Thai banks have confirmed they will pay back victims of unauthorised online withdrawals.

Payong Srivanich, chairman of the Thai Bankers' Association (TBA), said all member banks have agreed to refund victims within five business days for debit card holders.

In the case of credit cards, banks will cancel suspicious transactions and will not demand interest or any fees from cardholders.

The banks also will close the accounts of the credit cards used in irregular transactions and open new ones for customers with no fee charged, he said.

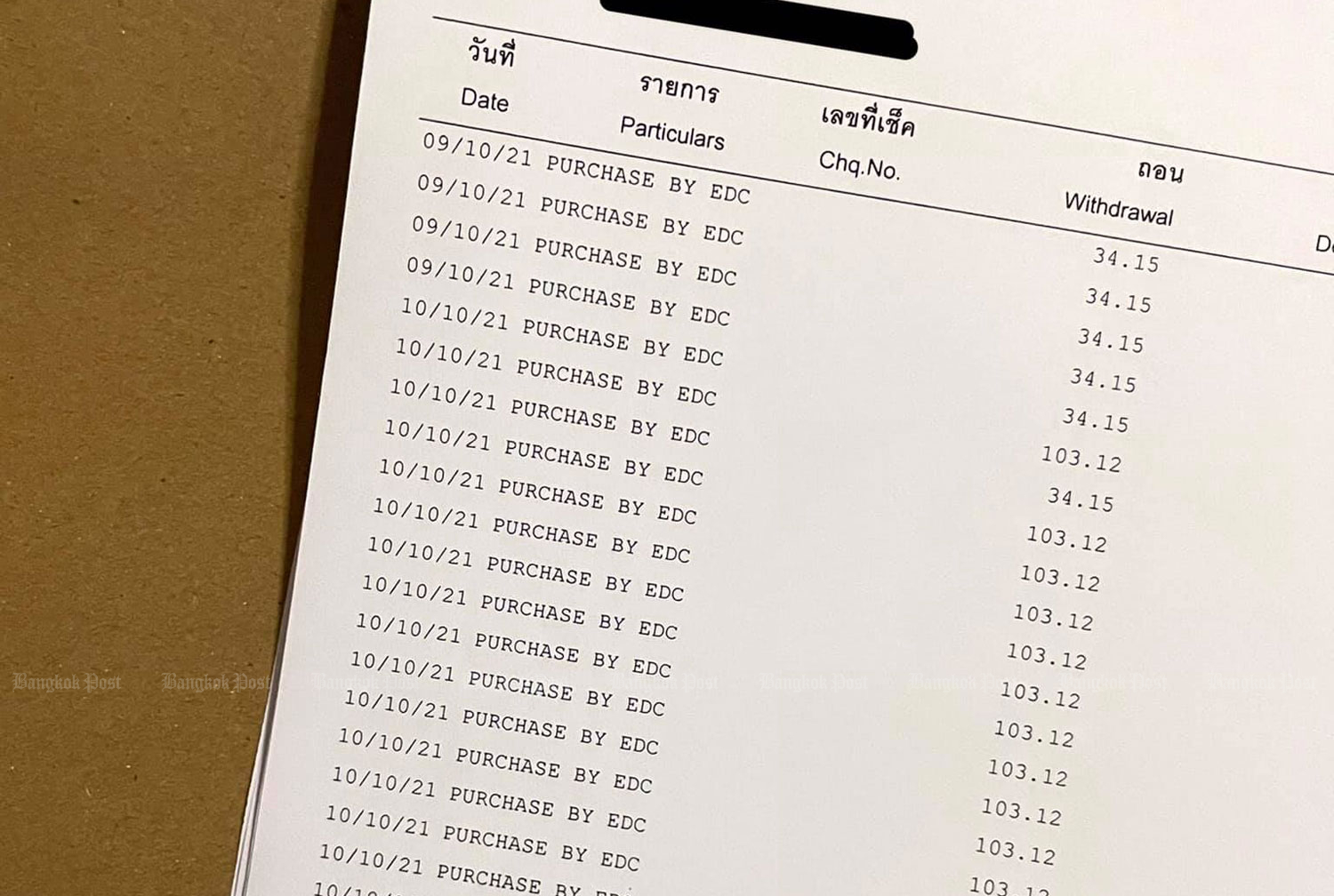

During Oct 1-17, the fraud involved 10,700 cards, of which 5,900 are credit cards, accounting for a transaction value of 100 million baht.

The remaining 4,800 are debit cards with transaction value of 31 million baht.

The Bank of Thailand (BoT) and the TBA on Tuesday held a joint press conference providing more details of the cases.

Siritida Panomwon Na Ayudhya, the Bank of Thailand's assistant governor for payment systems policy and financial technology group, said the BoT and the TBA have set guidelines for all banks to improve the prevention of unauthorised withdrawals.

Measures include stepped up detection of suspicious transactions by extending monitoring to cover low-value as well as highly frequent transactions.

Once irregularity is detected, the banks should immediately freeze card usage and alert customers through all channels. The banks should also pay special attention to transactions made overseas.

Earlier, on Sunday, the BoT and TBA issued a joint statement noting that most cases were not the result of data leakage or hacking. Instead, they were mainly caused by the perpetrators' use of cardholder information to do transactions at online shops registered outside Thailand.

Most of the transactions involved small sums of approximately USD 1 per transaction.