Welcome to the latest edition of “ignore the headlines.”

Day after day, the stock market seems to exhibit a very short memory. When playing sports and losing a game, that’s a good trait to have. When it relates to what drives markets now, as opposed to what drove them a decade or two ago, that’s a bad habit. It has not cost traders that much yet. But it could.

The biggest banks and brokerage firms kicked off earnings season Tuesday morning. As usual, the big fellas came through with their usual outperformance versus estimates that were just enough over the last few quarters to make the bar easy to cross. This is what some have referred to as “millennial soccer.” Everyone gets a trophy.

I applaud those skilled at forecasting earnings and other aspects of quarterly reports (revenue, margins, etc.) from public companies. It is a skill I never learned, as my path was that of a technician and portfolio manager.

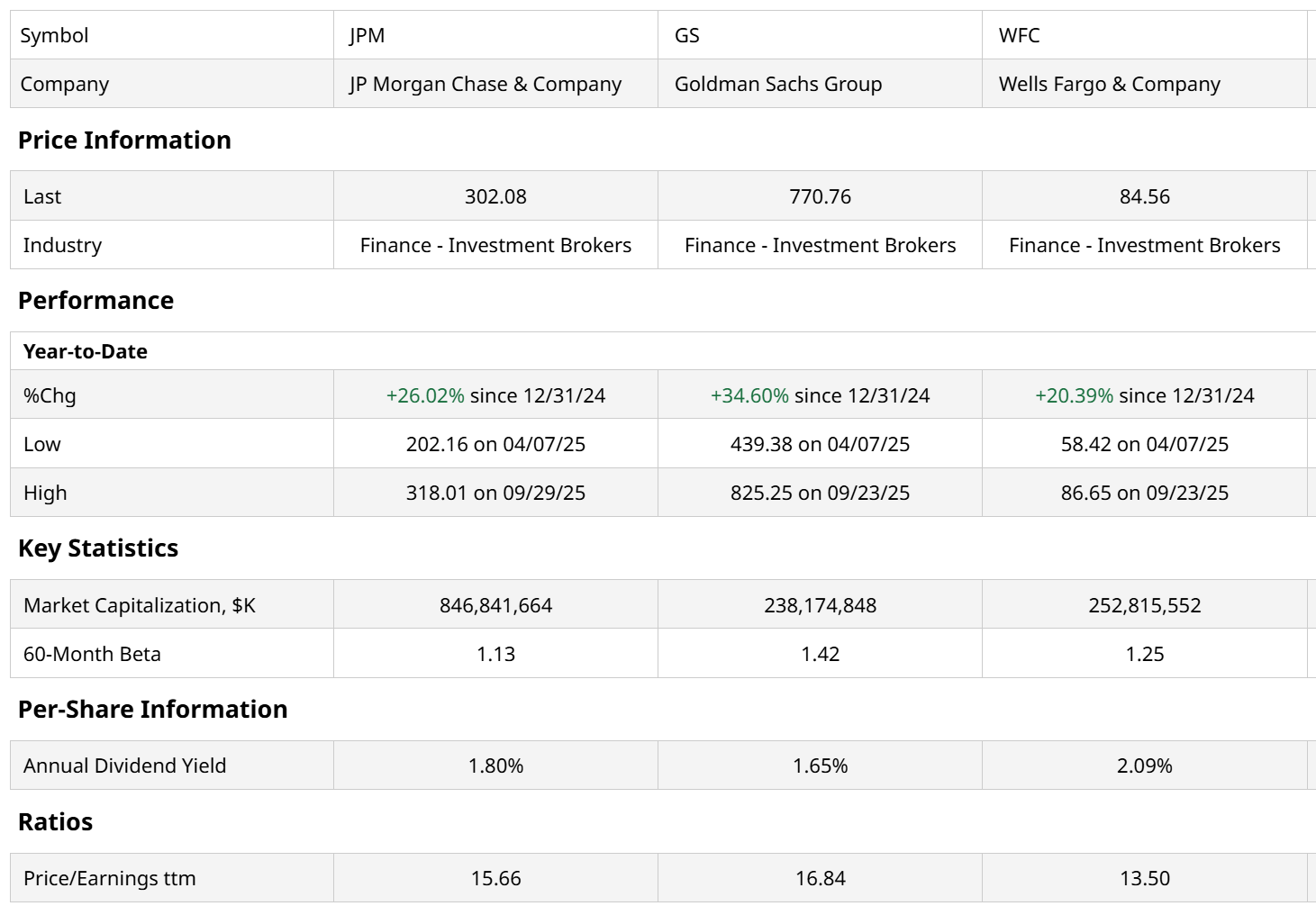

But analyst accolades aside, there’s something not right to me about how this latest set of bank earnings is showing up in the price charts. Let’s take a look at three of the majors.

Starting with the head honcho, Jamie Dimon’s JP Morgan Chase (JPM), this weekly chart tells me two things: 1) The run-up after Liberation Day in April was followed quickly by a run-up to earnings. And 2), the stock may have peaked for a while. That 20-week moving average is at risk of rolling over for the first time since March, and the Percentage Price Oscillator (PPO) in the lower end of the picture is teetering from a high level.

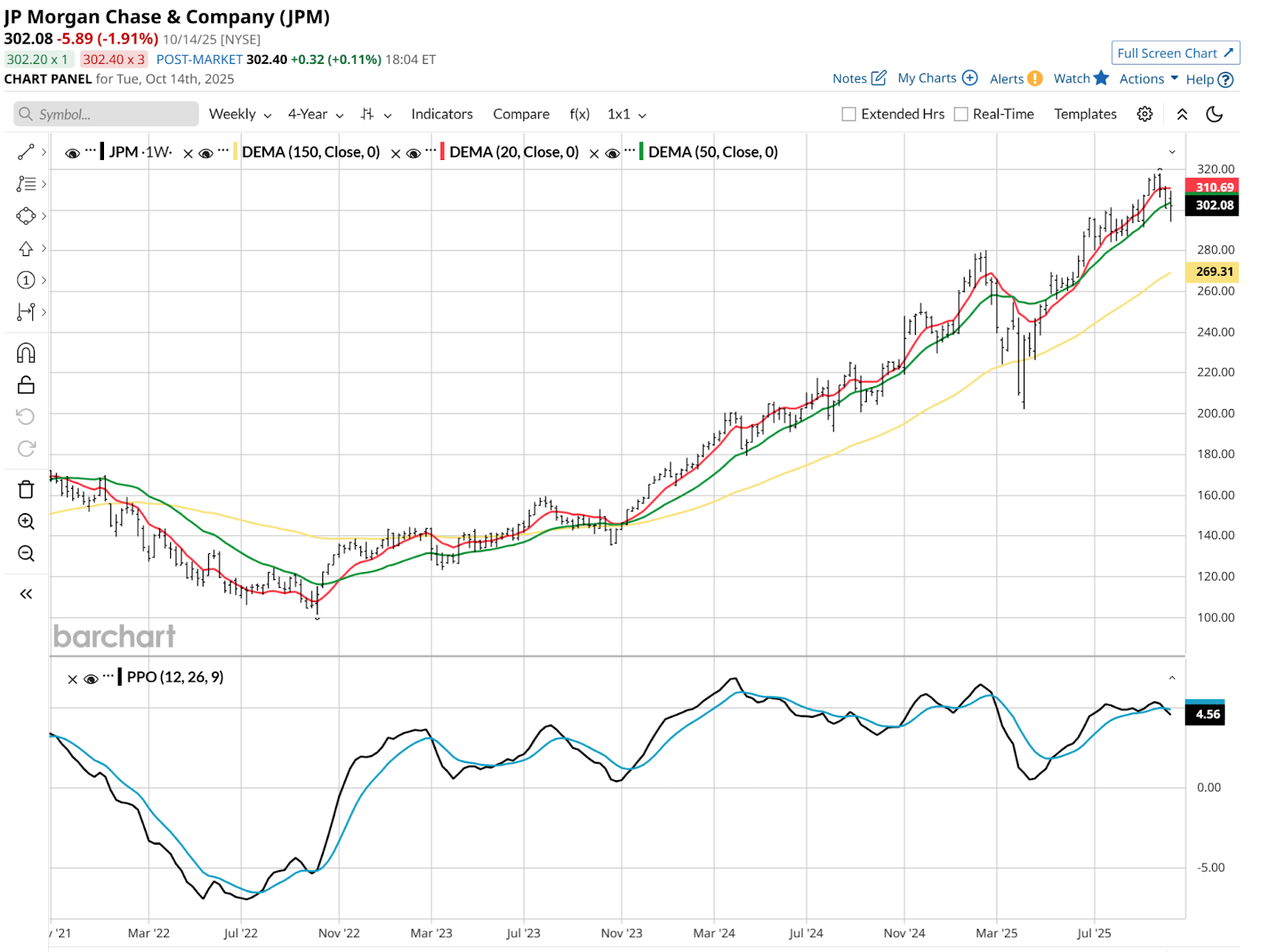

Goldman Sachs (GS) is one of the canaries in the coal mine for the occasional financial crisis. And while there will always be much debate over Goldman’s financial progress among the analyst community, price is a “tell.”

Currently, it is telling me to look out below. Big-cap stocks like this one can have more lives than a feline, but again, this is a weekly look. And it is getting toppy. Translation: A rough period ahead is one possibility, but the stronger takeaway for me is that much of this stock’s move for the year is behind it.

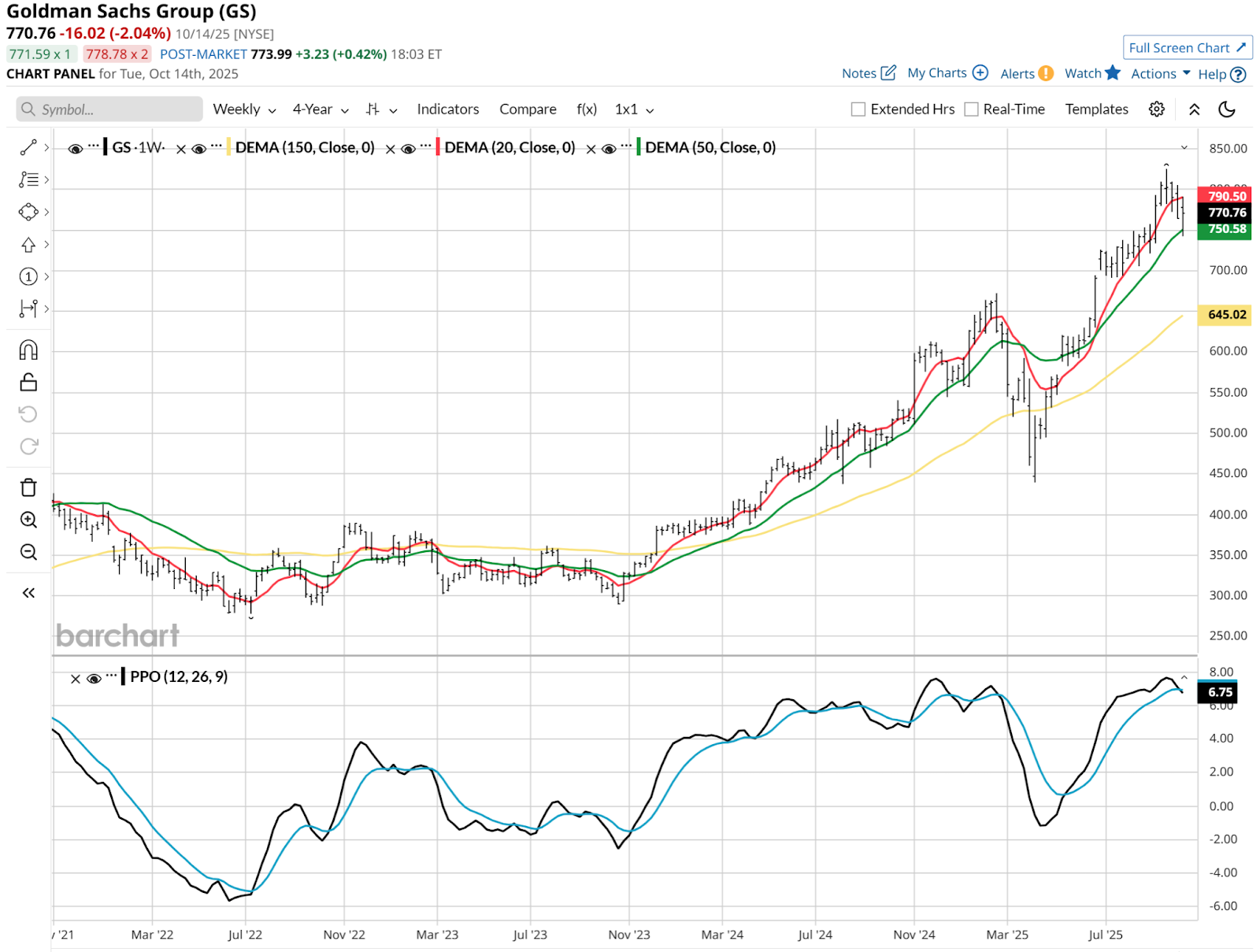

Finally, below we see a weekly view of Wells Fargo (WFC), which had a banner Tuesday after its earnings release. However, that enthusiasm takes on a different tone when we smooth things out to this longer time frame.

This is more neutral than negative, and I’d call this the best-dressed chart in the trio. However, this sector will not be the first place I’m hunting for new names to trade. It is looking like the good news is already out.

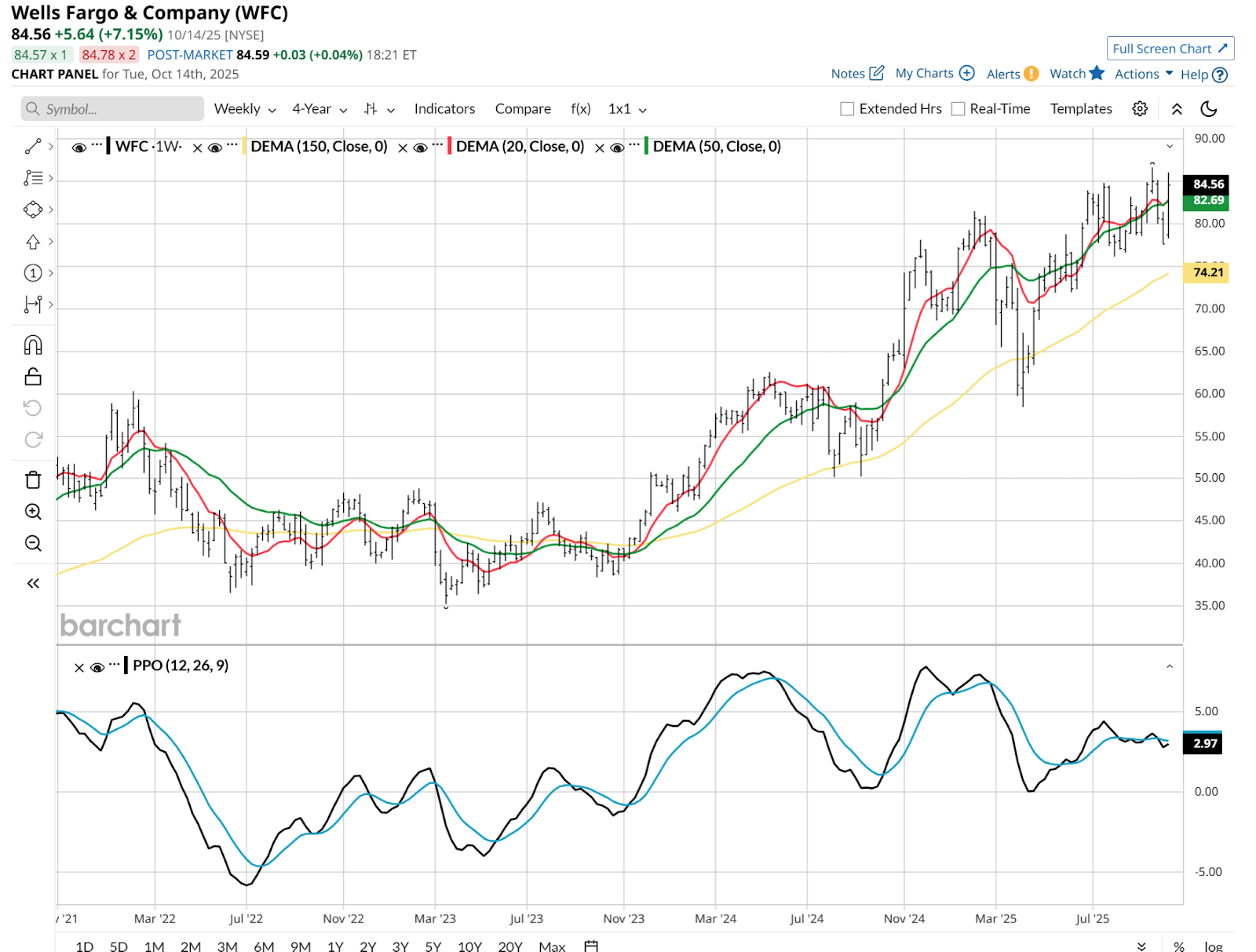

How to Profit From the ‘Bearish Financial’ Trade

My chart snapshots above are one part of a more detailed process. But regardless of what your decision system is for trading, with essentially two weak charts and a “meh” rating for the third from me, you might be thinking “if the financial sector falls hard, can I profit from it?”

With many thousands of exchange-traded funds (ETFs) to choose from, of course the answer is yes!

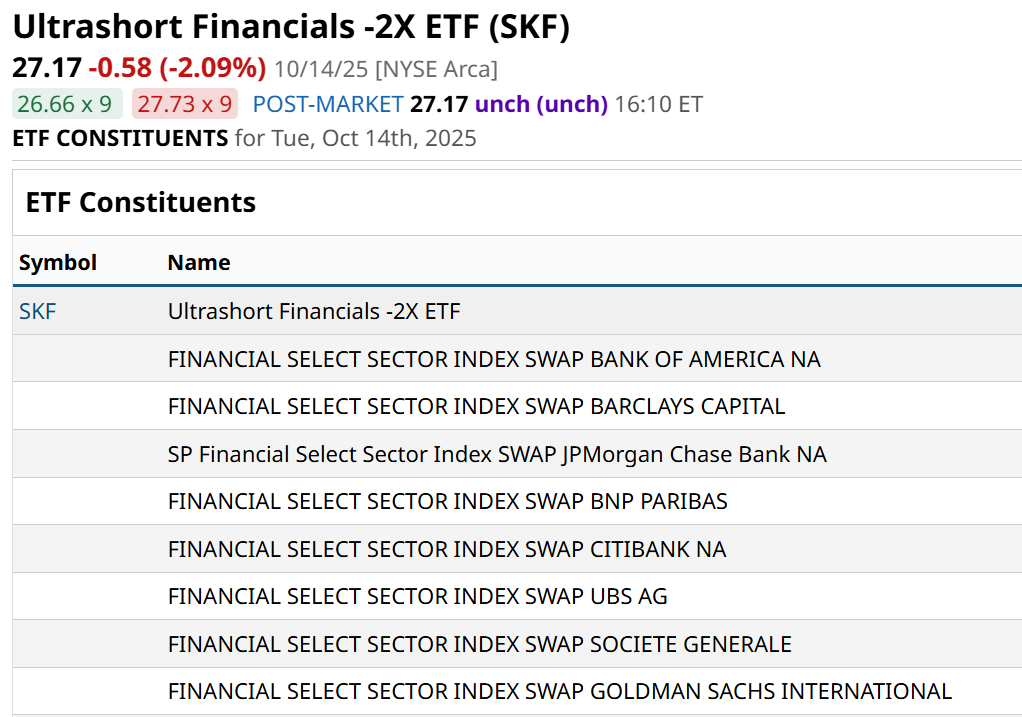

See above the holdings for one reasonably liquid 2X inverse ETF that shorts financials as a basket (SKF).

The Banks Are Betting Against Themselves… Sort Of

As with most inverse ETFs, especially the leveraged ones, they use private swap contracts to facilitate the daily number-crunching to maintain performance that delivers about a 2% gain on a day when financial stocks fall by 1%. But do you see who some of those swap counterparties are?

Some of the biggest financial stocks in any cap-weighted ETF!

Maybe we’ll go another couple of decades without a financial calamity. Or, maybe we’ll have something of a moment of zen, with bank stocks falling while their swap departments help their clients essentially bet against their stocks. Welcome to modern Wall Street.