The Bank of England is poised to cut interest rates as the threat of an escalating global trade war looms and the economic growth outlook worsens.

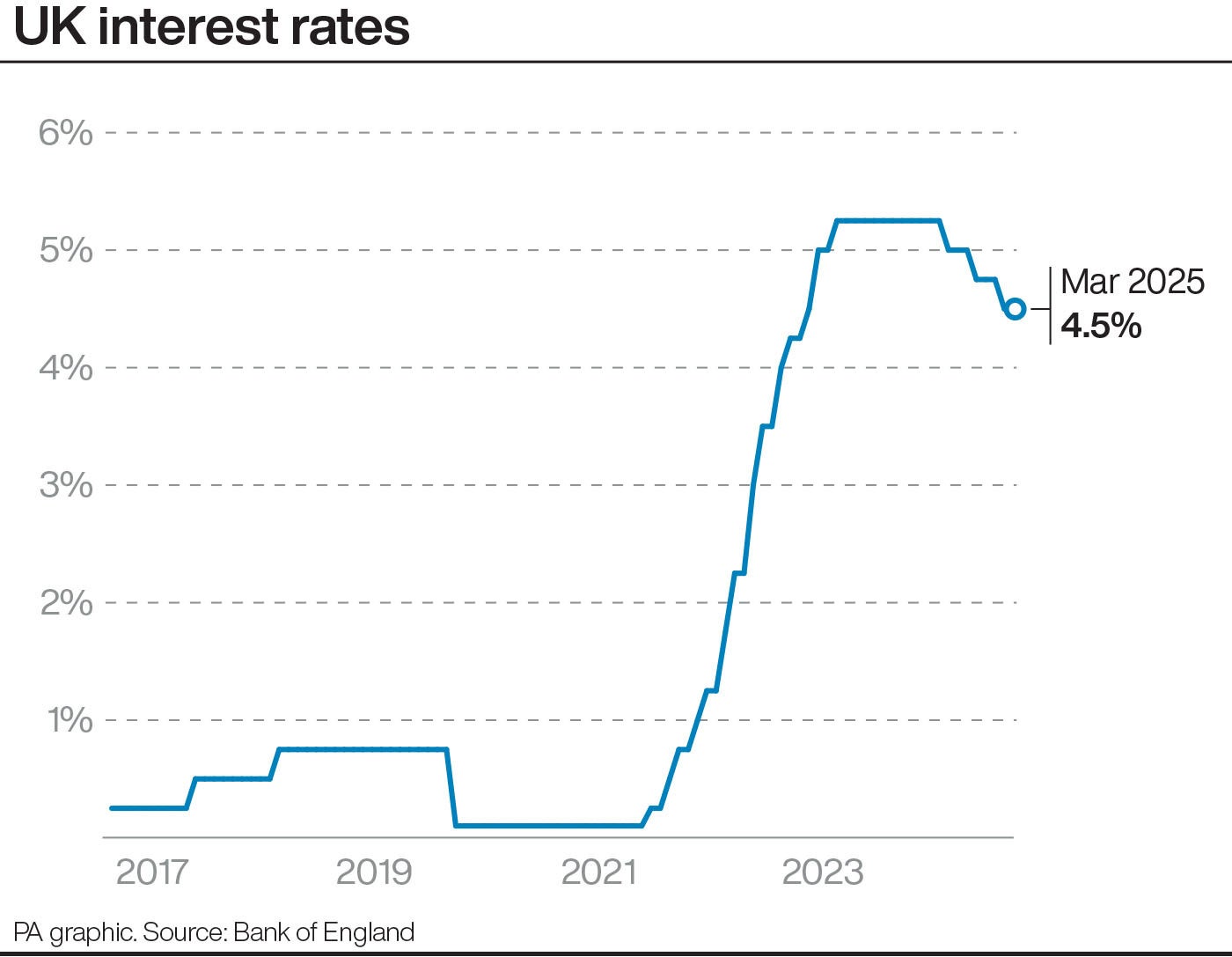

Most economists think UK interest rates will be reduced to 4.25% from their current level of 4.5% on Thursday.

Analysts said some members of the central bank’s Monetary Policy Committee (MPC) could push for a larger 0.5 percentage point cut in a bid to reduce borrowing costs further and ease pressure on households and businesses.

It will be the first time the MPC has met to decide monetary policy since US President Donald Trump’s “liberation day” tariff announcements last month.

The decision, along with quarterly economic forecasts, will be delayed by two minutes to honour the silence to mark the 80th anniversary of VE Day – meaning it will be published at 12.02pm, rather than noon.

Some economists have warned that UK economic growth could slow sharply over the next two years because of Mr Trump’s plans, which will directly impact British exporters, but could also weaken spending among households and businesses.

Kallum Pickering, chief economist for Peel Hunt, said the “highly uncertain economic backdrop” would encourage policymakers to intervene by cutting rates on Thursday.

“Although UK economic momentum has picked up appreciably since last December, and has surprised to the upside relative to depressed Bank expectations, rising global growth worries linked to the US’s erratic and risky tariff policies pose fresh risks,” he said.

Economists will be paying close attention to the MPC’s forecasts for inflation and economic growth, which some said could both be downgraded.

This could “provide a strong signal that policymakers are prepared to step up the pace of future rate cuts” in order to boost the economy, according to Mr Pickering.

Laith Khalaf, head of investment analysis at AJ Bell, said tariffs had caused a “massive reappraisal of the future path of UK interest rates”.

“As things stand, markets are focusing on the collateral damage to the UK economy rather than the potential for a trade war to ignite inflation once again,” he said.

“The effects of trade tariffs, once imposed, are highly unpredictable and could unleash both inflationary and deflationary forces.”

Sandra Horsfield, an economist for Investec, said it is a “near-certainty” that the Bank will reduce borrowing costs, with most participants in the financial markets pricing in a rate cut.

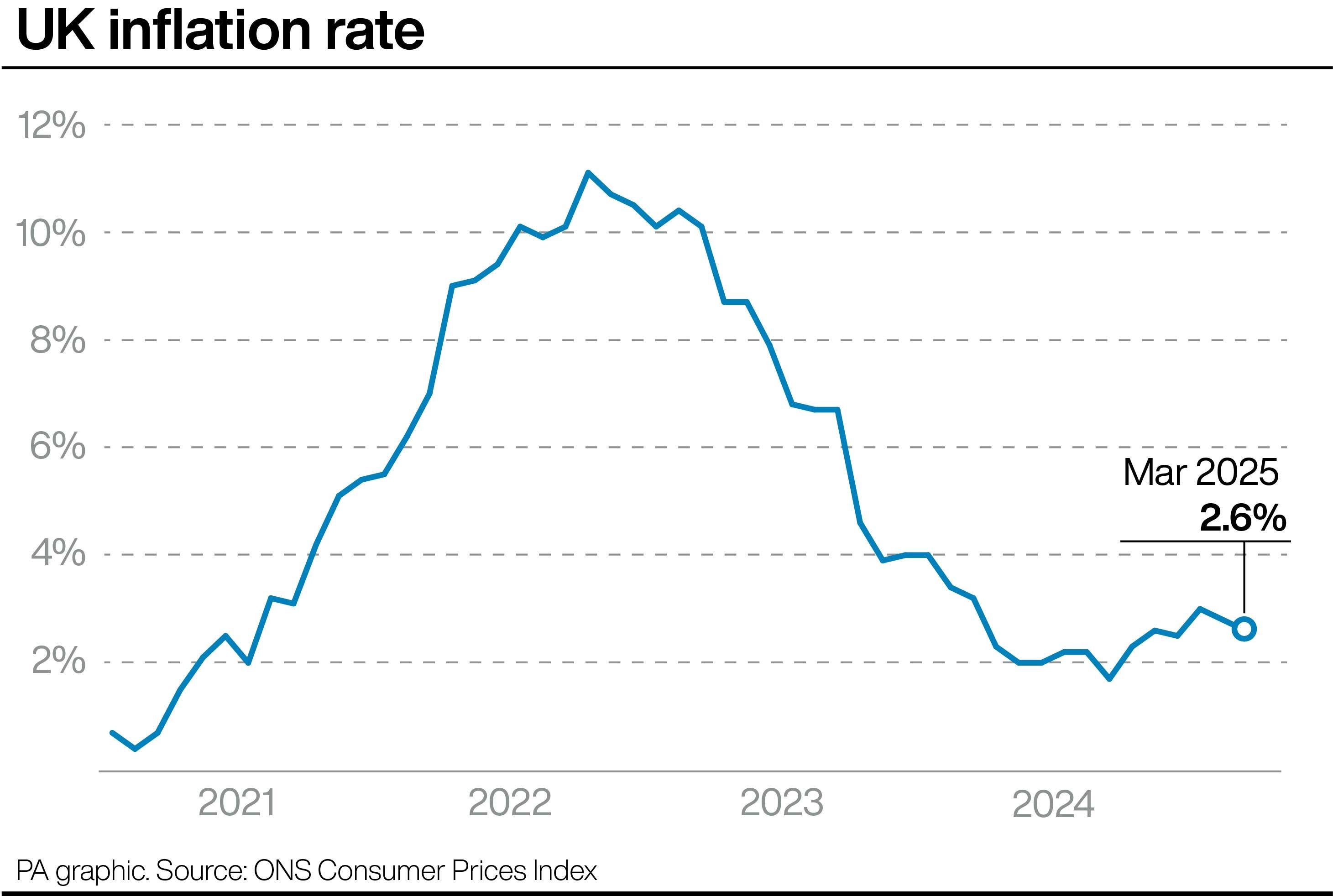

Inflation has fallen in recent months, which is likely to indicate to policymakers that interest rates – which are used as a tool to control inflation – can continue to come down.

Consumer Prices Index (CPI) inflation slowed to 2.6% in March, from 2.8% in February, according to the latest official data.

And importantly, the rate of services inflation – a metric closely watched by the Bank of England – fell to 4.7% from 5%.

“The new question now though for the MPC to consider is how the US trade policy shifts have changed the outlook for UK inflation,” Ms Horsfield said.

“What makes this month’s decision easy is that virtually everything has pointed in the direction of lower UK inflation pressure.”

Some economists have suggested that countries such as China, in the face of higher charges on exports to the US, will re-route trade and lower import prices for other countries, which could result in lower prices for UK consumers.

Combined with other factors, including a weaker US dollar and falling oil prices, this could put downward pressure on inflation.

Ms Horsfield said while the MPC continues to work out the possible effects, its “game plan will be to reassure the public and markets that it stands ready to act if needed”.

Meanwhile, Europe’s central bank cut interest rates last month, and said “exceptional uncertainty” over trade policy meant future rate decisions would have to be taken on a meeting-by-meeting basis.

Russia to host leaders of China and Brazil for the 80th anniversary of victory

Czech central bank cuts key interest rate to 3.5% as inflation drops more than expected

‘Nationally significant’ cyber attacks double since last year, security chief warns

Friedrich Merz to visit Warsaw and Paris in first trip as German chancellor to stress European unity

Harbour Energy axing 250 jobs in Aberdeen

Weight Watchers files for bankruptcy to help compete with Ozempic