UK house prices have experienced their sharpest July decline in over two decades, new figures reveal, with the average asking price falling by more than £4,500 this month.

Property portal Rightmove reported that the average asking price now stands at £373,709, marking a 1.2 per cent or £4,531 decrease month-on-month.

While a seasonal dip in prices is typical for July, this years’ drop is the most significant recorded by Rightmove for this time of year across its more than 20 years of data.

Rightmove has also cut its house price forecast for 2025 from 4 per cent growth to 2 per cent due to high level of seller competition limiting price growth, it said.

Despite this, the property website maintains its prediction of 1.15 million property transactions for the current year.

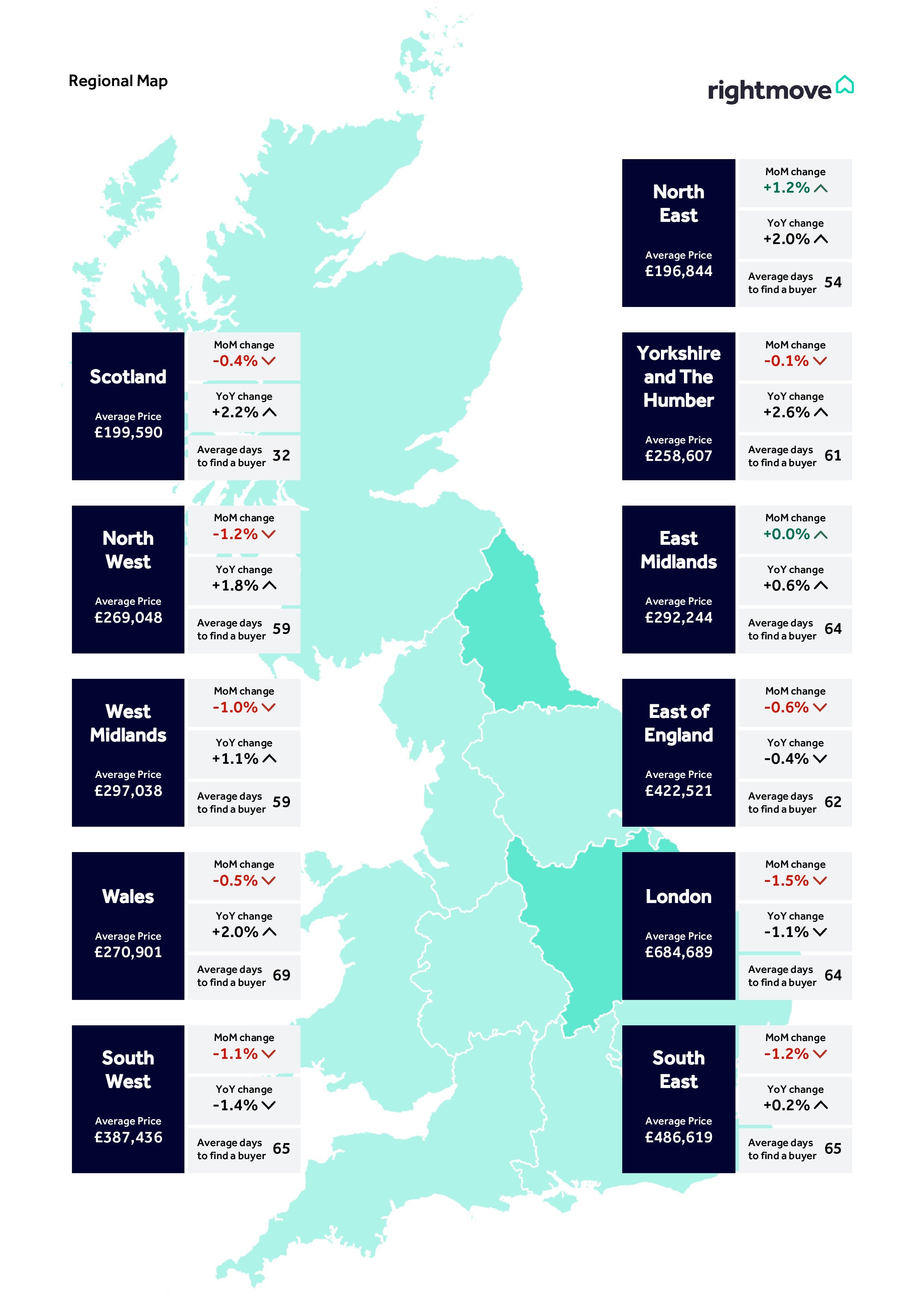

The data indicates that London, particularly inner London, has been a key driver of lower asking prices. Price tags across the capital have seen a 1.5 per cent month-on-month fall, escalating to an average 2.1 per cent decline in inner London.

April’s increase in stamp duty has had a particular impact in London where property prices are higher, the website added.

By contrast, the north east of England has seen a 1.2 per cent increase in prices month-on-month, continuing a trend of less expensive areas seeing faster price growth.

With mortgage rates falling and two more Bank of England base rate cuts still expected in 2025, the overall outlook for the second half of the year remains positive, the Rightmove report adds.

Many lenders have recently made changes to their criteria, allowing some borrowers to potentially take out bigger loans.r

Rightmove’s mortgage tracker indicates that the average two-year fixed mortgage rate is 4.53 per cent, compared with 5.34 per cent a year earlier.

Colleen Babcock, a property expert at Rightmove, said: “We’re seeing an interesting dynamic between pricing and activity levels right now.

“The healthy and improving level of property sales being agreed shows us that there are motivated buyers out there who are willing to finalise a deal for the right property.

“The decade-high level of buyer choice means that discerning buyers can quickly spot when a home looks overpriced compared to the many others that may be available in their area.

Ms Babcock added: “Crucially, buyer affordability is heading in the right direction, and another two (Bank of England base rate) cuts before 2026 would be a big boost to this.”