AUSTRALIA'S biggest coal port now gets 100 per cent of its electricity from renewable sources.

That's the claim as the Port of Newcastle unveils details of its electricity supply deal with Spanish-owned energy company Iberdrola, which supplies most of the port's power through its Bodangora wind farm near Wellington, 350 kilometres west of Newcastle.

Port chief executive Craig Carmody said the deal meant the organisation "started 2022 powered by 100 per cent renewable energy" and "decarbonising its operations in line with sustainability commitments set in 2020".

Confirmation of the deal coincided with new research showing renewables provided 31.4 per cent of Australian electricity in the final three months of last year, up from 26.5 per cent in the fourth quarter of 2020.

Coal - still the dominant power source - provided 62.3 per cent, down from 68.2 per cent, according to the University of Melbourne research.

The port announced its intention to move to renewable power in July 2020, and although the Bodangora contract was only announced yesterday, it and the port confirmed the supply arrangement began in November 2020, a five-year deal that would run until October 2025.

Bodangora already has a long-term power purchase agreement or PPA with Energy Australia, but Iberdrola confirmed it had sufficient power to also sell to the Port of Newcastle.

The company declined to put a figure on how much electricity the contract would involve.

Bodangora uses 33 General Electric turbines each rated at 3.43 megawatts, with a nameplate capacity of 113.2 megawatts.

It began generating in August 2018, producing about 350,000 megawatt-hours a year of power, with a capacity factor of about 35 per cent - meaning it produces about a third of its rated capacity, on average.

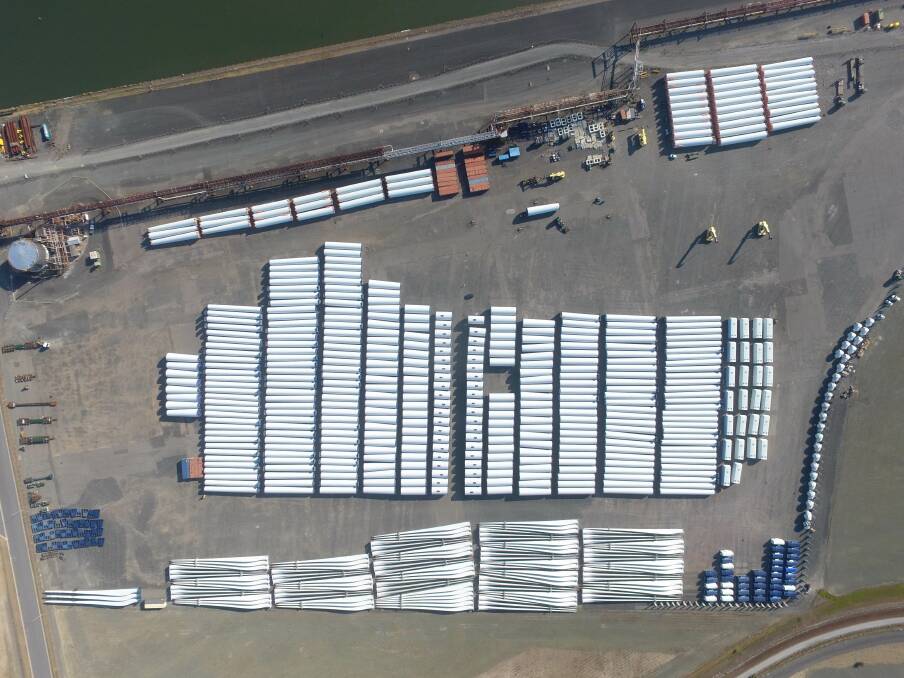

As it happens, the Bodangora turbines arrived in Australia via the Port of Newcastle, as some of the wind turbines cargoes unloaded at the Mayfield 4 berth and stored on part of the former BHP steelworks site.

Bodangora was built by Infigen - which began as a subsidiary of Babcock and Brown - before listing on the stock exchange in 2005.

It was bought outright by Iberdrola - one of the world's biggest wind power companies - in a deal valued at about $900 million that was completed midway through last year.

Mr Carmody said that as well as the long-term power purchase agreement or PPA, the port was also buying Large Scale Generation Certificates - known as LGCs that had "direct linkages" to Bodangora.

"In achieving 100 per cent renewable energy at Port of Newcastle we are showing tangible evidence of just how committed we are to driving sustainability in every aspect of our business," Mr Carmody said.

RELATED READING: Another Spanish firm in Hunter offshore wind project

"In doing so we have also enabled 15 port tenants that work in and rely on Port of Newcastle to make their own operations more sustainable."

Mr Carmody said the port's renewable power sources meant its carbon dioxide (CO2) emissions were 5000 cubic tonnes a year lower than they would be - the equivalent of taking 1000 cars a year off the road, or planting 80,000 trees.

Clarifying the "100 per cent renewables" statement, a spokesperson for the port said the Iberdrola wind contract supplied "most, but not all" of the port's electricity needs.

"It is the main supplier for [our] embedded networks," the spokesperson said.

"We have a separate retail agreement with a different provider for a couple of small sites, however we purchase and retire additional LGCs from Iberdrola to cover this usage at the small sites.

"It is this, along with the Port's other electricity and fuel fleet and operational changes that have led to the 100 per cent renewables achievement we've been striving to achieve since 2019 as part of our ESG [environmental, social and governance] strategy."

The reference to "retiring" LGCs refers to the federal government's Renewable Energy Target (RET) scheme, with one certificate issued for each megawatt-hour of renewable power generated.

The regulator website shows LGCs selling for about $80 each from 2016 through to 2018, but industry sources say that with more renewable power feeding into the grid the "spot" or traded price is now about $40.

"Through the scheme, large renewable power stations and the owners of small-scale systems are eligible to create certificates for every megawatt hour of power they generate, creating the 'supply' side of the certificate market," the Clean Energy Regulator says.

"Wholesale purchasers of electricity, mainly electricity retailers, buy these transferable certificates to meet their renewable energy obligations-forming the 'demand' side of the certificate market.

Wholesale purchasers of electricity then surrender these certificates to the Clean Energy Regulator in percentages set by regulation each year.

Because all connected generators - from the largest coal-fired power station to the smallest rooftop solar - feed their power into the same grid, customers are buying "pooled" electricity.

Certificates are "proof" of the origin of the power in question.

Big generators and customers use LGCs, while smaller players use a separate "small-scale" certificate scheme.

The scheme is almost 20 years old.

In a December 2020 announcement about its purchase of Infigen, the Spanish firm Iberdrola described Australia as "the birthplace" of the long-term power purchase agreements or PPAs that were now commonplace across the world's power markets.

Electricity prices have risen sharply in the northern hemisphere, but the Australian Competition and Consumer Commission's said in November that electricity costs in Australia were at their lowest in eight years.

Large scale certificates were cheaper but small-scale more expensive in every region of the National Electricity Market.