/Bank%20Of%20America%20Corp_%20branch-by%20MivPiv%20via%20iStock.jpg)

With a market cap of $392.7 billion, Bank of America Corporation (BAC) is one of the largest financial institutions in the United States. Operating through four main segments: Consumer Banking; Global Wealth & Investment Management; Global Banking; and Global Markets, it serves individual consumers, small and mid-sized businesses, large corporations, and governments worldwide.

The Charlotte, North Carolina-based company's shares have outperformed the broader market over the past 52 weeks. BAC stock has increased 24.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 18.3%. Moreover, shares of Bank of America are up 20.3% on a YTD basis, compared to SPX’s 17.2% return.

In addition, shares of the nation's second-largest bank have also outpaced the Financial Select Sector SPDR Fund’s (XLF) 12.2% rise over the past 52 weeks and a 9.6% YTD gain.

Shares of Bank of America rose 4.4% on Oct. 15 after the bank reported stronger-than-expected Q3 2025 earnings of $1.06 per share and revenue of $28.09 billion. The strong results were driven by a 43% jump in investment banking fees to $2 billion and a 9% rise in net interest income to $15.2 billion, with the bank projecting Q4 NII between $15.6 billion - $15.7 billion.

For the current fiscal year, ending in December 2025, analysts expect BAC’s EPS to grow 14.9% year-over-year to $3.77. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

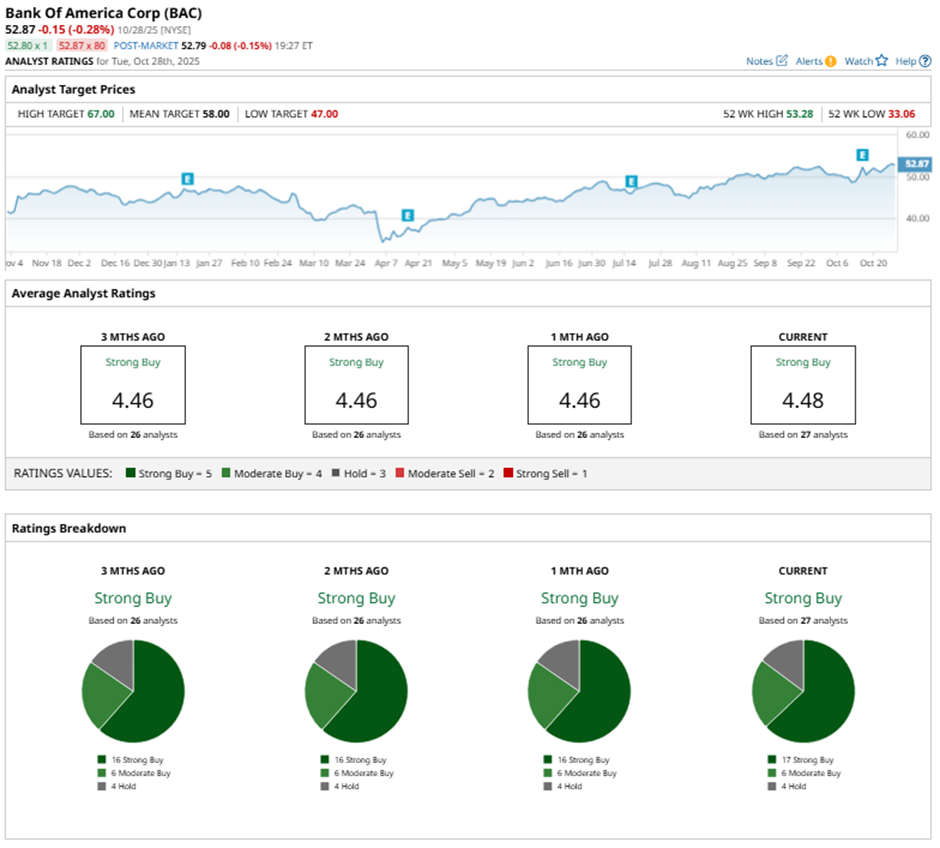

Among the 27 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, six “Moderate Buys,” and four “Holds.”

This configuration is slightly more bullish than it was three months ago, when BAC had 16 “Strong Buys” in total.

On Oct. 27, Wells Fargo raised its price target on Bank of America to $62 and maintained an “Overweight” rating.

The mean price target of $58 represents a premium of 9.7% to BAC's current price. The Street-high price target of $67 suggests a 26.7% potential upside.