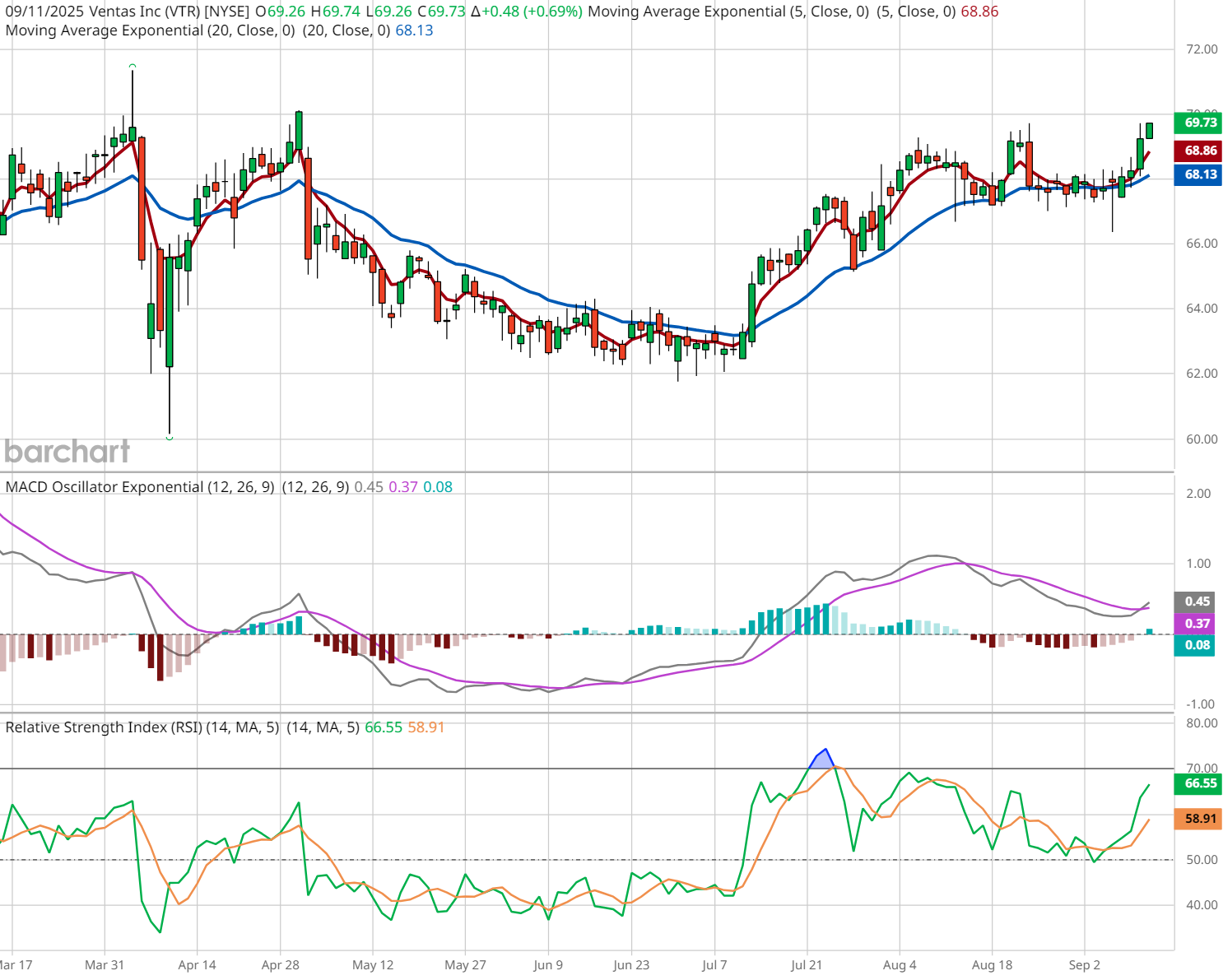

One of my favorite Barchart screeners is the eMACD New Buy Signal. This screener highlights new bullish crossover “Buy” signals based on the 12-26-9 Day eMACD indicator.

The MACD indicator is a momentum oscillator that identifies when short-term momentum shifts to the positive and overtakes the longer-term momentum. Under the right conditions and in the right set-up, this signal can alert a trader to the early stages of a new uptrend.

There are two conditions I’m particularly fond of: one, when the MACD line crosses the signal line above the zero line; and two, when the daily RSI turns positive above the 50% level. One candidate meeting both of these criteria was captured by the screener on Wednesday, September 10: Ventas (VTR).

What makes the stock particularly interesting to me is that it has a strong 100% Barchart Technical Opinion, meaning that 13 different technical indicators are alerting a bullish signal. In addition, it is a healthcare real estate REIT with a specific niche, catering to our aging population demographic.

Putting this all together, we have an equity that has been in an extended uptrend, which has recently paused to gather energy, and is now signaling a positive change at the shorter timeframe, in an industry-specific sector with clear macro trend tailwinds.

Caveat: Understanding this assessment is more about putting the pieces together, technical and fundamental, and not an endorsement to buy, sell, or hold any particular stock. Every trader and investor has their own goals and risk tolerances. Trading is inherently risky and should be only undertaken on the advice of qualified financial professionals, which I am not.

- John Rowland, CMT, is Barchart's Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.