With many people, including the self-employed, not paying into the national pension plan, the system is becoming increasingly hollowed out. The officially announced payment rate is in the 60 percent range, but the actual situation is worse. The risk is growing that many elderly people will only be able to receive a meager pension in the future.

Up for 6 straight years

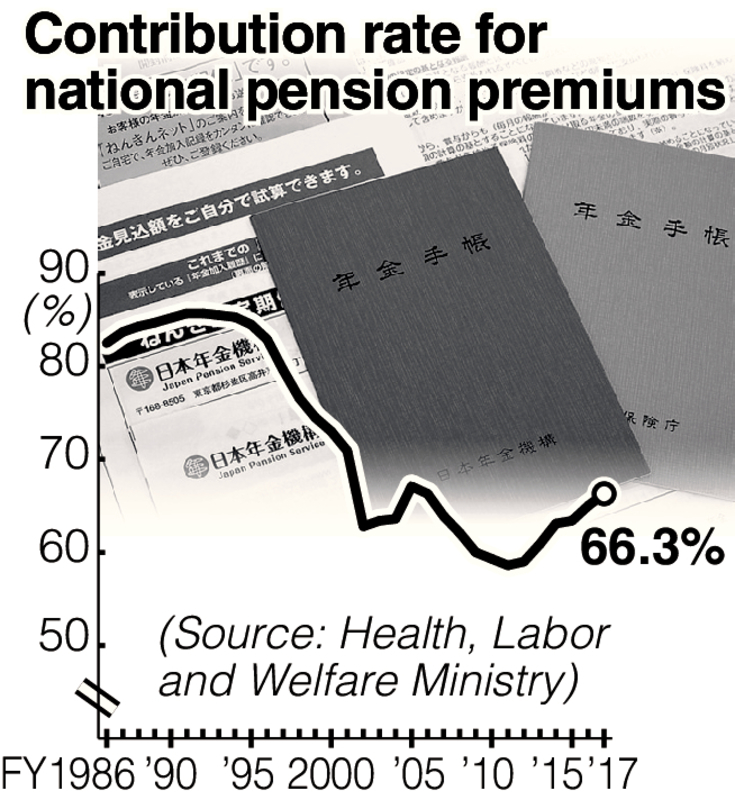

The Health, Labor and Welfare Ministry announced in June that the national pension premium payment rate (see below) in fiscal 2017 was 66.3 percent. This is 1.3 percentage points higher than the previous fiscal year and represents the sixth consecutive yearly increase since fiscal 2011, when the rate stood at a record low of 58.6 percent.

"We broadened the scope of compulsory collection and also continued to encourage people to pay. We're now seeing the results," a Health, Labor and Welfare Ministry official said.

Until the mid-1990s, however, the payment rate was more than 80 percent. For the mandatory subscription system, a payment rate in the 60 percent range is woeful.

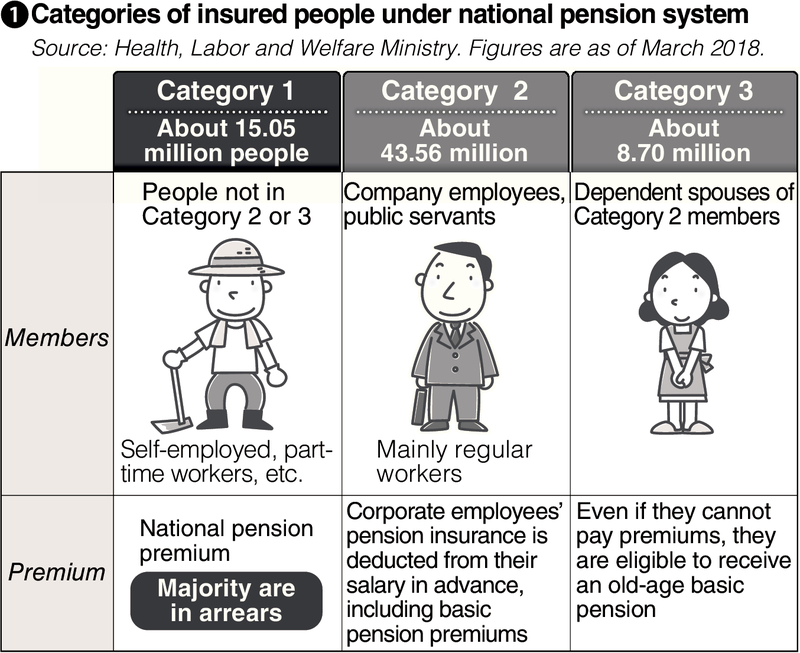

National pension premiums are mandatory for those classified as Category 1 insured persons, which includes the self-employed and part-time workers. Unlike employees' pension premiums, which company employees have deducted directly from their salary, Category 1 insured persons must pay on their own.

The national pension premium has been raised by more than 100 percent, from 7,100 yen per month in fiscal 1986, when the current system was put in place, to 16,340 yen in the current fiscal year. In addition to this increased burden, another reason for the low payment rate is the sense of distrust spreading among younger generations -- Is the pension system really reliable, they wonder.

A variety of measures

People who continue to be in arrears are in danger of receiving no pension after they retire. The ministry and the Japan Pension Service are employing various measures to increase the payment rate.

One method is a discounted premium rate. A new system introduced last fiscal year allows people to pay two years of premiums in advance via credit card. Compared with paying in cash every month, this enables people to save about 14,000 yen over two years. However, there is no such discount for company employees' pension plan, so this strategy can be criticized as unfair.

About 14,000 people who were in arrears had savings and other assets seized last fiscal year. Such carrot-and-stick measures appear to have been effective to a certain extent.

In arrears versus exempted

It is not only people in arrears who do not pay premiums -- there are also low-income earners who utilize the payment exemption system. Almost every day, a JPS office in Saitama Prefecture receives calls from people in arrears who say there is no way they can pay.

"We have the payment exemption system for people whose income is low. You can use it, but your pension benefits will be lower in the future," an experienced pension official tells them, explaining about the procedures to use the system.

Pension benefits are not paid out for the period during which payments were in arrears, but if people are exempted from paying, their pension benefits will not be zero but half the standard amount.

Therefore, the JPS strongly recommends low-income earners who are in arrears to use the exemption system. This is not wrong in itself.

Number magic

The JPS recommendation appears partly spurred by its desire to boost the payment rate. What does this mean, exactly?

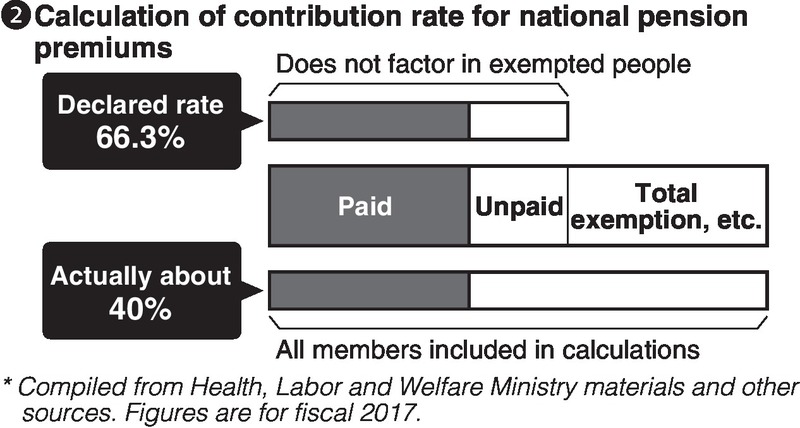

Calculations for the payment rate officially announced by the ministry do not include the 5.74 million people -- as of the end of March this year -- who receive partial or full exemptions. According to a senior Health, Labor and Welfare official, this is because "they're not legally obligated to pay."

When many people are in arrears, the payment rate drops. However, if such people newly come under the exemption system, they are not included in the calculations and the figure consequently goes up.

If people using the exemption system are included in the payment rate calculations, the actual rate for fiscal 2017 stands at 40 percent, although the ministry does not officially disclose such figures. This is 26 percentage points lower than the officially announced payment rate of 66.3 percent.

Moreover, this actual payment rate is down about seven percentage points from 47 percent 10 years ago. One reason is that the JPS recommends people use the exemption system.

In 2006, the former Social Insurance Agency, the predecessor to the JPS, was found to have allowed unlawful exemptions, doing paperwork for the exemption system without receiving people's consent. As many as 1,770 JPS employees were punished across the country in connection with the scandal. The employees were making no effort to collect pension premiums and instead simply lowered the number of people required to make premium payments, so as to improve their own work performance results.

The JPS stressed that it no longer conducts this kind of illegal activity. However, doubts remain over whether it recommends taking the exemption even to low-income earners who have certain assets such as savings and could therefore pay the premiums.

(From The Yomiuri Shimbun, July 24, 2018)

Collection measures need to be strengthened

"The pension system will fall apart if many people are in arrears" -- this concern is often raised but it is a complete misperception. People who are in arrears will not receive pension benefits for the corresponding non-payment period. Those who have received exemptions will only be given reduced pension benefits, so pension finances will not be negatively affected.

However, if the present situation continues, it will lead to a large number of elderly people living on limited pensions. Even now, livelihood protection allowance costs are as high as nearly 4 trillion yen, and this could increase even more.

The higher costs will be covered by the taxes of future working generations. The current low payment rate is the equivalent of billing future generations. This is exactly why the ministry and the JPS must move forward with measures to get people in arrears to pay premiums.

Currently, 312 pension offices across the country as JPS branches are in charge of collecting premiums. Isn't it possible to ask for cooperation from municipalities in performing this task? One idea is changing the current system in which companies directly deduct employees' pension plan premiums only from full-time workers' salary, to one in which they also collect premiums from part-time workers' salary and pay them to the government.

Innovative ideas are needed to resolve the situation.

-- National pension premium payment rate

The percentage of people who paid premiums, among the total number of people who are obliged to pay them, in a particular fiscal year. To calculate the rate, the number of months in which people paid premiums across the country is divided by the number of months premiums were required to be paid in a particular fiscal year. Exemptions for low-income earners, university students who have deferred their payments and others are excluded from this calculation. As people in arrears sometimes pay premiums in the subsequent fiscal year and beyond, the final payment rate, in many cases, is nearly 10 percentage points higher than the figure that was originally announced.

Read more from The Japan News at https://japannews.yomiuri.co.jp/