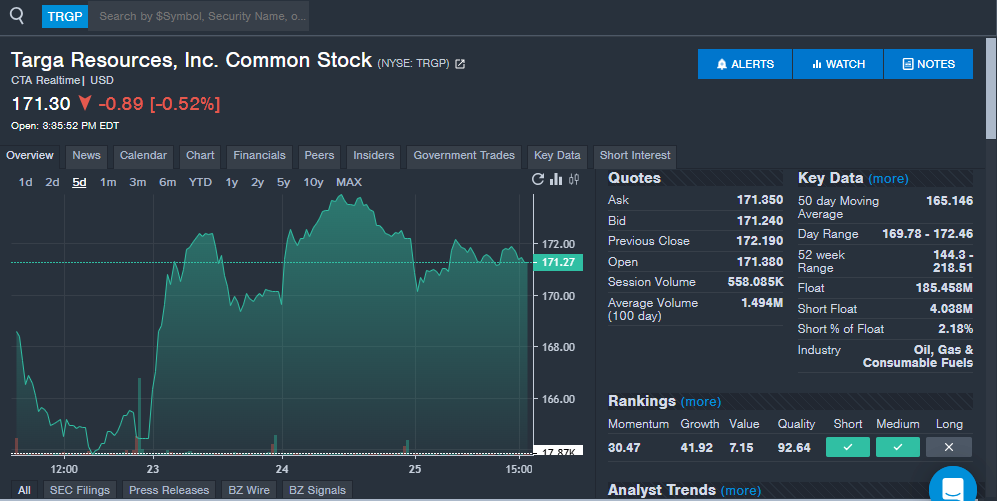

Targa Resources Corp (NYSE: TRGP): The midstream energy infrastructure company is seeing strong interest from readers with shares down 6% year-to-date. The company received favorable ratings from analysts recently. BMO initiated the stock with an Outperform rating and $185 price target. Bank of America maintained a Buy rating, but lowered the price target from $220 to $200. The company beat analyst estimates for earnings per share in the second quarter, which was reported in August, but missed estimates for revenue. The stock remains one to watch for investors.

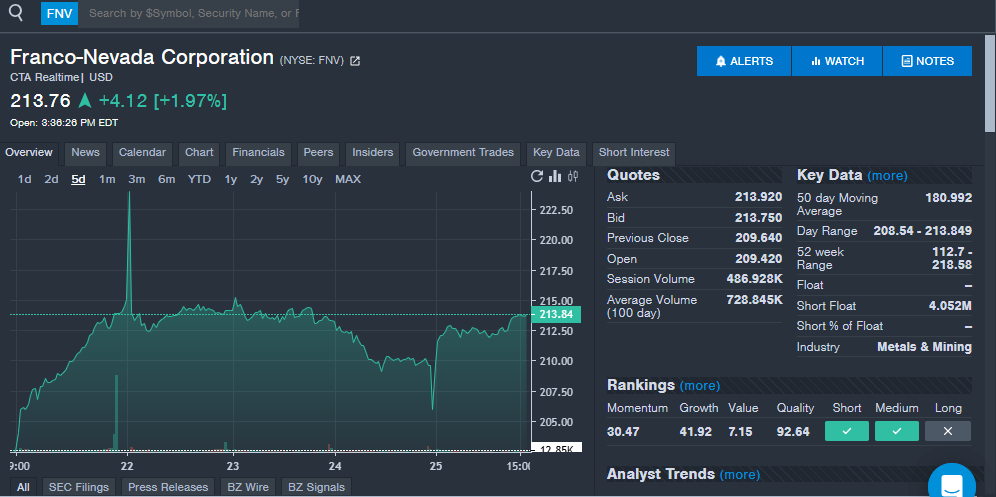

Franco-Nevada Corp (NYSE: FNV): Another gold-related stock makes its way onto the Stock Whisper Index, with Franco-Nevada this week's pick. The company recently announced a settlement over a Canadian tax dispute, which may have been an overhang item on shares. The company also received favorable ratings from analysts with Raymond James raising the price target from $203 to $218 and UBS raising the price target from $210 to $250.

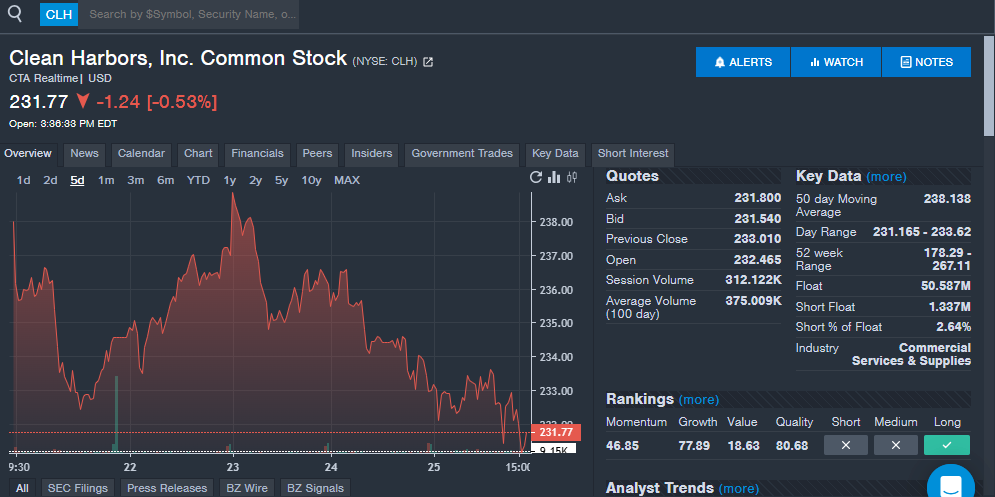

Clean Harbors Inc (NYSE: CLH): The waste management company saw strong interest from readers during the week. In July, the company missed analyst estimates for both earnings per share and revenue, but highlighted future margin expansion and a robust pipeline. These items could be contributing towards reader interest as the next quarterly results get closer. A recent initiation with an Equal-Weight rating and $252 price target from Barclays could also be a reason for the reader interest. The stock remains one to watch ahead of its next quarterly results.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: