Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending August 29:

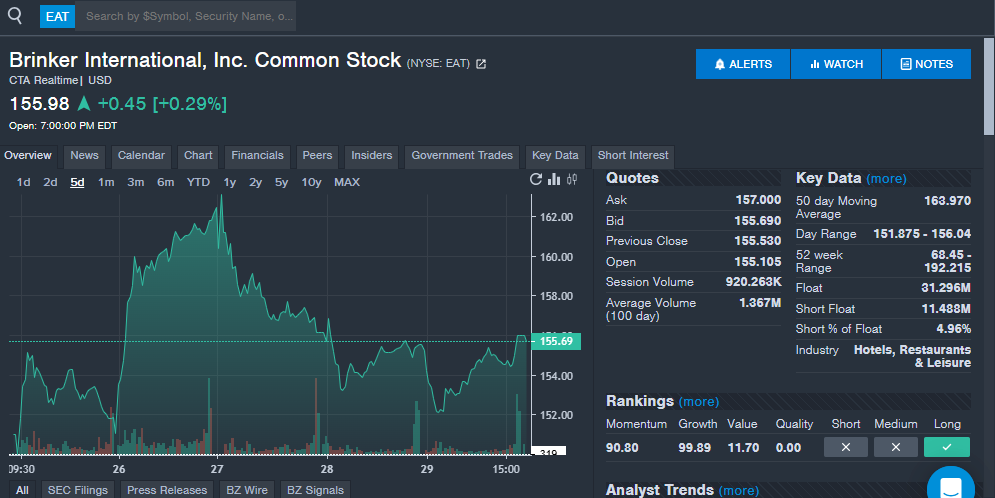

Brinker International (NYSE:EAT): The owner of Chili's and Maggiano's is heating up with strong interest from readers weeks after the company beat analyst estimates once again. The company's fourth-quarter results saw a fourth straight earnings per share beat and a fifth straight revenue bate. The restaurant company has now beaten analyst estimates for earnings per share in nine of the last 10 quarter sand for revenue in seven of the last 10 quarters. While other restaurants are struggling to see growth, Chili's has been a strong player in the sector and investors appear to be taking notice. Fourth quarter sales were up 21% year-over-year for the company overall. Comparable restaurant sales were up 23.7% for Chili's, with the company highlighting growth in traffic and strong menu innovation. Multiple analysts raised their price targets after the financial results.

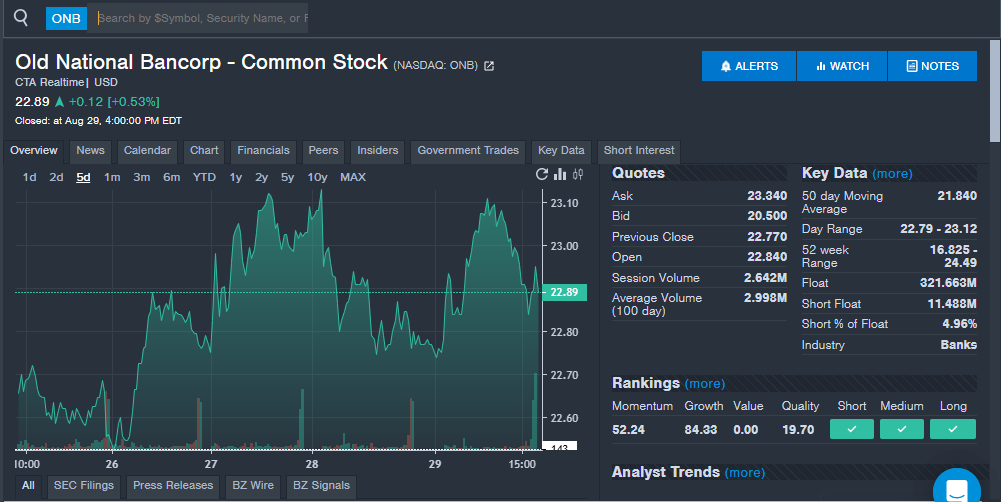

Old Nation Bancorp (NASDAQ:ONB): The regional bank company saw strong interest from readers during the week. Owning banks in Indiana, Illinois and Kentucky, the company reported second-quarter financial results in July. The company beat analyst estimates for both earnings per share and revenue, a third straight time for each key financial metric. Several analysts raised their price targets on the stock. With a strong history of beating analyst estimates and with shares up around 8% year-to-date, this could be a stock to watch for investors.

SiriusXM Holdings Inc (NASDAQ:SIRI): The satellite radio company saw strong interest from readers, which comes after recently reported second-quarter financial results showed subscriber revenue declines. The company's financials were mixed to analyst estimates with revenue beating estimates and earnings per share missing. Along with subscriber revenue declining, the company also reported a drop in advertising revenue on a year-over-year basis. The company reiterated full-year revenue guidance. Warren Buffett has been a buyer of SiriusXM stock in recent quarters, but the latest 13F filing showed no new purchases in the second quarter. Several analysts kept Underweight and Neutral ratings on the stock following the latest earnings report. SiriusXM's next catalyst is likely news of whether or not it is renewing its contract with Howard Stern. While Stern brings in significantly less listeners than he did years ago, he remains a key exclusive for SiriusXM. Without Stern, the company might have to invest in other top names and the stock could face pressure from fears of accelerated subscriber losses moving forward.

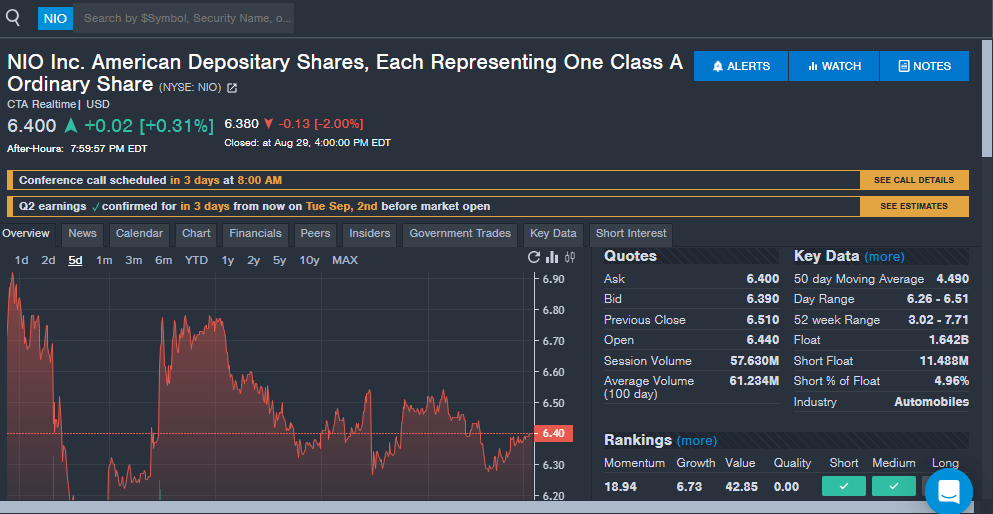

NIO Inc (NYSE:NIO): The electric vehicle company saw strong interest last week ahead of second-quarter financial results, which are set for Tuesday, Sept. 2. Analysts expect the company to report a loss of 30 cents per share and revenue of $2.76 billion. The company has struggled in recent quarters, with earnings per share missing analyst estimates in two straight quarters, and revenue missing estimates in five straight quarters. Nio does have some positive momentum heading into the company's quarterly results. The company's Onvo hit a new monthly record with more than 10,000 units of the L90 in August. Nio also announced that a special edition of its Firefly EV sold out in 30 hours. The company's ES8 SUV will launch later this year and is seeing strong momentum according to the company. JPMorgan analyst Nick Lai recently upgraded the stock from Neutral to Overweight and raised the price target from $4.80 to $8.00 ahead of the earnings report. A report from Deutsche Bank predicts that Nio has momentum in China for the month of August as well. Nio shares are up over 40% year-to-date, but a strong earnings report on Tuesday could send shares higher.

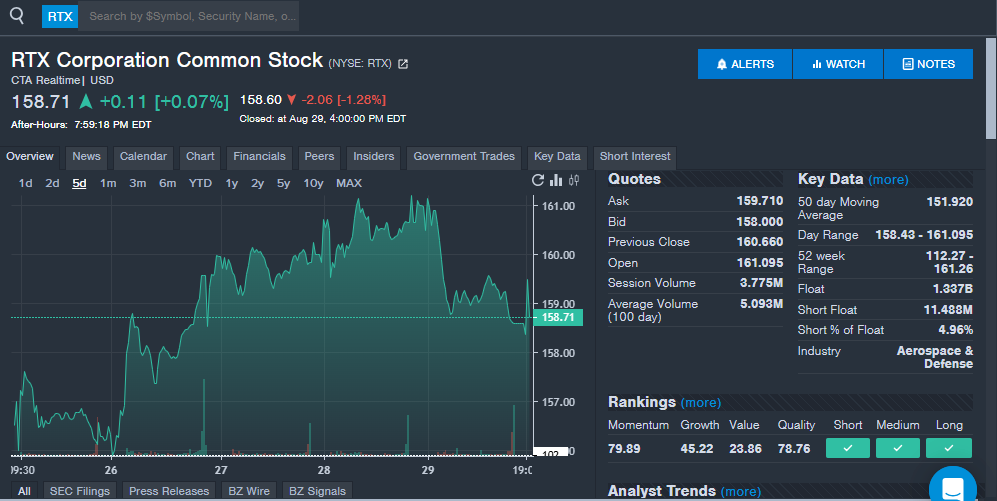

RTX Corporation (NYSE:RTX): The aerospace and defense company saw strong interest from readers during the week, which comes as the sector is seeing increased attention due to multiple global conflicts. RTX owns Collins Aerospace, Pratt & Whitney and Raytheon, giving it exposure to commercial and government aircraft divisions. The company landed a recent $2.8 billion Pentagon deal and could be a winner from news that Ukraine will be committing to buying more weapons from the U.S. In July, the company beat analyst estimates for earnings per share and for revenue. RTX has now beaten analyst estimates for earnings per share in more than 10 straight quarters and beaten analyst estimates for revenue in 10 straight quarters. Analysts raised their price targets after the latest financial results.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: