Bakkt Holdings Inc (NYSE:BKKT) shares are trading higher, lifted by a broader crypto market rally and recent strategic restructuring. Here’s what investors need to know.

What To Know: On Wednesday, the company finalized the sale of its loyalty business, cementing what the company calls its transformation into a pure-play digital asset platform. This move, aimed at lowering costs and sharpening focus, follows the Sept. 22 appointment of fintech veteran Mike Alfred to its board, further signaling its commitment to core crypto services.

The stock’s rise Thursday is tied to Bitcoin’s (CRYPTO: BTC) strength, which is being partly attributed to the ongoing U.S. government shutdown. During times of government instability and fiscal uncertainty, some investors view decentralized assets like Bitcoin as a safe haven.

Operating outside of traditional financial and political systems, Bitcoin can be seen as a hedge against potential currency devaluation and economic disruption. This perception boosts its value and, in turn, benefits crypto-linked companies like Bakkt that are directly aligned with the digital asset ecosystem.

Read Also: Applied Digital Stock Rallies As Bitcoin Surges Amid Government Shutdown

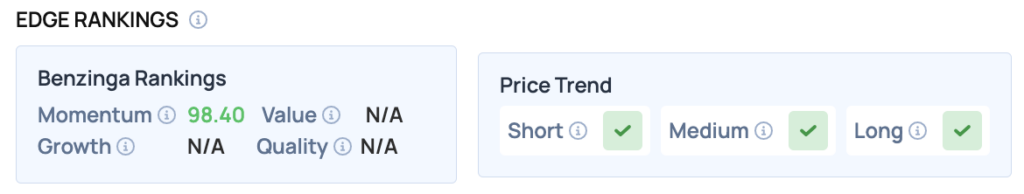

Benzinga Edge Data: Underscoring its positive price action, the stock currently holds a strong Benzinga Edge momentum score of 98.40.

BKKT Price Action: Bakkt shares were up 37.51% at $46.96 at the time of publication on Thursday, according to Benzinga Pro. The stock is making new 52-week highs on Thursday.

Bakkt stock has surged well above its 50-day, 100-day and 200-day moving averages, which are all below $15. This suggests a robust upward trend, with potential resistance near the recent highs for the session.

Read Also: Sharps Technology Teams Up With Crypto.com To Grow Solana Strategy

How To Buy BKKT Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Bakkt’s case, it is in the Financials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock