Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending August 15:

Embraer SA (NYSE:ERJ): The jet manufacturing company saw strong interest from readers during the week. The company reported second-quarter financial results with earnings per share missing analyst estimates and revenue beating estimates. The quarter saw record revenue and a large backlog worth $29.7 billion. The backlog and the company's pledge to make a $1 billion investment in the U.S. are boosting investor confidence as the company has some tariff concerns given its ties to Brazil. Analysts raised the price targets on the stock and shares remain up over 50% year-to-date.

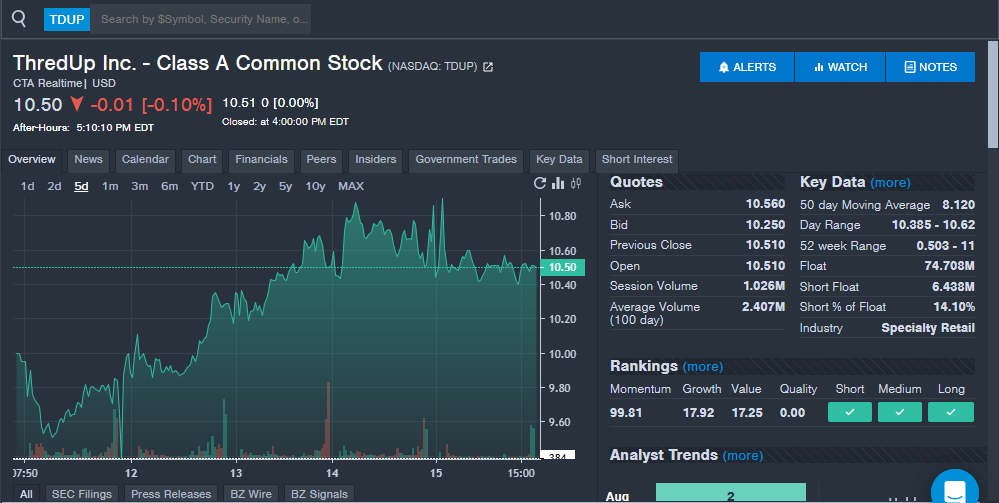

ThredUp Inc (NASDAQ:TDUP): The online resale apparel company continues to see shares soar in 2025, hitting the highest levels since 2022. The company beat earnings per share estimates and beat revenue estimates from analysts in the second quarter. This marked a fourth straight quarter of a double beat on the key financial metrics. The company also raised its full-year revenue outlook from a range of $281 million to $291 million to a new range of $298 million to $302 million. The company's third quarter revenue guidance also came in ahead of analyst estimates. Analysts raised their price targets on the stock after the quarterly financial results, which were reported earlier this month.

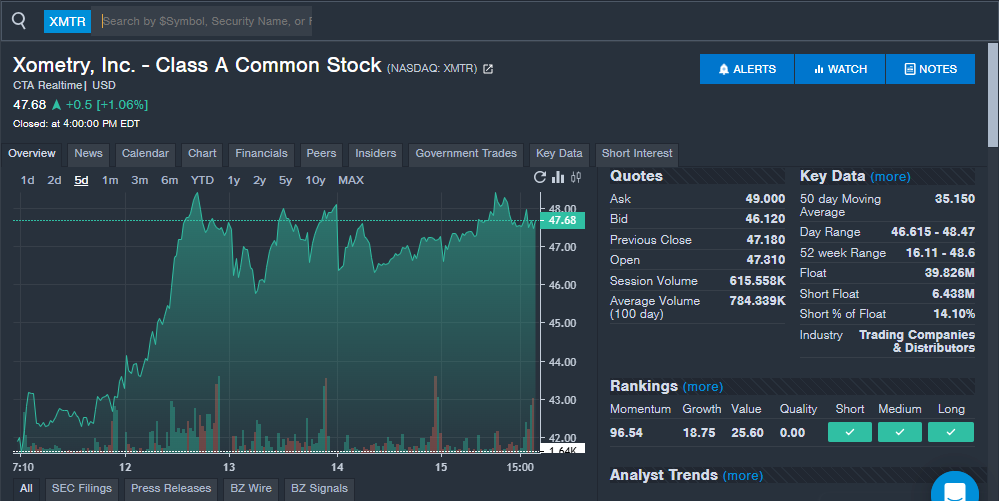

Xometry Inc (NASDAQ:XMTR): The AI-enabled manufacturing equipment company saw strong interest from readers during the week with shares up around 1%. The company reported second quarter financial results earlier this month. The second quarter results beat analyst estimates for earnings per share and revenue, a sixth straight quarter with a double beat. Xometry raised its full year outlook and sees margins expanding going forward. Analysts raised their price targets on the stock after quarterly results.

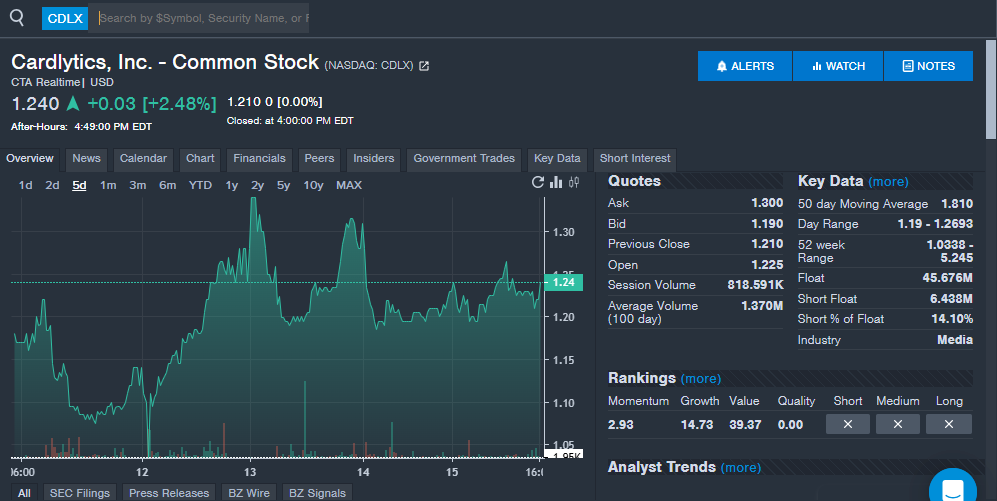

Cardlytics Inc (NASDAQ:CDLX): The advertising platforms company is one of the smaller names to appear on the Stock Whisper Index and comes with the warning of higher volatility as a penny stock and low market capitalization name. The company reported mixed second quarter results with earnings per share beating analyst estimates and revenue missing estimates slightly. The company's third quarter revenue guidance is below analyst estimates. Despite the mixed results and weak guidance, shares held up fairly strong during the week down around 1% and the stock is seeing increased interest signaling a potential stock to watch.

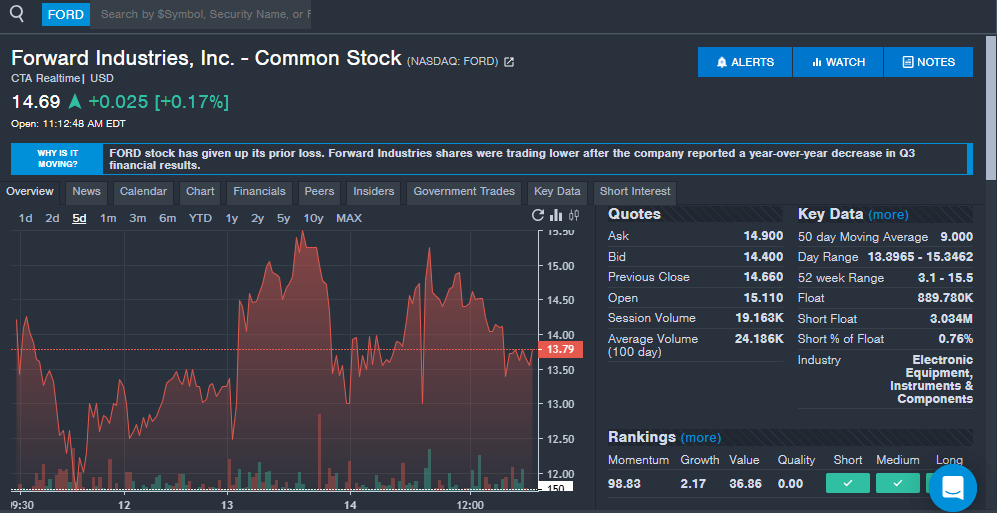

Forward Industries (NASDAQ:FORD): The protective solutions company reported third quarter financial results that showed declining revenue and earnings per share. The company's revenue was down 3.9% year-over-year and missed estimates. Adjusted EBITDA improved in the quarter despite the declining revenue. Company executives highlighted improved pricing and cost controls that could boost margins going forward. While shares were down 5% during the week, the stock remains up over 170% year-to-date and could be a stock to watch going forward.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next: