Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here's a look at the Benzinga Stock Whisper Index for the week ending October 3:

Nokia Corporation (NYSE:NOK): The telecom equipment company saw interest surge during the week among Benzinga readers. Formally known as one of the largest phone companies, Nokia has changed over the years. The company recently signed a global licensing deal with Hewlett Packard Enterprise to expand the company's networking capabilities for the shift from 5G to 6G. Nokia said its customers will benefit from the deal, which improves the company's AI-driven automation. Nokia also recently partnered with Super Micro Computer to expand AI and cloud infrastructure. The increased interest in Nokia also comes ahead of third quarter earnings, set for Oct. 23. Analysts expect earnings per share of 6 cents per share and revenue of $5.39 billion for the quarter. Nokia has had mixed results in recent quarters with earnings missing analyst estimates in three of the last four quarters and revenue beating estimates in two of the last three quarters.

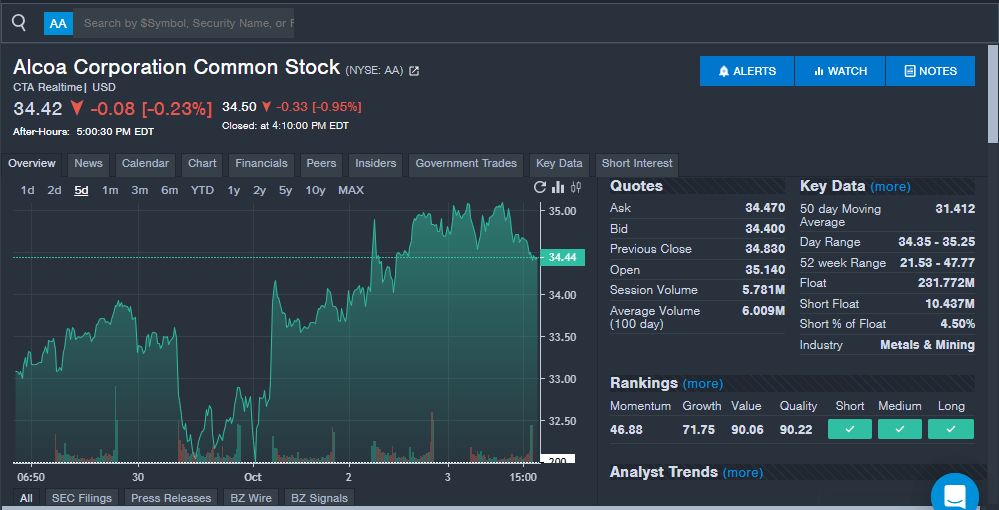

Alcoa Corporation (NYSE:AA): The aluminum company saw increased interest from readers, which comes after the company reported a company update. Alcoa announced it will permanently close the Kwinana Refinery and take an $890 million charge. The company updated that its 2025 total spending for asset retirement obligations and environmental reserves will be $20 million higher than originally expected, totaling $260 million. The 2026 total is expected to be around $300 million. Alcoa is set to report third-quarter financial results on Oct. 22. The company has beaten analyst estimates for earnings per share in four of the last five quarters and beaten analyst estimates for revenue in four of the last six quarters.

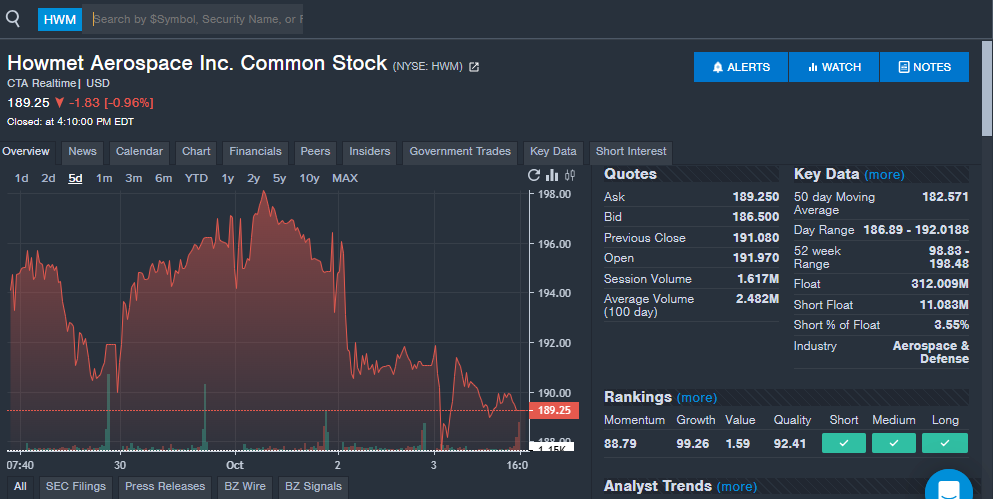

Howmet Aerospace (NYSE:HWM): The aerospace company saw strong interest from readers during the week, which comes with shares trading near all-time highs. The company announced it will report third-quarter financial results on Oct. 30. Analysts are expecting earnings and revenue to grow on a year-over-year basis. The company has beaten analyst estimates for earnings per share in 10 straight quarters and beaten revenue estimates in eight of the last 10 quarters overall. With consistent growth and analyst beats, the stock is likely one to watch ahead of quarterly results.

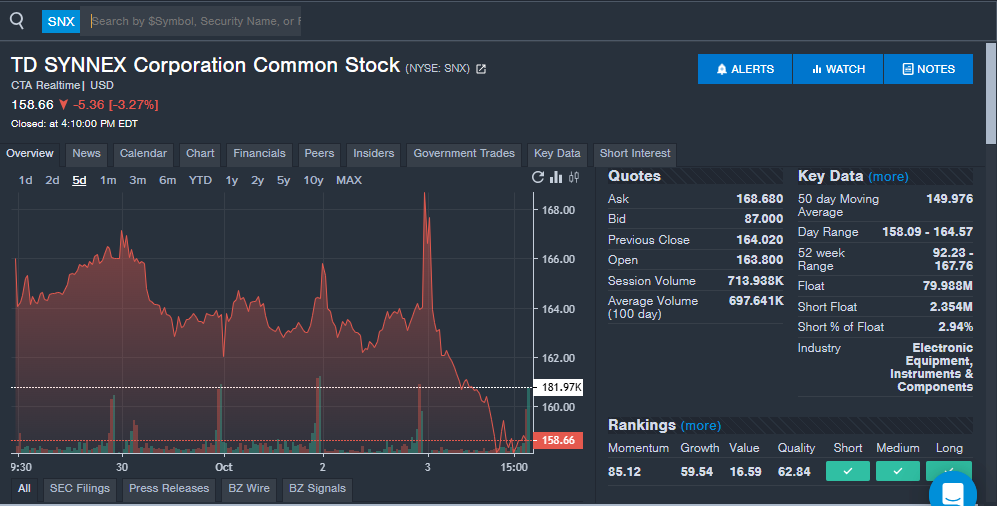

TD SYNNEX Corporation (NYSE:SNX): The IT company gained interest from readers after a recent quarterly beat and acquisition. TD SYNNEX completed its acquisition of Gateway Computer, a deal that it says will boost its global footprint. The company said it expects the deal to help it book new business in Japan. Gateway Computer will also begin using the TD SYNNEX global footprint for business expansion. The company beat analyst estimates for both earnings per share and revenue in the third quarter, reported on Sept 25. The company has beaten analyst estimates for each earnings per share and revenue in four of the last five quarters. Multiple analysts raised their price targets for the stock after the earnings beat.

Cloudflare Inc (NYSE:NET): The software company may have attracted new readers and investors after its recent announcement. Cloudflare said it plans to launch a U.S. dollar-backed stablecoin called "NET Dollar." The stablecoin would be used to enable secure payments for AI agents to make transactions. The company said this will help with "agentic web," helping software agents to act on a user's behalf to make purchases, handle subscriptions and access data. Cloudflare highlighted that the token could help support microtransactions at scale. Given growing interest in AI and stablecoins, Cloudflare's latest endeavor could be one to watch.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: