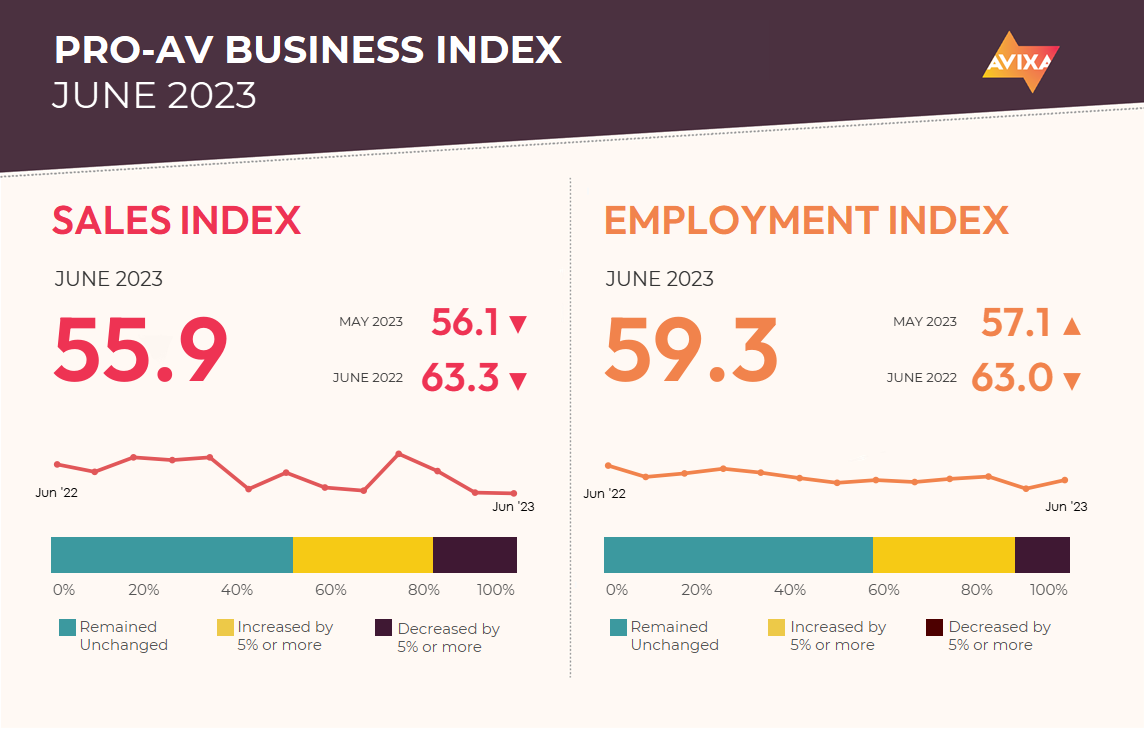

With the backdrop of a stagnant global macro economy, it’s no surprise to see Pro AV settling into a level of modest growth. After the AV Sales Index (AVI-S) registered a slow expansion of 56.1 in May, the AVI-S held steady at 55.9 in June. Both numbers are comfortably above the no-net change line of 50, but below historic norms of expansion for our industry.

Survey respondents reported a mix of positivity, emphasizing a return to normal, and negativity from ongoing supply issues and economic weakness. Interestingly, in our categorical survey question on the top issue facing respondents, supply issues were at the lowest level, and the percentage reporting no significant challenges was at the highest level since we introduced the question in September 2022.

[SCN 1-on-1: AVIXA Industry Insights from InfoComm 2023]

The late 2022 and early 2023 GDP numbers show significant weakness in the European economy. After GDP contraction of 0.1% in the Eurozone and 0.2% in the EU in 2022 Q4, the Eurozone contracted 0.1% again in 2023 Q1 while the EU saw a 0.1% increase.

Does the back-to-back decrease in Eurozone GDP indicate a regional recession? Of course, everyone is entitled to their own decisions on classifications, but our perspective is to focus on a broad slate of numbers rather than only GDP. A broader look reveals greater strength, with 0.3% increase in Eurozone employment in 2022 Q4 and an even greater 0.6% increase in 2023 Q1. The net is not good news; the European economy is weak. But it’s far from a crisis, and Pro AV growth remains likely from technological advances, evolving AV needs, and the continuing small recovery from the return to in-person.

Pro AV employment continues to catch up on the gap developed during the rapid revenue rebound of 2022. In June, the AV Employment Index (AVI-E) increased by 2.2 points to 59.3. This is 3.4 points higher than the AVI-S, an unusually large advantage for the normally steadier payroll shifts.

[AVIXA Report: Solid AV Growth Despite Economic Uncertainty]

This comes at a moment when “Hiring new employees” was at its highest level in our top business challenge question—though that may reflect how much supply difficulties have eased more than a real increase in hiring difficulty. U.S. employment numbers show continued strength, with more than 200,000 jobs added and a small decline in the unemployment rate in June. This growth allays recession fears, but increases the likelihood of future interest rate increases.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.