SYDNEY (Reuters) - Australia's bank watchdog on Wednesday said it had decided to keep the extra capital buffers banks are required to hold for emergencies at zero, but flagged the likelihood of a change at some point in the future.

The Australian Prudential Regulation Authority (APRA) said setting the countercyclical capital buffer default position at a non-zero level would help preserve the resilience of the banking sector and allow more flexibility to address financial stability risks.

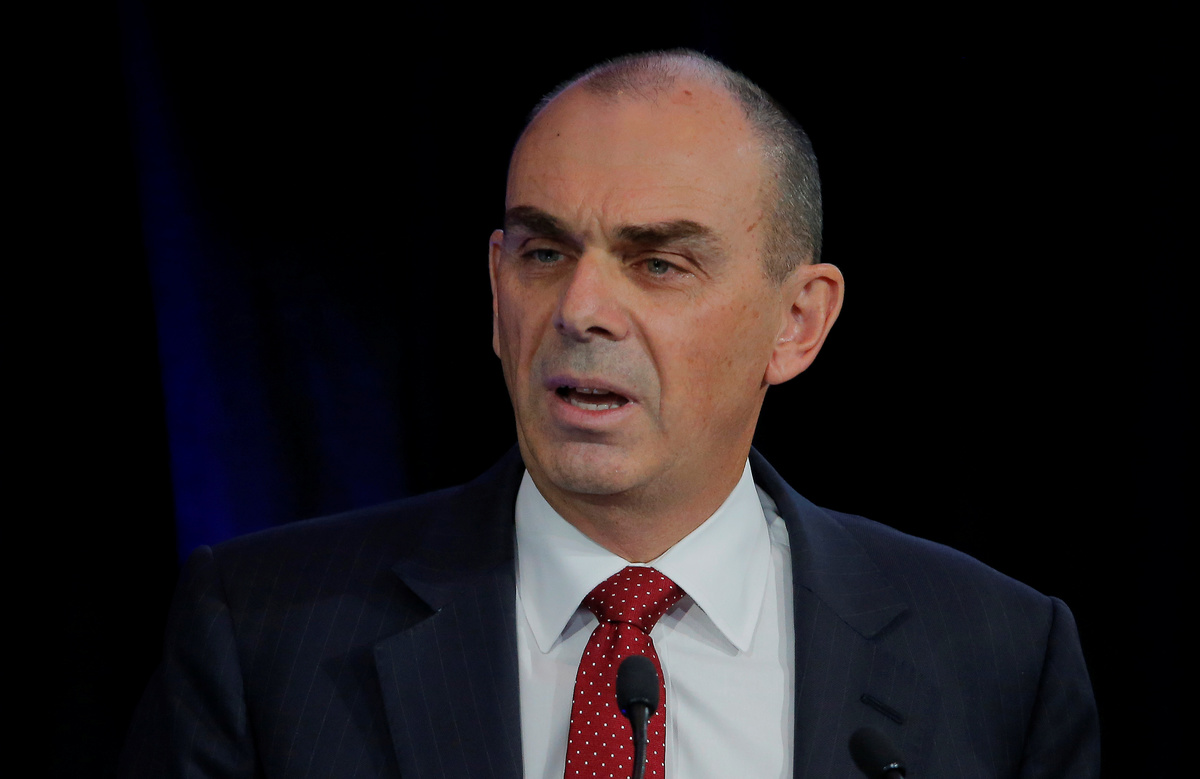

"Importantly, this would be considered within the capital targets previously announced – it does not reflect any intention to further raise minimum capital requirements," said APRA Chair Wayne Byres in a statement.

The buffer is an additional amount of capital that APRA can require banks to hold at certain points in the economic cycle to bolster the resilience of the sector during periods of heightened systemic risk.

It has been set at zero percent of risk-weighted assets since it was introduced in 2016.

(Reporting by Wayne Cole; Editing by Shri Navaratnam)