The Reserve Bank governor has called on businesses to help lift Australia's sluggish productivity growth as she tries to bring inflation under control.

Facing a string of questions about the government's role in driving up inflation at a parliamentary grilling in Canberra, Michele Bullock looked to the private sector for a helping hand.

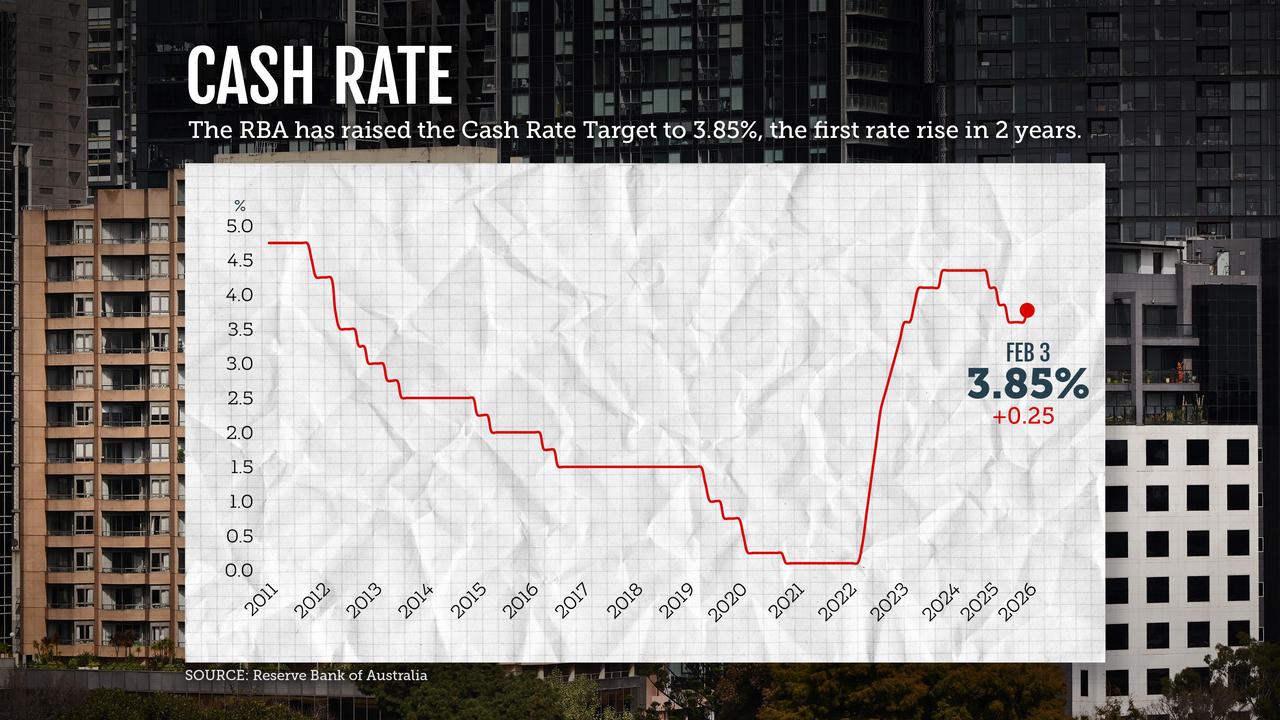

Lacklustre productivity growth was a contributing factor to the imbalance between demand and supply in the economy, which forced the Reserve Bank to raise interest rates on Tuesday, Ms Bullock said.

An uptick in business investment towards the end of 2025 provided a ray of hope that it could flow through increased productivity, as more equipment and technology per worker make the economy more efficient.

Much of that increase in investment was due to a few large data centre projects, but Ms Bullock hoped it signalled a more sustained pick-up and not just a few big lumps.

"If we are to get productivity improvements, we need two things: we need investment so that we can get more labour productivity; but we also need businesses to be thinking about how they combine labour and capital in more efficient ways," she said.

"Certainly, our analysis of productivity at a higher level is that both of those things have not been occurring, and that's part of the reason for the slowdown in productivity."

Higher productivity growth would allow for both public and private demand to grow faster without contributing to inflation.

Much of the hearing was devoted to whether the federal government was at fault for running the economy too hot by failing to control budget spending.

Amid a barrage of questions from Liberal MPs, Ms Bullock was careful not to directly criticise the Albanese government for spending blow-outs.

But she acknowledged lower public spending would help close the gap between demand and supply in the economy, all else being equal.

"Mathematically, if government spending declines, public demand doesn't grow as quickly, if you like, then that will bring down aggregate demand, unless the private sector picks up the slack," she said.

December's mid-year budget update projected Commonwealth spending to hit 26.9 per cent of GDP this financial year - the highest level since the 1980s, excluding the COVID-19 pandemic

Asked if the Reserve Bank's quick turnaround between its last rate cut in August and its first hike six months later was a sign of an error by the board, Ms Bullock said they always knew it would be tricky when interest rates got to a neutral position.

"I think it reflects the fact that we've been trying very hard to bring the economy down on a soft landing," she said.

"It would have been very easy to bring the economy to its knees ... just increase interest rates a long way. We tried not to do that.

"The labour market is in a good position. Inflation is higher than it should be ... but it's not a disaster at the moment."