The Bank of England has raised interest rates again as it warned the Ukraine conflict could see under-pressure households hit with double-digit inflation later this year.

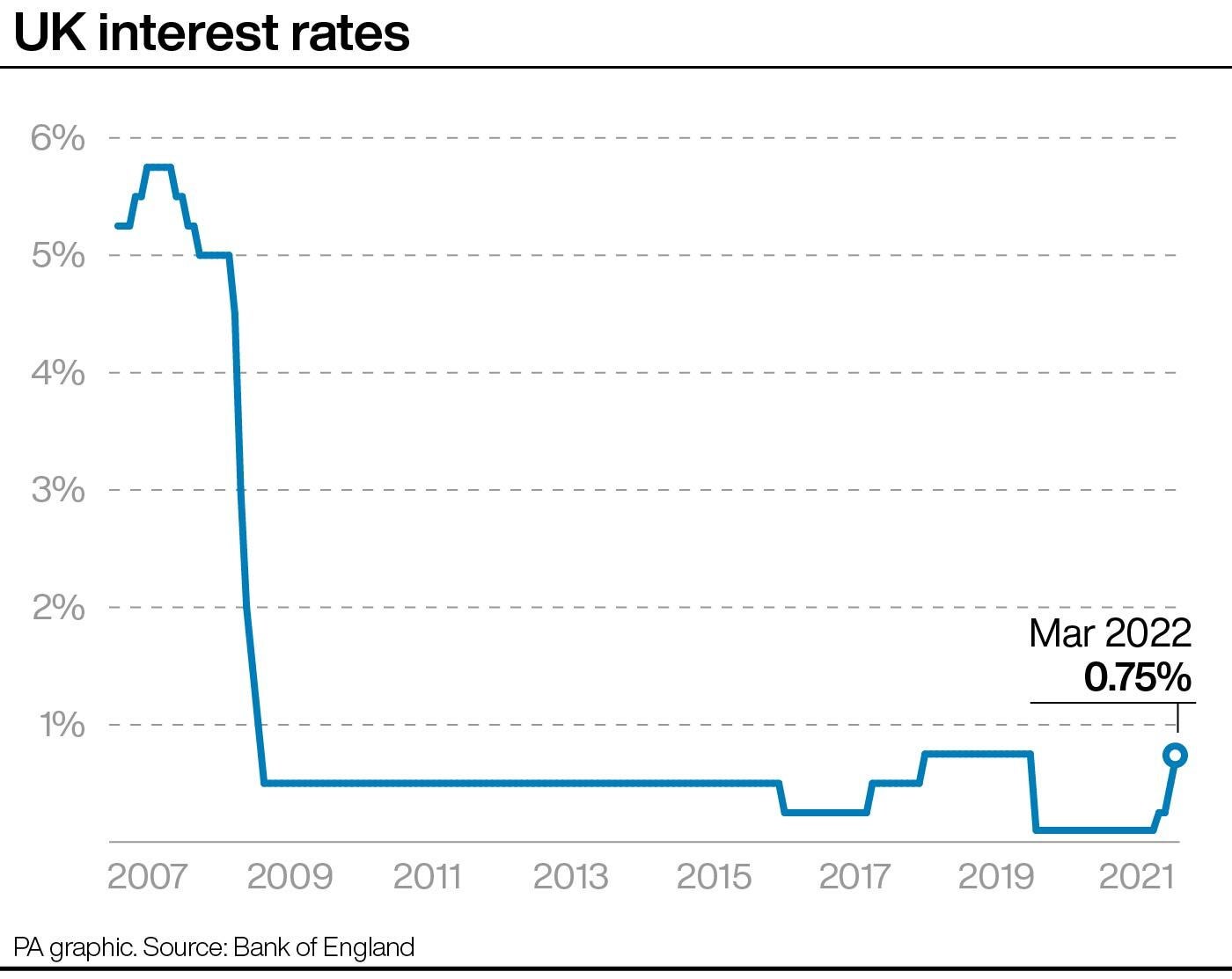

Members of the Bank’s Monetary Policy Committee (MPC) voted eight to one to increase rates from 0.5% to 0.75%, marking the third rise in a row.

The move has now taken rates back to where they were before the pandemic struck.

In minutes of the latest decision, the Bank signalled that more rate rises might be needed as it laid bare a gloomy inflation outlook, with the Consumer Prices Index now set to reach around 8% in the second quarter.

It said that, if wholesale energy prices continue to soar, inflation could rise even further by the end of the year and potentially be temporarily “several percentage points higher” than the 7.25% peak forecast last month.

“The effects of Russia’s invasion of Ukraine would likely accentuate both the peak in inflation and the adverse impact on activity by intensifying the squeeze on household incomes,” the Bank cautioned.

Policymakers still believe that inflation will fall back sharply after this spike, however, as energy prices stop rising and the cost of living crisis weighs on spending.

Experts said the tone of the Bank’s minutes suggested it was less certain of the case for further rate rises, given the impact of cost pressures on growth.

The Bank said the blow from rocketing energy costs to household finances – and the knock-on effect on economic activity – is set to be bigger than first feared, with growth in the UK and globally “likely to slow” over the coming months.

It stressed that the shock to the economy from energy prices and Russia’s invasion of Ukraine is “something monetary policy was unable to prevent”.

It said this month’s rate rise is “warranted”, with growth proving stronger than expected in January despite the Omicron variant of coronavirus, and the Bank now forecasting expansion of about 0.75% in the first quarter, up from a previous expectation for gross domestic product (GDP) to remain flat.

If economic activity takes a serious turn and uncertainty remains elevated, the case for the MPC to hold fire and pause policy tightening would be strong

The jobs market has also held up well and is unlikely to weaken as quickly as expected, it added.

But the Bank’s deputy governor Jon Cunliffe called for rates to remain unchanged at 0.5% amid fears over the impact of the cost of living squeeze on growth, according to the minutes.

The rate rise comes after the US Federal Reserve raised interest rates in America on Wednesday for the first time since 2018 in an attempt to cool rampant inflation.

Economist Martin Beck, at the EY Item Club, said the Bank is likely to put more emphasis on supporting growth than trying to rein in inflation, over which it has little control, “implying a slower pace of rate increases going forward”.

He believes another rise is a “strong possibility” in May, with rates ending the year at 1% to 1.25%.

“But if economic activity takes a serious turn and uncertainty remains elevated, the case for the MPC to hold fire and pause policy tightening would be strong,” according to Mr Beck.